- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Stock in Focus, Foodies Edition: Starbucks

In this edition of “A Look at a Stock”, we’re having a look at Starbucks (NASDAQ:SBUX).

When it comes to American-style coffee, Starbucks will usually be the first brand one would think of. With a market cap of over $83 billion, it is the second-largest company in its category after Walmart (NYSE:WMT). But what makes Starbucks so synonymous with coffee, and what can we learn about the stock? What makes Starbucks, well... Starbucks?

Let’s look at the company’s history, present, and future:

The Mermaid’s Tale

What brought three Seattleites (an English teacher, a history teacher, and a writer) to create a coffee brand that would take the world by storm? The answer is that they never meant to start a coffeehouse at all.

The three founders were inspired to start a company after being taught how to roast coffee beans by the famous coffee entrepreneur - Alfred Peet, and opened up the first Starbucks store on March 31st, 1971, at 2000 Western Avenue, Seattle.

It may come as a surprise, but for the first 15 years of its existence, Starbucks only sold roasted coffee beans, tea leaves, and spices. In fact, the only fresh coffee served in the shops was in the free samples.

In 1982, Howard Schultz joined the company as the director of marketing. Schultz was a big fan of the Italian coffee culture, which he tried to introduce to Starbucks by suggesting they offer fresh espresso in the stores. Despite a successful pilot in one location, the founders refused to expand it to other locations. Schultz’s frustration began brewing and in 1985 he left the company to start his own chain of coffee bars called Il Giornale.

In 1988, Starbucks management decided to sell its Starbucks retail unit and Schultz jumped on the opportunity, buying it for $3.8 million.

Schultz rebranded all of the Il Giornale shops into Starbucks Coffee shops and started offering fresh espresso drinks in all original Starbucks stores.

The company then launched an aggressive expansion plan, and by 1990 there were 46 Starbucks stores around the U.S. Northeast and Midwest.

The Evolution of the Starbucks’ Logo

IPO and Going Global

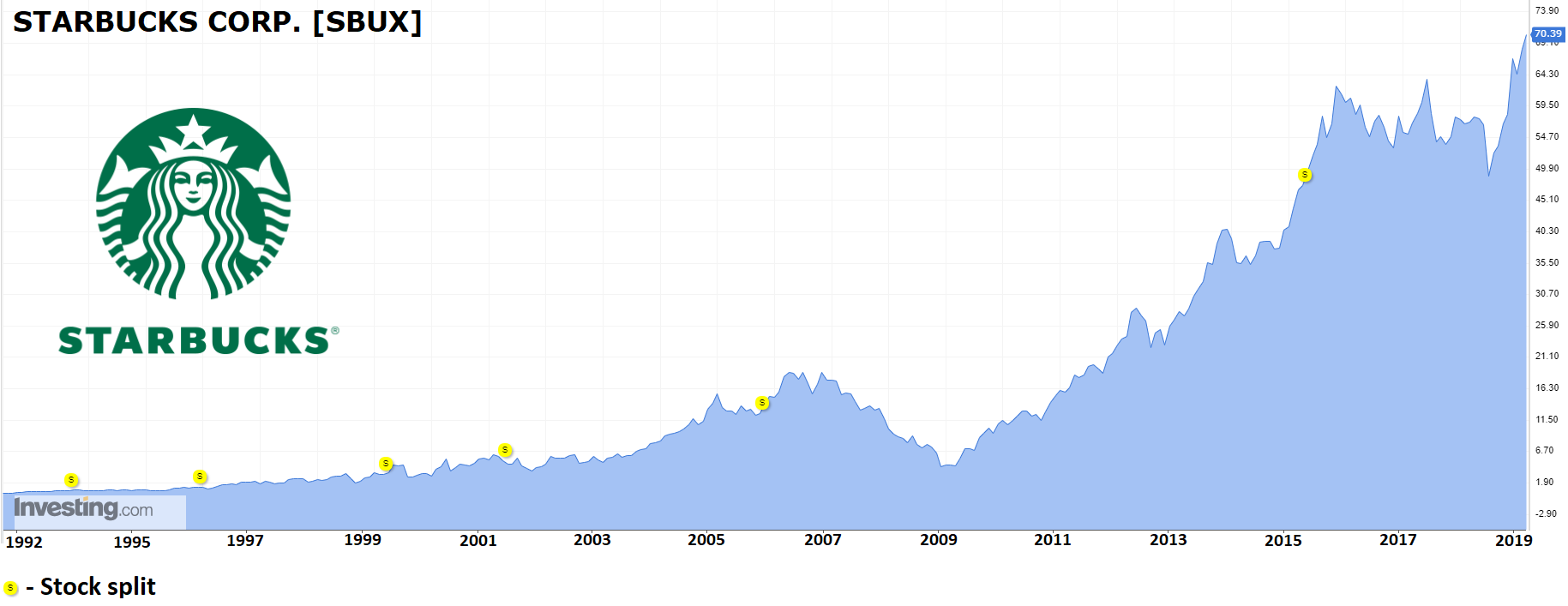

The company’s rapid expansion was a success and Schultz decided to take Starbucks public, and in June of 1992, the company IPO’d at $17 a share.

If you bought 100 shares upon the initial IPO (for $1,700), and accounting for 6 2-for-1 stock splits, you would now own 6,400 shares that are worth approximately $429,000 at the time of this writing.

It may be hard to imagine traveling around the world without finding a Starbucks, but the company opened its first location outside of the U.S. only in 1996.

The first non-U.S. Starbucks store was in Tokyo, Japan. The company chose Japan as it was the 3rd-largest coffee consumer in the world and the strongest economy in the Pacific Rim.

