- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Derivatives

What Is a Derivative?

A derivative is a security that’s based on an underlying asset. Derivatives are often called contracts because they depend upon the parties of the agreement to comply with specific terms relevant to the derivative.

There are two major types of derivative contracts:

- Forward commitments (e.g., futures)

- Contingent Claims (e.g., options)

The value of a derivative is indirectly dependent upon the price fluctuations of the asset that underpins the contract. Derivatives are commonly used to hedge established positions, reduce exposure to the risk of price fluctuations, and for pure speculation.

What are Futures Contracts?

A futures contract is a forward commitment contract between a buyer and seller to exchange a specific, standardized asset at a precise time in the future for a particular price. Futures contracts are most often created for a standardized asset such as a government bond, currency or commodity.

These contracts are bought and sold on exchanges, often by speculators with no intention of taking delivery of, or actually delivering, the asset. Rather, speculators enter and exit positions before the contract expires, hoping to profit from changes in market expectations of the underlying asset.

Price changes will result from, among other things, economic conditions, weather, political risk, or company management. If the contract is held through expiration, the seller must deliver the underlying asset to the buyer at the agreed upon price.

Forward Contracts

The over-the-counter version of a futures contract is called a forward contract. Forwards are not traded on an exchange; rather the terms are determined by the parties in the agreement.

Interest rate swaps are forward commitment derivative contracts between two parties, often a bank and a company. The two parties create the terms of the contract, which is not standardized and is not traded on an exchange.

The parties can customize the agreement in any way they please, including the frequency of the payments, the period of the loan, and the principal amount. The principle of the swap is called the “notional amount” because it is never exchanged. It is only used to calculate the payments.

The floating rate in the agreement is often linked to either the one-, three- or six-month LIBOR (London Interbank Offered Rate).

Options Contracts

An option contract is a contingent claim contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price on a specific date. A “call” option is a contract that grants the buyer an option to purchase an underlying asset; a “put” option grants the buyer an option to sell an underlying asset. On the other side of the option is the seller of the contract, also known as the option “writer” since they are the party creating the agreement.

The writer agrees to comply with the agreement at the “strike” price when and if the option owner exercises their right to buy or sell. The “expiration” of the contract is the date that the owner of the option can exercise their right to buy or sell.

Mortgage-Backed Securities

Mortgage-Backed security (MBS) is another type of derivative. An MBS makes payments to investors from the payments of a group of home mortgage borrowers. Each MBS is comprised of many loans from home buyers, which were originally created individually, then sold to other companies that grouped the loans together for sale as shares to investors.

Each group of loans has similar characteristics, including terms and risk. An accredited credit rating agency must give the security one of the top two ratings, and the original loans must have originated from a regulated and authorized financial institution.

The MBS instrument expands the amount of capital available to home buyers by allowing investors to loan their funds to home borrowers without making a loan to each individual. From the perspective of the investor, an MBS provides institutional investors with a higher yield than might be obtained via Treasurys or corporate bonds. They also offer diversification but are higher risk than more conventional securities.

Finding Derivatives on Investing.com

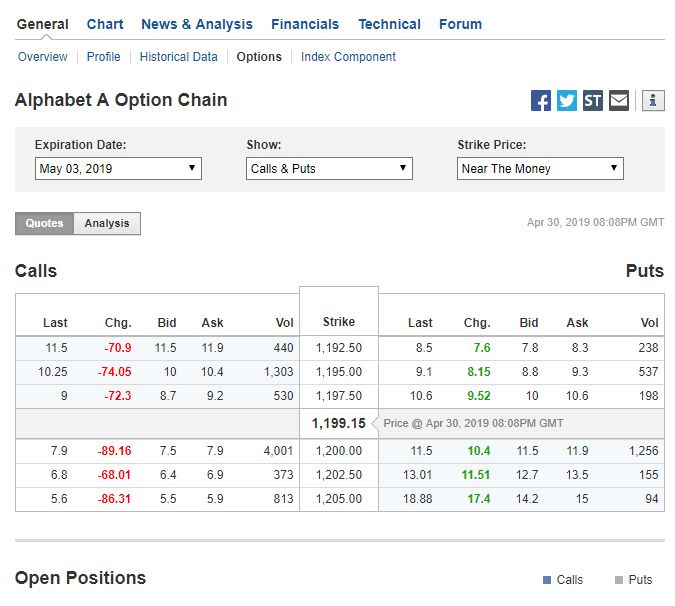

Derivatives coverage is available on a variety of pages at Investing.com. Every individual stock page on the website includes a link to an options page with pricing for puts and calls, e.g., Alphabet (NASDAQ:GOOGL).

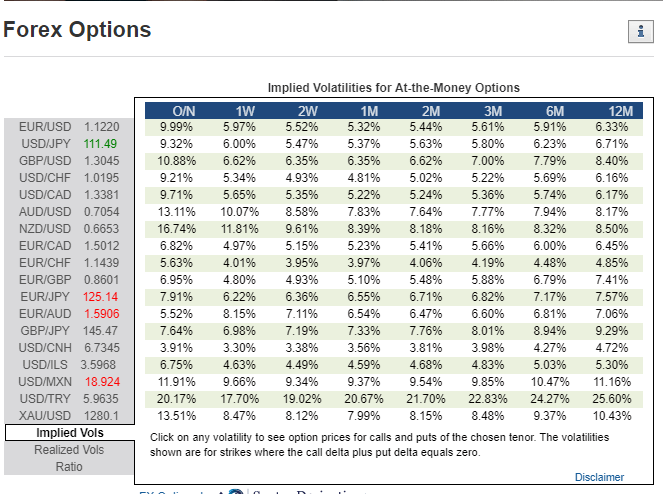

The Forex Options page provides pricing information and detailed modeling for currencies. Market activity for futures contracts is available on the Commodities and Financial Futures pages.