- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Speculative Longs Cut To The Lowest Since July 2009

Hedge funds and large investors continue to scale back their long exposure to commodities as the economic outlook for 2012 worsens and it could potentially reduce the demand for raw materials. The European sovereign debt crisis has become a liquidity crisis with banks busy tightening lending. This is reducing the amount these funds have available for margin trading and the impact is now being felt across most markets including commodities.

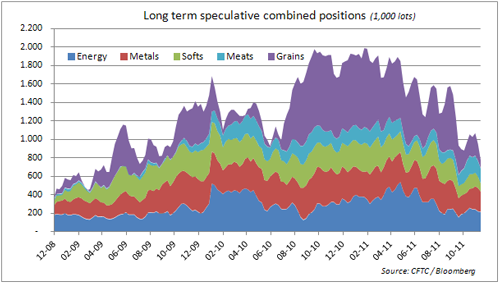

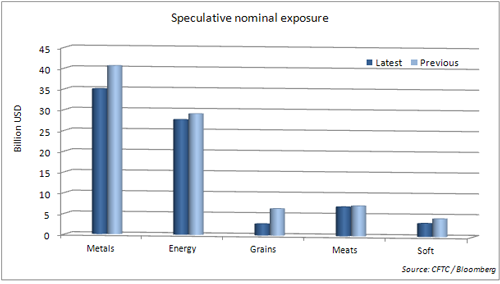

Last week speculators reduced their combined long exposure of futures and options on the 25 commodities we track by 19 percent to 770,000 lots, the lowest level since July 2009 and well below the recent peak of nearly 2 million contracts back in February. In nominal terms the exposure dropped by $12 billion to $76 billion last week.

All sectors saw reductions with the agriculture sector especially suffering a 34 percent setback as global grain growers will produce a record in 2011 thereby responding strongly to the high prices seen in 2010 and early 2011.

The grain sector tumbled with long exposure to corn, the darling of the grain markets, dropping by 22 percent. The overall long exposure to grains now sits at only 84k lots, down from 865k lots in February when worries about this year's crop reached boiling point. The short position in the soy complex, which comprises soybeans, soy meal and soy oil, grew for the second week reaching -45K lots.

Energy sector relatively unscathed with small reductions in WTI, Heating oil and gasoline being offset by an almost equal reduction in the natural gas short position. The metal sector saw reductions across the board with investors trimming long positions in gold after the failure to make further progress while the short position in copper nearly tripled.

Related Articles

The stock market sold off on a decline in February's Consumer Confidence Index (CCI), confirming a similar decline in February's Consumer Sentiment Index (CSI), which was reported...

Back in late December, I showed gold stock investors some key cycle and oscillator charts for XAU/USD and the miners, suggested that the GDX (NYSE:GDX) ETF and its component...

The central bank’s job is never easier, but in the current climate, it’s unusually tricky. In addition to the usual challenges that complicate real-time monetary policy decisions,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.