- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

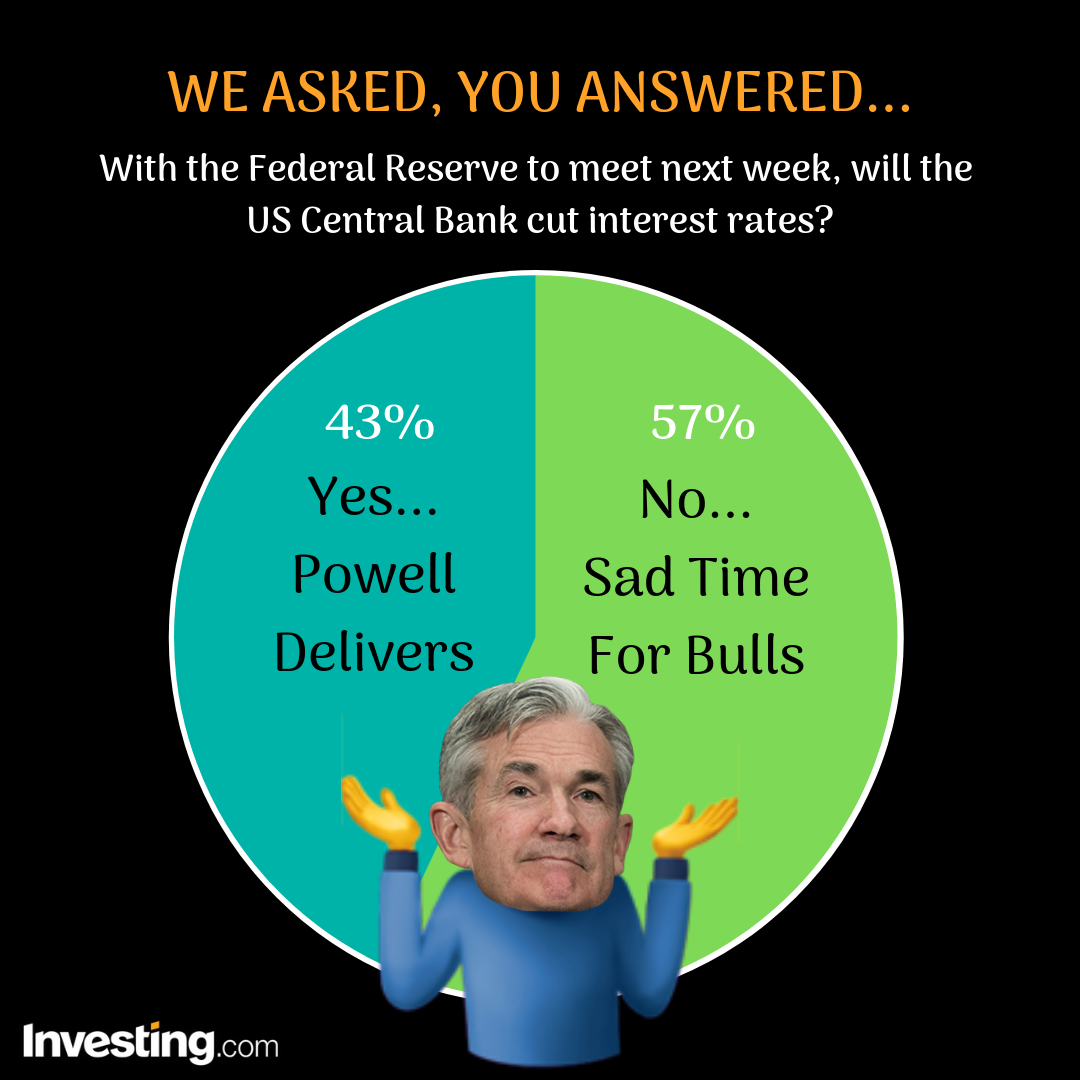

Investing.com Poll: Will The Federal Reserve Cut Rates This Week? We Asked, You Answered!

Investing.com Poll: Will The Federal Reserve Cut Rates This Week? We Asked, You Answered!

For our latest social media weekly poll, which ran both on Investing.com’s Facebook and Twitter accounts, we asked our users:

Will The Federal Reserve Cut Rates This Week?

The Federal Reserve's Federal Open Market Committee (FOMC) begins its two-day policy meeting on Tuesday, with a decision due Wednesday afternoon. The highly-anticipated meeting comes against the backdrop of rising trade tensions between Washington and Beijing as well as recent signals of slowing U.S. economic growth.

