- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Despite a notoriously bearish year, retail investors maintain hope for a bullish future

As the bear market of 2022 painfully persists in the U.S. and around the world, conventional wisdom suggests that investors would be waving the white flag.

Yet a new survey by the Investing.com global financial markets platform reveals that although retail investors are indeed experiencing fatigue as their portfolios continue to get hit, they are nonetheless maintaining a hopeful outlook for the remaining months of this year and beyond.

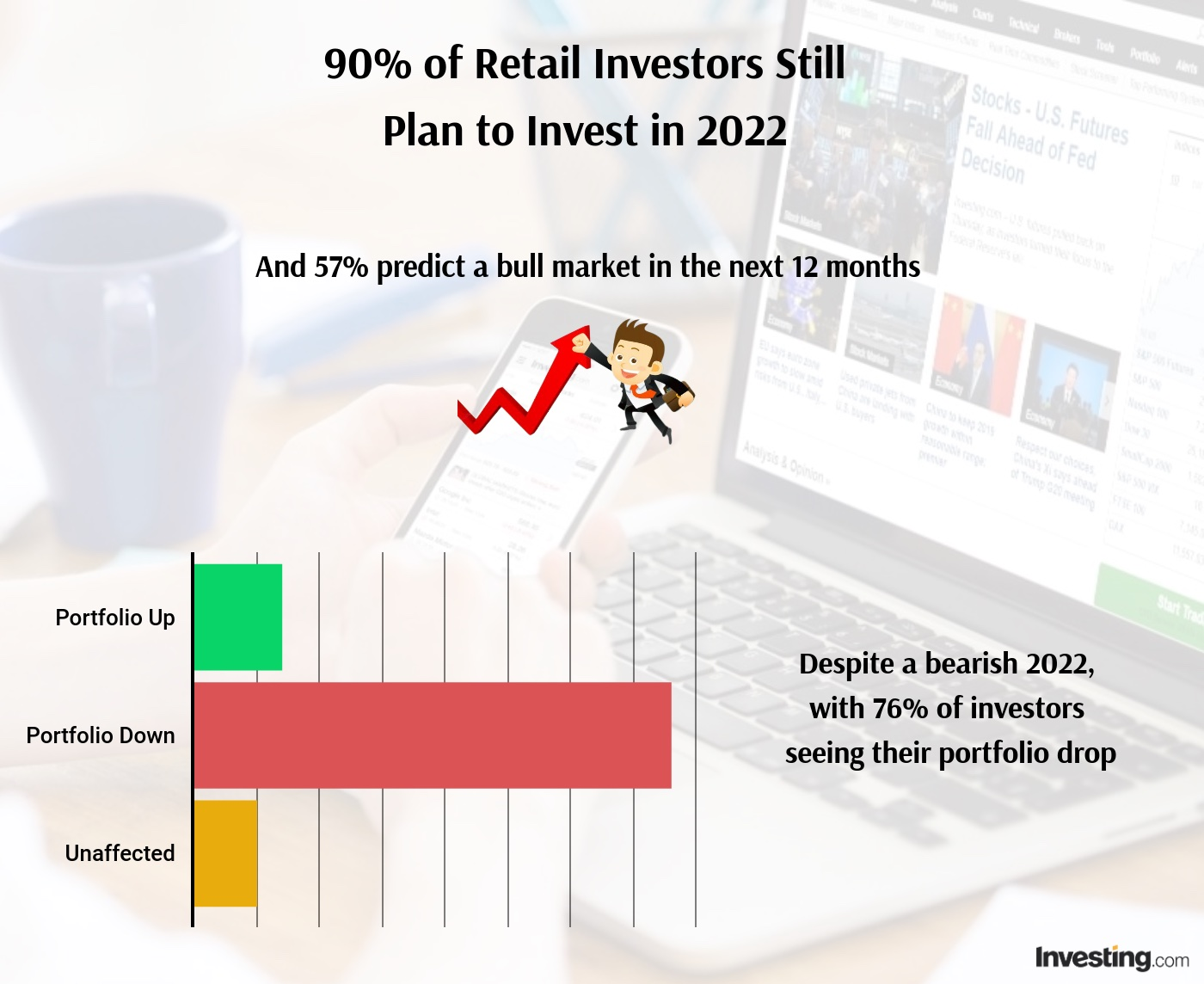

According to the survey of 1,602 U.S.-based respondents, 90% of retail investors still plan to continue investing this year, including 30% who intend to invest “aggressively.” And while institutional investors are reportedly increasingly abandoning stocks, for 85% of retail investors, their portfolios remain largely comprised of equities (followed by 40% for ETFs, 17% for bonds, 15% for cryptocurrencies, and 13% for commodities).

