- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Elon Musk: visionary or fraud?

With his tweets prompting sudden and seismic shifts in the market value of cryptocurrencies and other investments, Tesla (NASDAQ:TSLA) CEO Elon Musk has an unprecedented ability to move mountains with a simple click of the keys. But when Musk manipulates the markets, is the result of his influence a reflection of reality, or is it more of a mirage?

In a new survey of more than 1,100 respondents in the U.S., global financial markets platform Investing.com sought to determine a more definitive and coherent assessment of the eccentric entrepreneur’s dominance over financial markets.

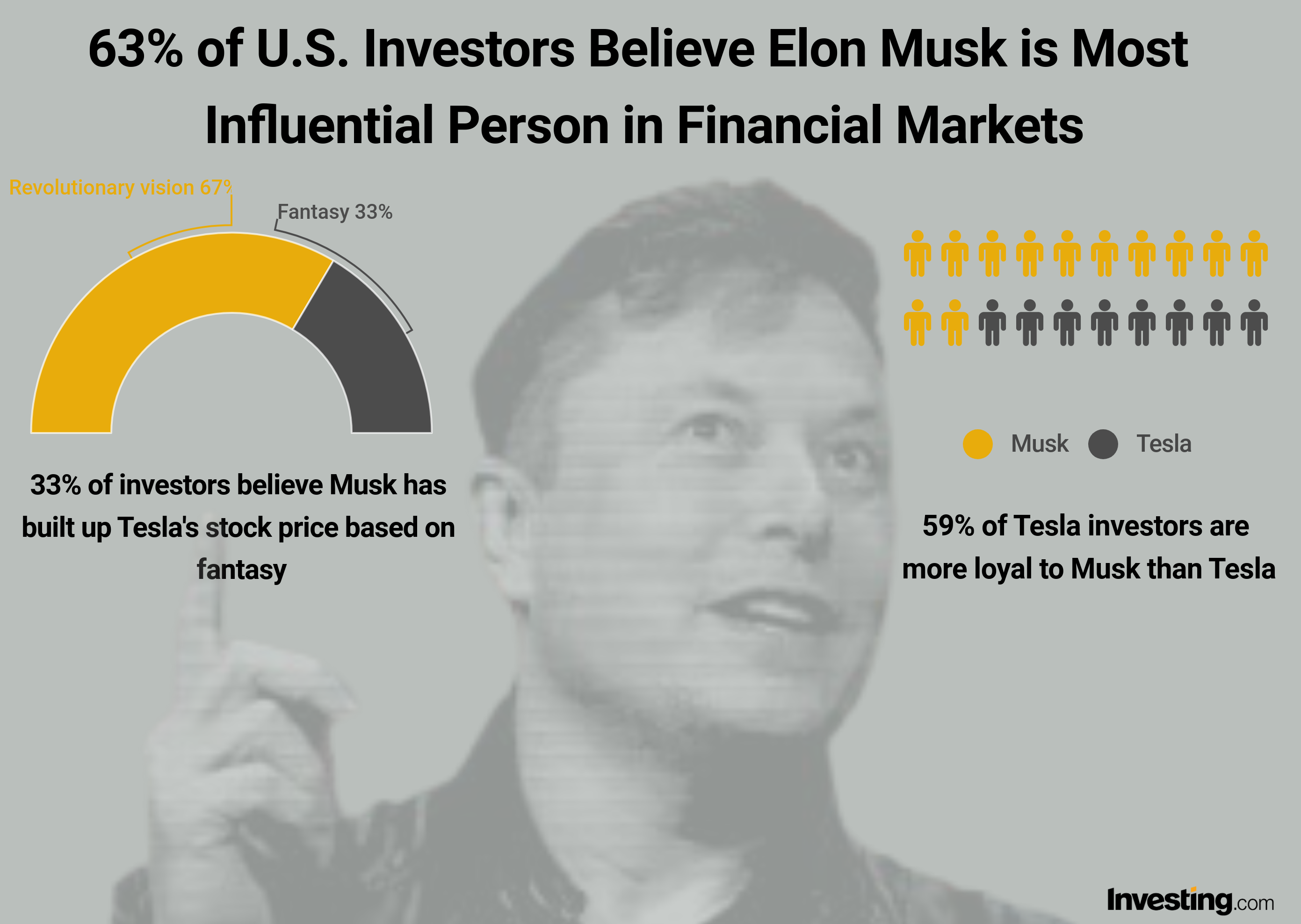

The survey reveals the sheer influence of Musk, with over 60 percent of investors believing him to be the most influential personality around when it comes to financial markets. A minority of respondents, yet still a striking 33 percent, agreed that Musk has built up Tesla stock’s price based on “fantasy” as opposed to “revolutionary vision.” Perhaps more telling, however, was that almost 60 percent of Tesla investors are more loyal to the CEO than to the company itself.

“As one of the leading innovators in the auto industry, Tesla has generated a lot of interest from retail traders in recent years,” said Jesse Cohen, senior analyst at Investing.com. “It has developed a loyal cult-like following from fans and enthusiasts who believe in the company’s technology and often laud CEO Elon Musk with praise, devotion and admiration. However, at the same time, the company has many vociferous critics who argue the electric vehicle pioneer could go bankrupt in the years ahead due to its soaring debt and high cash burn.”

