- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cash Flow (CF)

What is Cash Flow

Cash flow is the balance of a company’s incoming and outgoing cash and cash equivalents for a given period.

Positive cash flow indicates that a company’s liquidity position is strong or increasing; negative cash flow indicates that a company’s liquidity position is weak or shrinking. Companies with favorable cash flows are more flexible, able to meet obligations, improve company assets, return money to shareholders, and overcome challenges.

Cash flow only pertains to cash or cash equivalent aspects of the operation, it does not necessarily indicate that a company is profitable or unprofitable. A profitable company with weak cash flow could have difficulty growing or could even fail because of an inability to regularly settle short-term liabilities.

Why Cash Flow is So Important

If incoming company assets are dedicated to inventory, accounts receivable, or real estate, for example, which aren’t sufficiently liquid, paying monthly bills to keep the lights on could be difficult.

On the other hand, a company with strong cash flow, that can easily meet its short-term obligations using cash or cash equivalents, may have also borrowed against its potential growth or may have sold assets that make servicing long-term debt unsustainable. This could lead to unprofitability, but would not at all be reflected in the company’s cash flow.

For example, if a startup received cash from investors who were expecting a new product to generate revenue in the future, the stability of the company would be ensured for the short term. However, without revenue with which to generate additional cash flow, the long-term stability of the company is by no means certain.

Cash Flow Statement

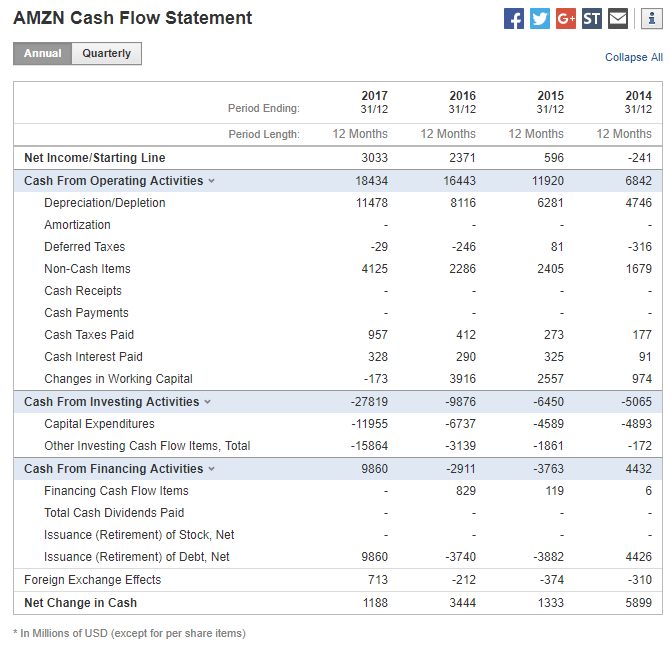

The three major sections of a Cash Flow Statement are operating activities, investing activities, and financing activities. Cash from operating activities includes inflow and outflow attributable to the fundamental purpose of the company, e.g. revenues and costs from sales of products.

Investing activities include the cash balance associated with improving the operation of the business, e.g. acquiring and liquidating manufacturing equipment. Financing activities include paying down debt and reissuing stock.

How to Analyze Cash Flow Statement at Investing.com

At Investing.com, the main page of every company includes their Cash Flow Statement under the Financials tab, e.g. Amazon. Tabs at the top left of the table allow readers to change the cash flow statement interval to wither Annual or Quarterly calculations.

At the upper right of the table the Collapse All link condenses or expands the details of each of the major headings.