- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Investing.com Poll: Gold or Oil? Which Will Perform Better Through The End Of 2019?

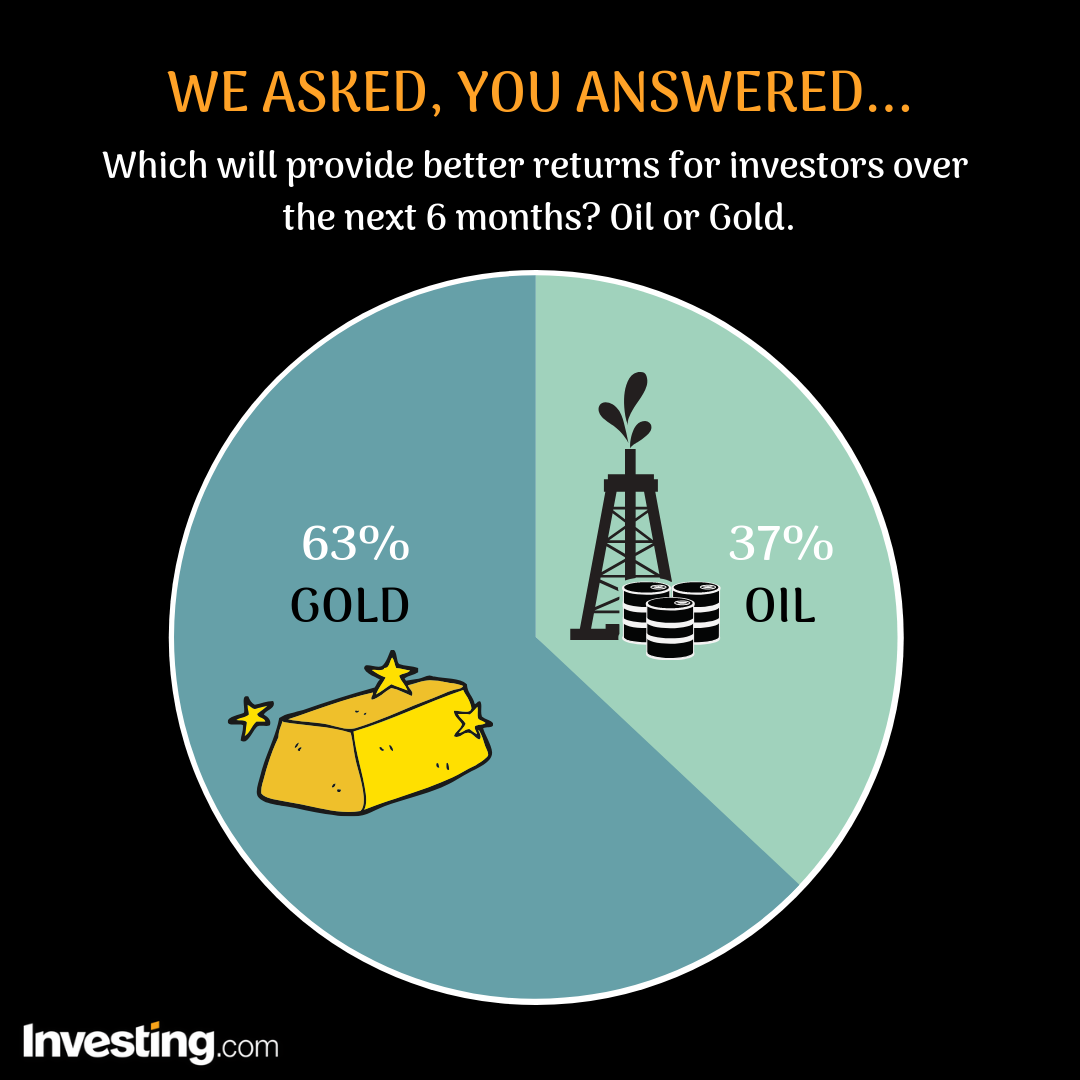

We Asked, You Answered!

For our latest social media weekly poll, which ran on both Investing.com’s Facebook and Twitter accounts from June 30 to July 7, we asked our users:

Gold or oil? Which will provide better returns for investors over the next 6 months?

Gold bulls are back in control as prices of the precious metal have soared around 10% since the start of the year to currently trade near their highest level since September 2013.

Not to be outshined, oil has also been on a tear this year, with West Texas Intermediate crude futures gaining around 34% in 2019.

The commodities have been two of the best-performing assets in the first six months of the year. The question is which will provide the better returns in the next six months.

Breaking Down The Results:

In a rather surprising outcome, the poll results revealed a clear majority that expected gold to outperform oil through the end of the year.

Overall, when taking votes from both Facebook and Twitter into account, 63% of users voted that gold will provide better returns for investors over the next six months.

Only 37% said oil will be the better investment in the months ahead.

Out of the 1,767 votes recorded on Facebook, 1,100 users, or 63%, said gold will outperform oil.

In contrast, just 667 users, or about 37%, voted that oil will be the better investment of the two in the six months ahead.

The results we saw on Investing.com’s Twitter account underlined the same view.

Of the 882 votes recorded, 547 users, or around 62%, said gold will outshine oil through the end of the year.

Meanwhile, 335 users, or 38%, said they expected oil will outgain gold.

Behind the Numbers:

Gold futures were at around the $1,420-level on Thursday, not far from a six-year high of $1,439.95 touched on July 3.

Investors have gotten gold fever on improved prospects for easier monetary policy from the Federal Reserve, with markets currently pricing in a 100% probability of a rate cut in July, according to Investing.com’s Fed Rate Monitor tool.

Mounting geopolitical tensions between the U.S. and Iran as well as lingering uncertainties over the U.S.-China trade front have also lured investors into gold.

Meanwhile, U.S. WTI prices rose to a six-week high of $60.93 a barrel this morning.

Oil prices have been supported for much of 2019 by efforts by the Organization of the Petroleum Exporting Countries (OPEC) and non-affiliated allies like Russia, who have pledged to withhold around 1.2 million barrels per day (bpd) of supply this year to prop up markets.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.