- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

COVID-19 threatens to disrupt Christmas spirit, reveals survey on personal finance

From a personal finance perspective, COVID-19 could be the proverbial grinch that steals Christmas in 2020.

It stands to reason that the personal finance woes typically associated with the pandemic, including job loss and instability in the financial markets, would affect consumers’ spending habits around the holidays. As we approach Christmas day, millions of Americans are out of work and at risk of losing their homes. Yet COVID-19 has also spurred unprecedented government financial assistance for businesses and individuals.

Does the government support offset consumers’ personal finance concerns, or is the pandemic’s destabilizing impact the overriding factor shaping spending behavior?

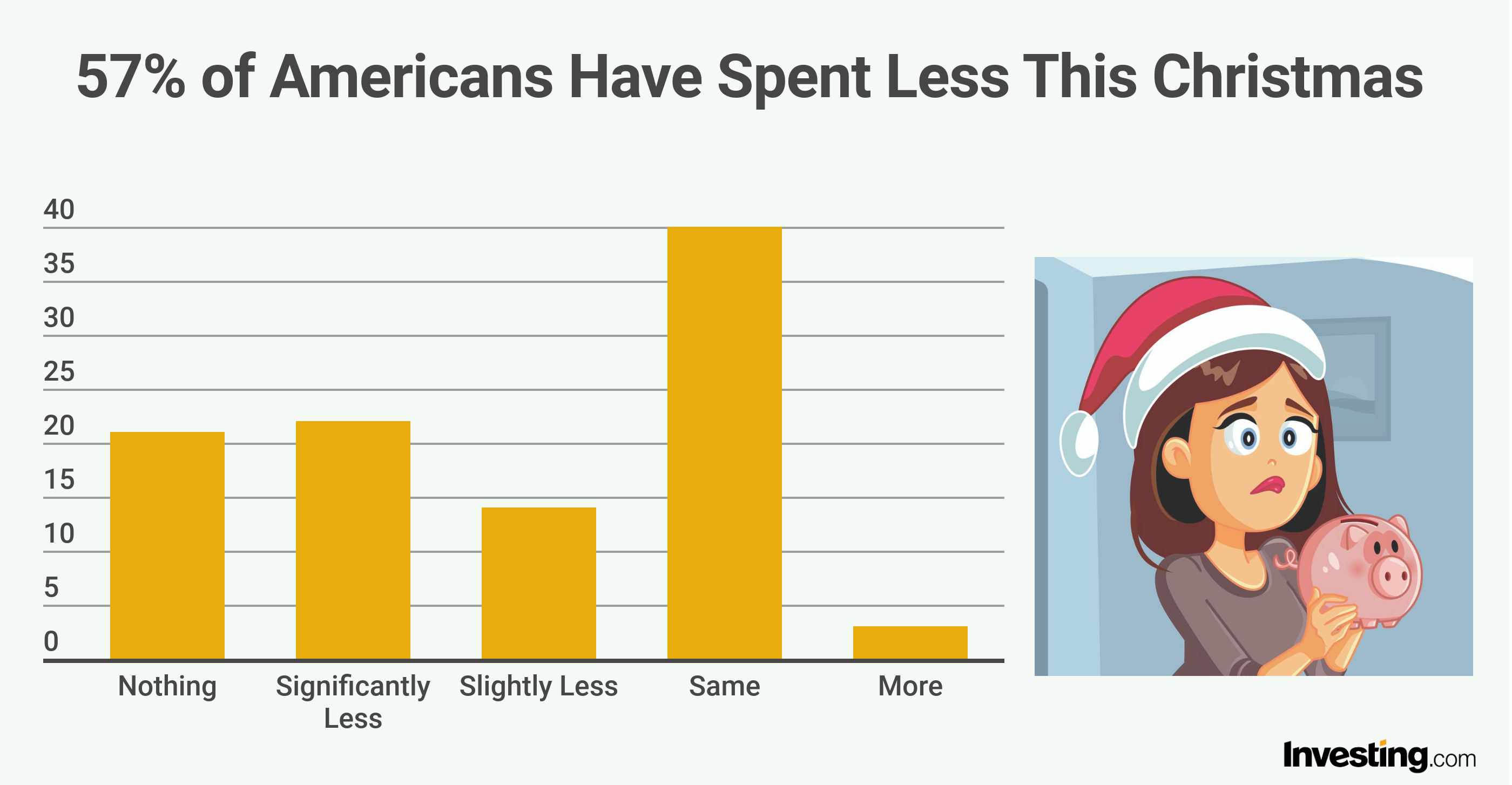

According to new survey data compiled by Investing.com on the effect of COVID-19 on personal finance in the U.S., the pandemic has in fact led to more cautious consumer behavior this holiday season. Approximately 57 percent of the poll’s 2,651 respondents said they have decreased their Christmas spending, including 21 percent who stated they “won’t be able to purchase anything this year.”

“The upcoming holiday season will likely be very different for families across the United States when compared to previous years,” said Jesse Cohen, senior analyst at Investing.com. “Not only will holiday gatherings be smaller, but the economic impact of the COVID-19 pandemic will mean that holiday shopping and spending on gifts is out of reach for many Americans this year.”

