- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Initial Coin Offering (ICO)

What Does an ICO Mean?

New cryptocurrencies can gain traction as well as market capitalization via an initial coin offering (ICO). ICOs are similar in spirit to an initial public offering (IPO) which creates a publicly traded equity by offering corporate shares of a privately-held company thereby transforming it into a public company.

ICOs, however, are not as formal as IPOs which generally require underwriters, price offerings, and extended marketing plans. ICOs are actually more similar to crowdfunding—in fact, the term “crowd sales” is commonly used in the ICO arena because the sale of a new currency is an investment, not a donation.

How an ICO Works

An ICO starts with an idea for a new cryptocurrency, which is published in a white paper. The white paper details the rules that will govern the digital currency, including how new units of the currency will be created, how records will be kept and who will keep them, and how values will be transferred from one entity to another.

The white paper also details the mission, i.e. what the project seeks to accomplish, how much money--in what kind of currency--is needed to get started, and for how much time the ICO will be available.

Tokens = ICO Cryptocurrency?

During the ICO period, ‘shares’ of the new cryptocurrency are referred to as tokens. The funding process can be executed in a few different ways. If the number of tokens being offered and their value are fixed, once the goal has been reached the ICO is complete.

If the supply of tokens is fixed but the funding goal is dynamic, the value of each token is decided once the predetermined time for the ICO has expired. Another option for an ICO is to allow unrestricted funding at a specific token price to determine the number of tokens that should be generated.

Pros and Cons of ICO Explained

Supporters of the ICO attempt to generate interest by networking the idea, which is not normally handled by formal agents, as would occur for an IPO. Once the ICO is launched, it succeeds if enough of the desired capital is generated, either in the form of fiat currencies, other cryptocurrencies, or other types of capital.

Investors receive their share of the new cryptocurrency and the funds raised are used for the growth of the project. If the ICO does not meet its goals, backers are refunded their capital and the project is abandoned or restarted.

Finding Information About ICOs on Investing.com

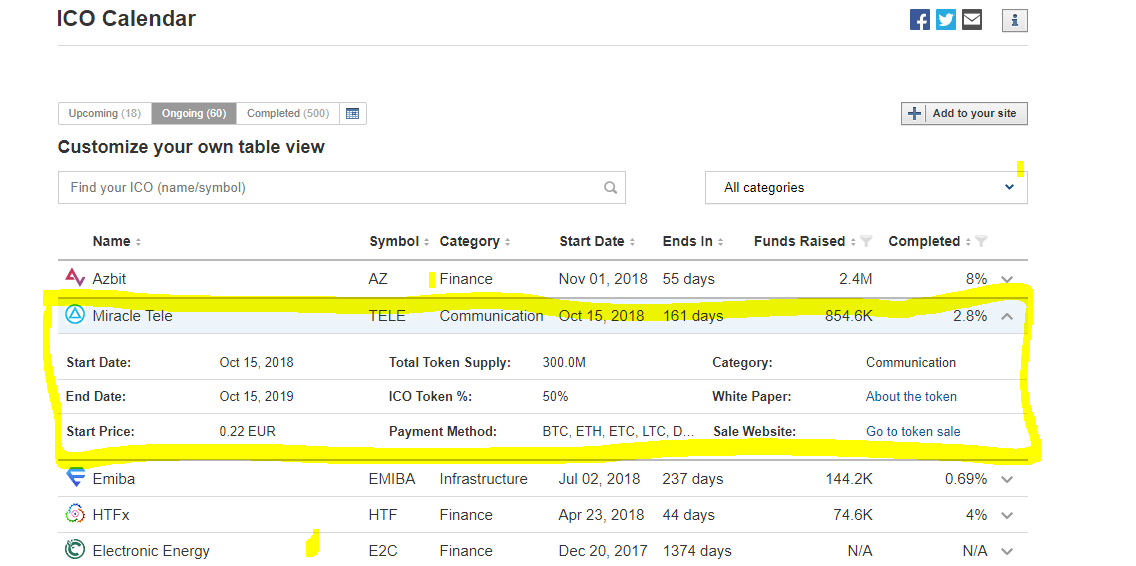

Cryptocurrency pages at Investing.com provide all the analytical tools, news, and information needed to make sound investment decisions about these assets. The ICO calendar page shows all the currently active ICOs in a table with sortable columns that include information about start and end dates, funds raised as well as progress toward completion of the ICO.

Clicking on the caret at the end of each row of the table reveals more details about the cryptocurrency offering.

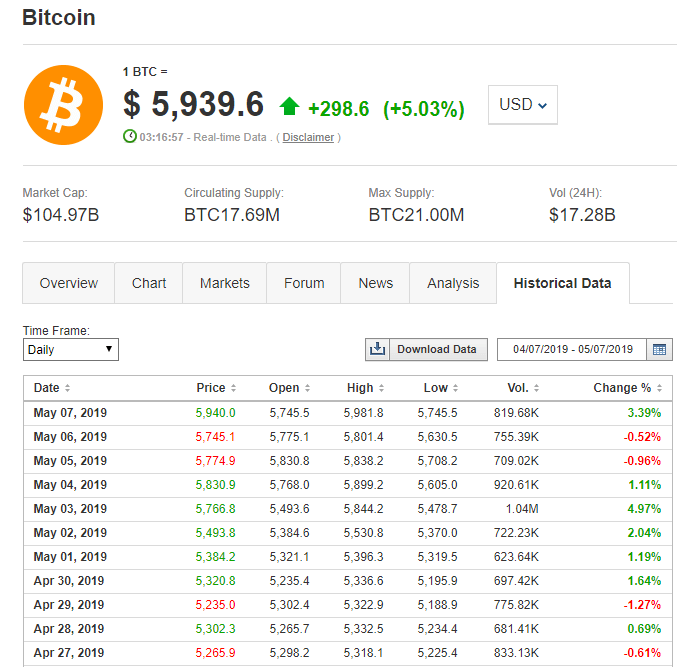

The Top Cryptocurrencies page starts with a table of the top 10 established cryptocurrency markets, sorted by market cap. Columns of the table can be reorganized to sort in ascending or descending order by clicking each header.

Initial Coin Offering (ICO) information and other active cryptocurrency charts and information round out the offerings on the page. Every currency pair has its own page with historical data, charts, news, and information, e.g. Bitcoin.