Breaking Down The Results:

The poll results showed a clear majority not expecting the U.S. central bank to take any action on interest rates this week.

Overall, when taking votes from both Facebook and Twitter into account, 57% of users thought the Federal Reserve will leave rates on hold, while 43% said they expected a rate cut.

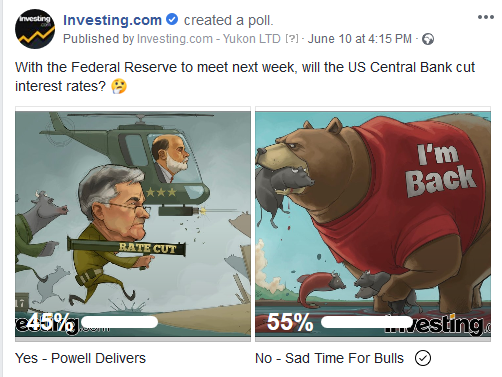

Out of the 647 votes recorded on Facebook, 358 users, or 55%, said that Powell will disappoint the bulls and keep rates at current levels.

In comparison, 289 users, or about 45%, voted that Powell will end up delivering the rate cut markets so desperately want.

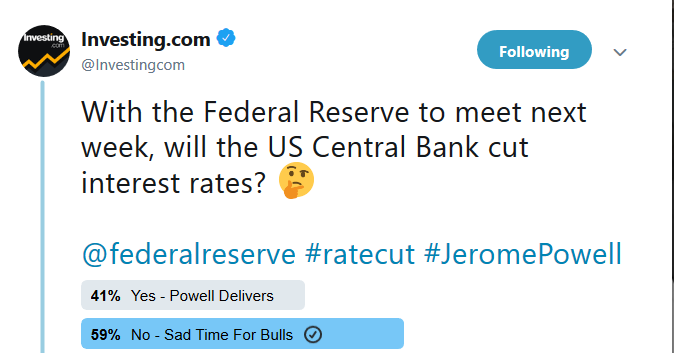

The results we saw on Investing.com’s Twitter account echoed the same sentiment.

Of the 273 votes recorded, 161 users, or around 59%, thought the Fed won’t act.

Meanwhile, 112 users, or 41%, said a rate cut was coming.

Behind the Numbers:

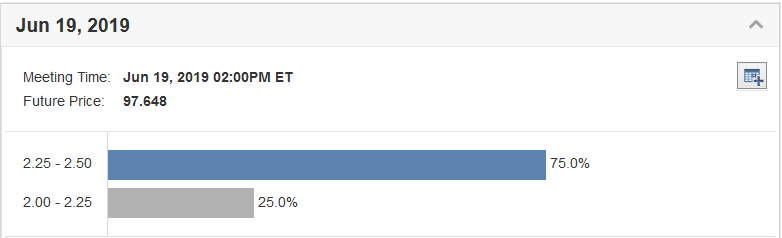

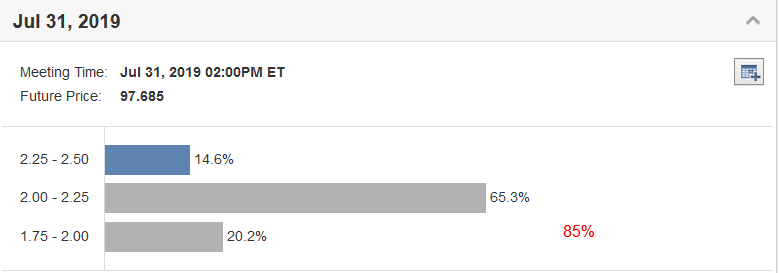

Investor expectations of a Fed rate cut at this week’s meeting currently stand at 25%, according to Investing.com’s Fed Rate Monitor Tool. The market gives an 85% chance of a cut at its July meeting.

With expectations running high, markets could experience disappointment if the Fed fails to send strong enough signals of imminent easing.

Global financial markets were jolted in May, when mounting fears over the worsening trade war between the United States and China drove equities lower.

However, bets that central banks around the world would turn more accommodative have helped spark a rally in risk-related assets so far this month.

In the beginning of June we asked: After global stocks suffered a selloff in May will June be better for the bulls?

Out of the combined 1,342 votes recorded both on Facebook and Twitter, 603 users, or roughly 45%, said they were bullish coming into June.

In comparison, 739 users, or about 55%, said they were bearish and thought June would be a rough month for stocks.

Whether the June rally continues depends mostly on what the Fed will say tomorrow.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.