At the same time, with Tesla shares already down more than a third from their peak value in January, 42 percent of investors said the stock’s market cap will continue dropping for the rest of this year; 25 percent said it will rise before the end of 2021 to a price close to the January highs, and only 17 percent anticipated a finish to the year that exceeds the previous peak. But investors’ prognosis is more optimistic in the long run, with 30 percent saying the stock price will land between $1,000 and $2,000 two years from now, followed by 17 percent projecting an $800-1,000 value and 11 percent a value of $2,000-3,000.

“The insane run-up in the price of the stock over the last decade is, like all investments, a bet on the future,” Cohen continued. “As such, it helps to be comfortable with roller coasters if you want to buy Tesla stock. That’s because wild up-and-down volatile price swings have become a hallmark of the stock’s performance over the years.”

“It is important to remember success won’t happen overnight when dealing with a volatile stock like Tesla. Investors should take a long-term approach on their investment, especially if they believe in the company for the long haul.”

In the realm of cryptocurrency, Musk’s deep influence is once again highly apparent. On the heels of the concerns that he recently expressed regarding Bitcoin’s environmental impact, a sizeable 49 percent of respondents said that Bitcoin being environmentally unfriendly is an issue for them as an investor. Thirty percent of those surveyed who are Bitcoin investors sold Bitcoin last month, with 20 percent attributing their sale to Musk’s comments on the environment. Seventy-two percent of investors would be in favor of a more green cryptocurrency, yet 38 percent didn’t even realize Bitcoin was environmentally unfriendly before Musk’s remarks.

“Bitcoin has an energy problem, as its network consumes more power than entire countries, like the Netherlands, or Pakistan,” Cohen explained. “Ripple and Cardano, for example, are two cryptocurrencies which have less environmental impact than BTC and are more efficient in terms of their mining and transaction environmental costs.”