“It seems evident that without additional stimulus support, the economy - and Main Street retailers - will continue to struggle with the negative effects of the ongoing health crisis,” Cohen added.

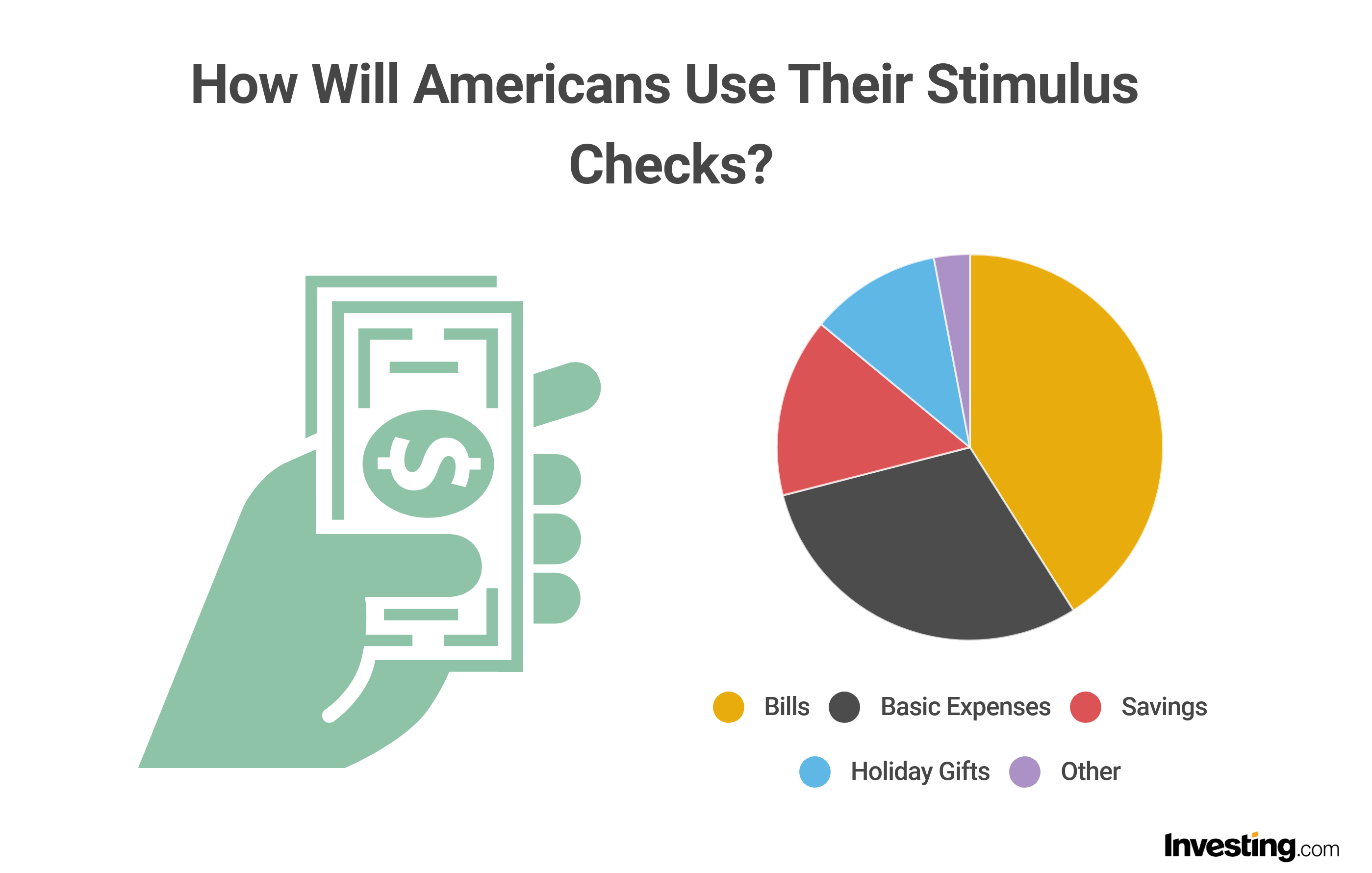

With Congress failing to quickly reach a deal that would send more money to struggling families, a second stimulus package was finally approved on Sunday night. However, there’s little to suggest this will have much of an impact on consumer spending this Christmas, with just 11 percent saying that they would use their stimulus check on holiday shopping. Over 70 percent of Americans said that they would use the check to either pay off bills (41 percent) or help cover basic expenses (30 percent).

“Following months of back-and-forth haggling, U.S. lawmakers finally came to an agreement on more fiscal aid which will provide much-needed financial breathing room for millions of Americans,” Cohen noted. “The potent combination of stimulus and vaccine optimism has investors looking past a tough winter to a better spring and summer ahead.”