Retail investors’ optimism is also reflected in the fact that 57% of respondents predict the onset of a bull market within the next 12 months.

“A new generation of retail investors, which entered the market at the peak of the coronavirus pandemic, has become conditioned to buy the dip, regardless of market conditions, valuation concerns, and macroeconomic worries,” said Jesse Cohen, senior analyst at Investing.com. “In many ways, the retail investor has become a more powerful collective force than the professional investor, and they simply don't care about the same things as the experts.”

Of course, this relatively upbeat outlook does not soften the blow of a notoriously bearish year. Seventy-six percent of retail investors have seen their portfolio drop in value during 2022, and 1 in 5 have stopped trading altogether.

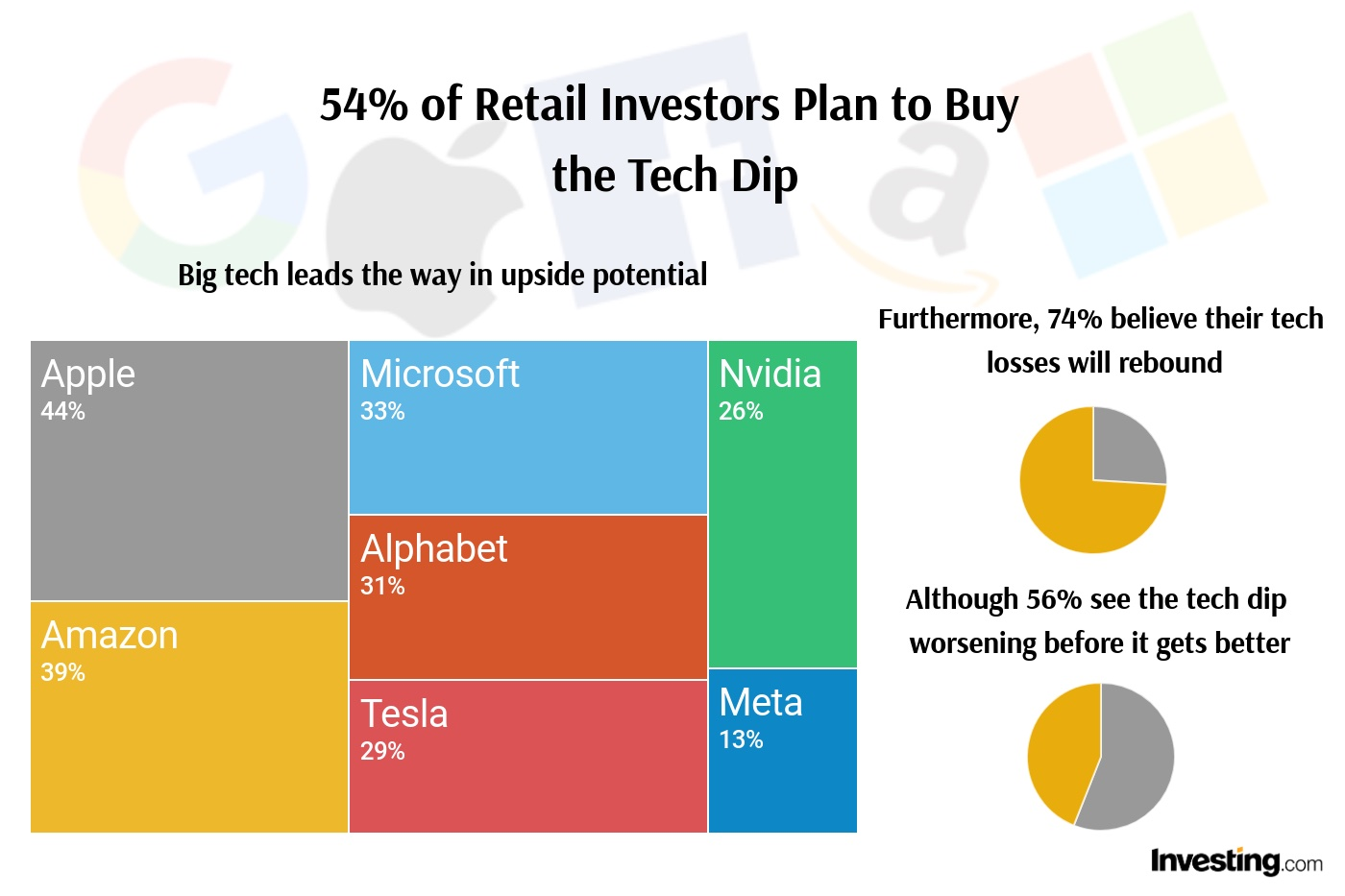

Digging deeper into the dip in the market, tech stocks experienced a particularly brutal 2022, with the Nasdaq’s value plunging by more than one-third. Fifty-six percent of respondents affirm that the tech dip is not over, and that they anticipate further losses for tech stocks in the remaining months of 2022. Yet the potential subtext of their expectations for the rest of this year is their belief that next year will be ripe for a rebound in the tech space, with 74% of respondents holding on to their tech stocks on the belief that they will rebound in the next 12 months. Citi analysts, too, are projecting a bounce-back year for tech stocks in 2023. Furthermore, retail investors are also seizing the moment in the belief that bottom is in, with 54% planning to buy the current tech dip.

“While further market volatility into year-end and early 2023 is expected, stocks are poised to stage a strong rebound amid signs that inflation may have peaked, potentially allowing the Fed to pivot on monetary policy and start cutting rates in response to a slowing economy,” Cohen continued. “Indeed, the stock market has a consistent track record of recovering steep losses and rallying to new records over time.”

Amid the continued instability in the market, investors are unsurprisingly most bullish on big-name tech stocks in the coming months, including Apple (NASDAQ:AAPL) (44%), Amazon (NASDAQ:AMZN) (39%), Microsoft (NASDAQ:MSFT) (33%), Alphabet (NASDAQ:GOOGL) (31%), and Tesla (NASDAQ:TSLA) (29%) as stocks with the most upside. This year, more than half (55%) of retail investors have invested in tech despite the dip in the sector, reinforcing the notion that they are poised to continue investing in tech in the months ahead. Thirty-four percent of retail investors believe that tech is the sector with the most potential in the coming months, followed by commodity stocks (20%).