Where’s the Venti and Where’s the Short?

The company’s success can be attributed to 2 main factors:

Starbucks rapid growth and dominance in the market was achieved through aggressive expansion and local saturation - the company would often find an area where there are successful coffee shops and set up a Starbucks in close vicinity, eventually driving these local mom-and-pop stores out of business, and opening shops “on every street”.

When the company decided to enter the U.K. market, they bought the UK-based Seattle Coffee Company and rebranded all the stores as Starbucks, giving the company a solid infrastructure in the country, and eliminating a competitor at the same time.

Additionally, Starbucks created a strong brand by focusing on the atmosphere in the shops which revolves around comfort, as stated in their mission “Creating a culture of warmth and belonging, where everyone is welcome.” They were one of the first companies to offer free WiFi in their shops back when most places either didn’t offer the service or charged for it. From freelancers to businessmen, through students and just people wanting to sit in a comfortable cafe, Starbucks became a hangout, instead of just a place to get a cup of coffee. This encouraged people to stay in the stores for longer durations, increasing the number of purchases made.

However, Starbucks’ expansion wasn’t always successful. 2 notable failures were:

In 2001, Starbucks opened its first shop in Israel, eventually expanding to 6 locations in Tel-Aviv. However, Starbucks’ approach, which seemed to work everywhere else before, wasn’t cutting it - Starbucks offers coffee at a premium, charging more for the atmosphere than for the quality of the coffee itself. The local market puts more emphasis on affordability and quality. Israelis were simply not willing to pay high prices for coffee that wasn’t as good as what was available locally. By 2003 Starbucks has admitted defeat and closed all locations in the country.

The story of Starbucks’ failure in Australia is quite similar - the first Starbucks in the Land Down Under opened its doors in July 2000. By 2008, the company had expanded to 84 locations, only to close 60 of them due to lack of public interest. Similarly to what happened in Israel, Australia already had a vibrant coffee culture, and Starbucks did not manage to adapt to the local taste.

Despite Starbucks’ brilliant business model, their inability to adapt to some markets sometimes results in missed opportunities.

Let’s Talk Schultz

On January 28th, 2019, Howard Schultz - Starbucks’ legendary former CEO and current executive chairman sent a tweet that made some waves in the American political pond:

Schultz’s announcement has won both criticism and praise on both sides of the political map, but it’s an interesting move, possibly inspired by current president Donald Trump’s successful presidential bid in 2016. No one can deny Schultz’s business savviness, as he’s the one who recognized Starbucks’ potential and turned it into a billion-dollar company.

In 2001, Schultz resigned from his CEO position, but following a decline of over 76% in share value between 2006 and 2008, Schultz returned to his CEO position.

Through a series of brilliant moves, he brought the company stock back up from under $5 to over $60! Some of these moves included closing all U.S. locations for 3.5 hours to teach their baristas how to make the “perfect espresso”, giving his personal email away to customers, modernizing all cash registers to computerized ones, replacing all their espresso machines with Swiss-made professional machines, improved the effectiveness of the supply chain from 3/10 accuracy in orders to 9/10, and more.

Caffeinated Investment

The green mermaid’s not your only option for investing in the coffee industry. In fact, there are a few other options, including stocks and futures.

If you prefer stocks, you can consider buying shares of the Dunkin Brands Group Inc (NASDAQ:DNKN), which owns the Dunkin’ Donuts coffee chain. Their market cap stands at $5.64 billion, with reported revenue of $1.23 billion in 2018 and a 9.5% growth in share value.

Another option is the JM Smucker Company (NYSE:SJM), who hold brands such as Folger’s, Kava, Medaglia D’Oro and more. The company has a market cap of $11.81 billion and annual revenue of $7.61 billion in 2018. It’s important to note that stock value dropped some 24% in 2018, but since January 1st, 2019, the stock climbed back 11%.

For those who prefer to invest in futures, you can definitely invest in coffee. In fact, it’s the second-most commonly-traded commodity. Your main options are US Coffee C Futures and London Robusta Coffee Futures. It’s important to note that coffee is quite a volatile commodity, as it is affected by weather, geopolitics, and consumer demand.

Last Cup for the Road

Looking at Starbucks’ 2018 Q4 earnings, the company made a record $6.3 billion in net revenue, seen sales go up 3% globally, in part thanks to finally showing growth in China.

In 2018 the company had net revenues of $24.7 billion, up 10% from 2017.

The coffee giant is clearly invigorated and full of energy, as our analyst Jesse Cohen points out:

"Overall it was an impressive quarter from Starbucks. The company's recent turnaround efforts are showing real progress. Sales from its U.S. business reached an all-time record in the final three months of 2018. More importantly, same-store sales in China, its second biggest market, also showed an increase, a positive development going forward."

When asked what he thinks about the Starbucks stock, senior analyst Clement Thibault said that:

“There's a reason why Starbucks is one of the few companies whose stock trades at an all-time high. The coffee chain has been doing great, whether in its China expansion or in increasing same-store sales. Starbucks has reached a saturation point in the US in regards to its number of stores, so getting people to spend more is the key - and Starbucks has been doing it very well. If the company keeps growing same-store sales at a rate of 3-4%, there's no doubt in my mind the stock will keep reaching higher.”

All in all, Starbucks seems to be a strong stock, with great growth potential, and a fascinating company in general.

So, how do you take your coffee?

Disclaimer: This post should not be considered an endorsement, nor investment advice. Do your due diligence before investing in any particular asset or asset class.

You may also like:

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.