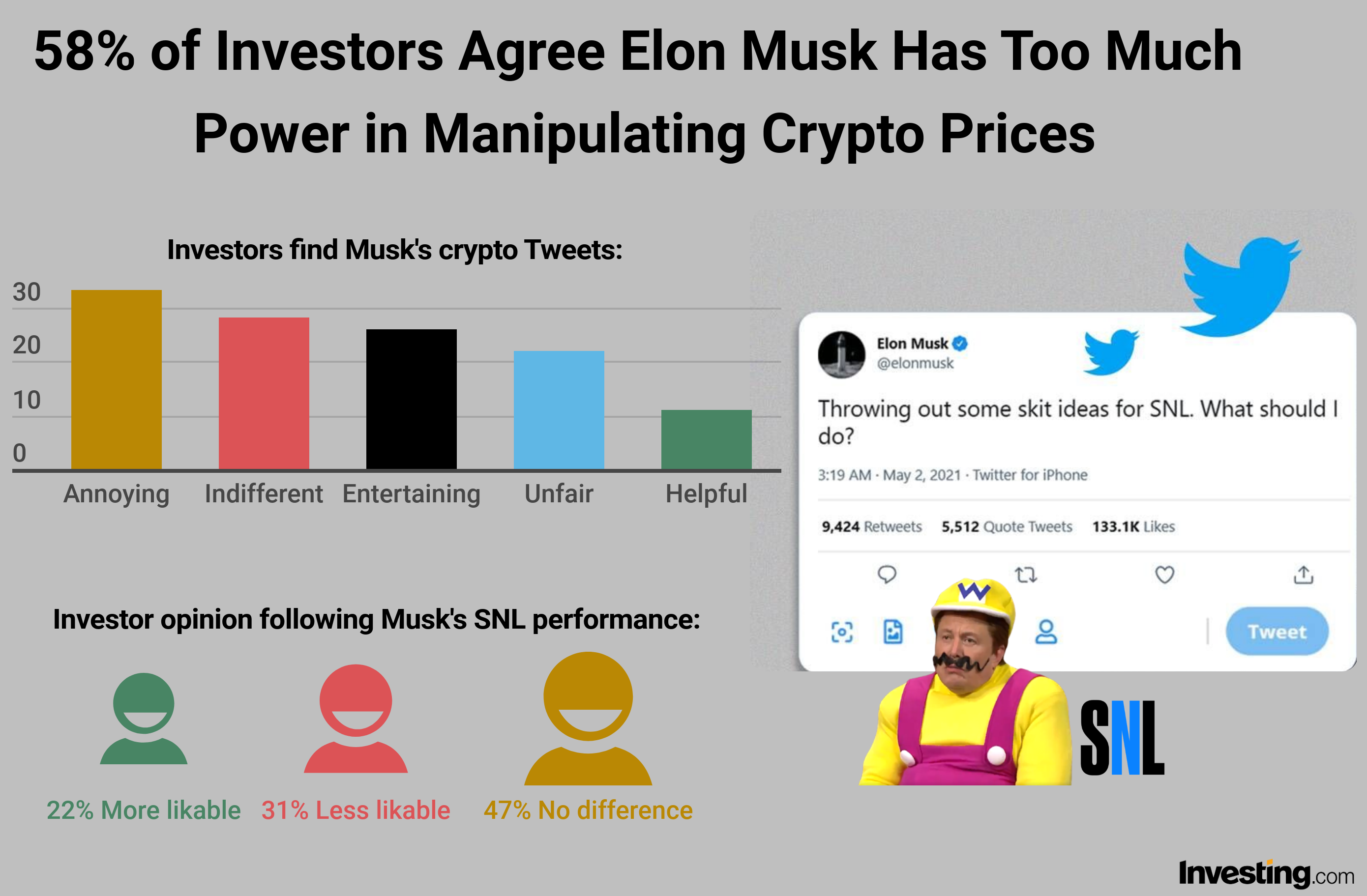

Asked if Musk’s manipulation of cryptocurrency values has changed their view of that investment, 58 percent of respondents agreed that the Tesla chief “has too much power” and 40 percent said that cryptocurrencies in general “are too volatile.” Twenty-four percent don’t believe Musk has too much influence over cryptocurrencies and just 12 percent said his influence makes them “more confident about digital currencies.”

Eighty-four percent of investors disagree that the future of Bitcoin hinges on Musk. Thirty-three percent consider his cryptocurrency tweets “annoying,” 27 percent deemed them “entertaining,” and 22 percent described them as “unfair,” while 28 percent are indifferent on that matter. Following Musk’s appearance on Saturday Night Live last month which sent Dogecoin plunging nearly 30 percent, as many as 31 percent of investors found the Tesla CEO less likable.

“After being hailed and crowned as king of the crypto community, Elon Musk has made himself some new enemies lately, following his recent shock about-face on Bitcoin,” said Cohen regarding Musk’s ability to move the cryptocurrency market. “For an asset whose price is driven mostly by psychological sentiment and momentum, Bitcoin could have a hard time recovering from this and may never revisit their record highs again.”

For the latest information on cryptocurrency markets, and for tracking prices and exchange rates, download Investing.com’s dedicated cryptocurrency app here.

Moving forward, 52 percent expressed support for policies that would reduce the power of big influencers such as Musk when it comes to manipulating financial markets.

Ultimately, is Musk a visionary or a fraud? The answer is a mixed bag. While his influence is undeniable, it seems that only time will tell.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.