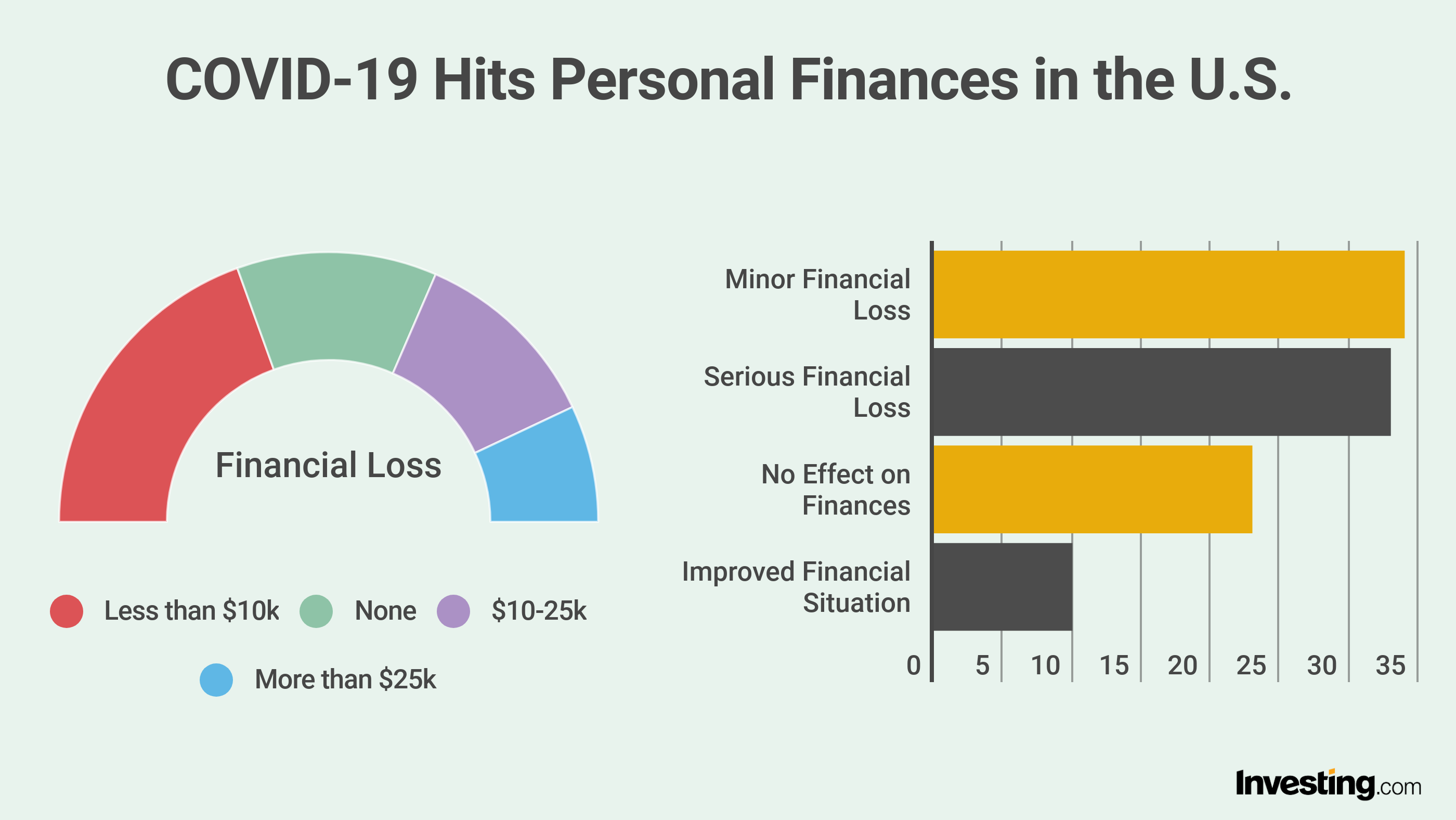

Two-thirds (67 percent) of Americans reported that the pandemic has caused some form of financial loss, with 33 percent describing their loss as “serious” and 34 percent as “minor.” Regarding the extent of their financial loss, 62 percent reported losses of less than $25,000, including 39 percent under $10,000. Only 14 percent experienced a loss of more than $25,000.

Ultimately, the psychological effects of COVID-19 on personal finance could be as significant as the pandemic’s actual impact on individuals’ bottom line, or even potentially more significant. Seventy-seven percent of Americans said the pandemic’s financial implications have made them more anxious, exceeding the 67 percent of respondents who reported tangible financial loss.

Further, despite the country beginning it’s vaccination drive last week, our respondents are bracing for the continuation of these financially challenging times, with 76 percent expressing some level of concern about their finances for as long as the pandemic persists.

“Despite the challenging times ahead, there is light at the end of the tunnel,” Cohen said. “Positive announcements on the vaccine front from the likes of Pfizer (NYSE:PFE), and Moderna (NASDAQ:MRNA) have boosted hopes that life could return to some sort of normalcy in the months ahead.”

Considering the pandemic’s impact on consumers’ mindset as well as on their actual spending patterns, COVID-19 poses a serious threat to disrupt this year’s Christmas spirit. Let’s hope that a vaccine or other breakthrough can restore the holiday cheer in time for December 2021.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.