“History shows that winning companies tend to keep winning,” Cohen added.

Investors’ thirst for stability extends to the cryptocurrency sector, as 42% of retail investors have decreased their investments or completely pulled out of cryptocurrencies this past year. Only 31% of retail investors now invest in cryptocurrencies — a dramatic decline from their 67% investment rate in cryptocurrencies that Investing.com documented in November 2021 survey. Sixty percent expect cryptocurrency values to plummet further during the next year, indicating that the golden era for cryptocurrency investing may have already come to a close; only 12% believe crypto will reach its previous highs.

“Rising interest rates and bond yields have been weighing on cryptocurrencies for most of the year,” said Cohen. “When rates are low, investors are more likely to jump into risk-sensitive assets. However, when rates start to go up, investors become much more sensitive to risk, and that’s what we’ve seen in the crypto market.”

Meanwhile, 29% of retail investors have invested in renewable energy in 2022, exhibiting their faith in one of the only sectors that has actually outperformed or even met expectations in the market this year. With the Inflation Reduction Act — signed into law by President Joe Biden in August — featuring $370 billion in subsidies and credits for clean energy investment, renewables will once again be a sector to watch for a potential surge in private investments during the remainder of this year as well as in 2023.

“Companies involved in the low-carbon energy industry, such as solar panel manufacturers and wind-turbine makers, as well as firms working throughout the EV supply chain, stand to benefit the most as the world shifts away from fossil fuels to alternative energy,” Cohen concluded.

Ultimately, it is impossible to sugarcoat the reality that 2022 took a heavy toll on investors. But retail investors’ assessment of both the shorter- and longer-term future is notably hopeful and confirms their intent to ride it out in the financial markets during 2023.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.