- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Bid and Ask Prices

Bid and Ask Prices definitions

The bid is the price a buyer is willing to pay for a security. The ask is the price a seller wants to receive in order to deliver that security.

When a bid or ask order is placed, the quantity of shares involved is also included. An order is filled when the number of shares specified has been reached at the price requested.

What do the bid and ask prices represent on a stock quote?

The price of a security seen on a screen or a chart is the last price at which a buyer and seller agreed to complete a transaction. However, it does not necessarily represent the price at which the next buyer and seller can expect to own or sell the same asset.

Markets are comprised of multiple buyers and sellers, all looking to complete a transaction under terms most favorable to their own particular interests. Buyers want to pay as little as possible to own a security and sellers want to receive as much as possible to deliver a security.

When a buyer meets a seller’s price to complete the transaction, it is called taking the ask--or taking the offer. When a seller agrees to accept the buyer’s price it is called hitting the bid.

Orders for securities include market, limit, and stop orders, each with varying degrees of flexibility for the participants.

- A market order does not include a price restriction; the number of shares ordered will be met regardless of the price.

- A limit order requires that the order is filled at a specific price, or better until the number of shares has been reached. A limit order is used by investors who only want the transaction to occur if the price is right for them.

- And finally, a stop order requires that another transaction occurs at a specified price before the stop order becomes a market order. This type of order is used by investors who want to limit losses or expect a market to break out of an established range.

Why are bid and ask prices so different?

The difference between the two closest bid and ask orders is called the bid-ask spread. It's also a good indicator of market liquidity on the asset. For example, imagine stock XYZ last traded 100 shares at $100 per share.

The next bids for the same stock are 100 shares at $99.90 followed by 10 shares at $99.80. The next ask orders for the stock are 50 shares at $100.10 followed by 50 shares at $100.20. The bid-ask spread is thus $0.20, indicating this is a market that lacks strong liquidity because neither buyers nor sellers can get what they want without compromising.

A completed market order using the example above would play out like this:

- Buyer A enters a market order to purchase 100 shares of XYZ stock: the order will take the asks of both sellers in the example, paying for 50 shares at $110.10 and 50 shares at $100.20.

- The fill price for buyer A would be $100.15, which is the average price of all the shares bought.

- At the completion of this transaction, the last price traded which would appear on screens and charts, would be $100.20, which is the last completed trade by buyer A.

Finding the Bid and Ask Prices in Investing.com

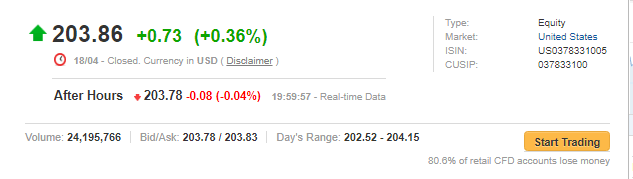

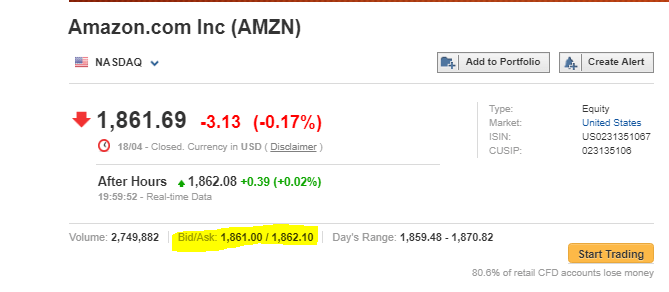

On Investing.com, you can find the bid and the ask prices on the main page of each stock and forex pair directly below the most recent price near the top of the page, e.g. Amazon (NASDAQ:AMZN).

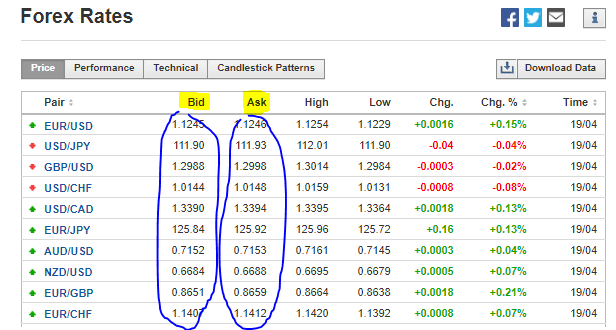

On the Foreign exchange Rates page (aka forex), the table includes the bid and ask of each currency pair, organized into sortable columns.