- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Of The “Strangest" ETFs That Need to Be on Your Radar

These strange exchange-traded funds offer investors potential for significant gains

Exchange-traded funds (ETFs) have taken the investing world by storm in recent years. According to research firm ETFGI, there are 5,024 ETFs trading globally, with 1,756 based in the U.S. alone.

It’s no surprise then that ETF managers are doing all they can to make their funds stand out from the rest of the crowd, whether that means giving it a “strange” name or investing in a “strange” industry.

But first let’s ask, what exactly is an ETF?

In short, an ETF is a security that tracks stock indices, commodities, bonds, or baskets of other assets, but trades like a common individual stock.

There are various types of ETFs available to individual investors and traders that can be used for either income generation or to hedge risk in an investor's portfolio.

So without further ado, here are the three ETF’s we found to be the “strangest” that offer investors and traders potential for significant gains.

Remember: Like beauty, “strange” is in the eye of the beholder.

In case you like “strange” investments…

UFO

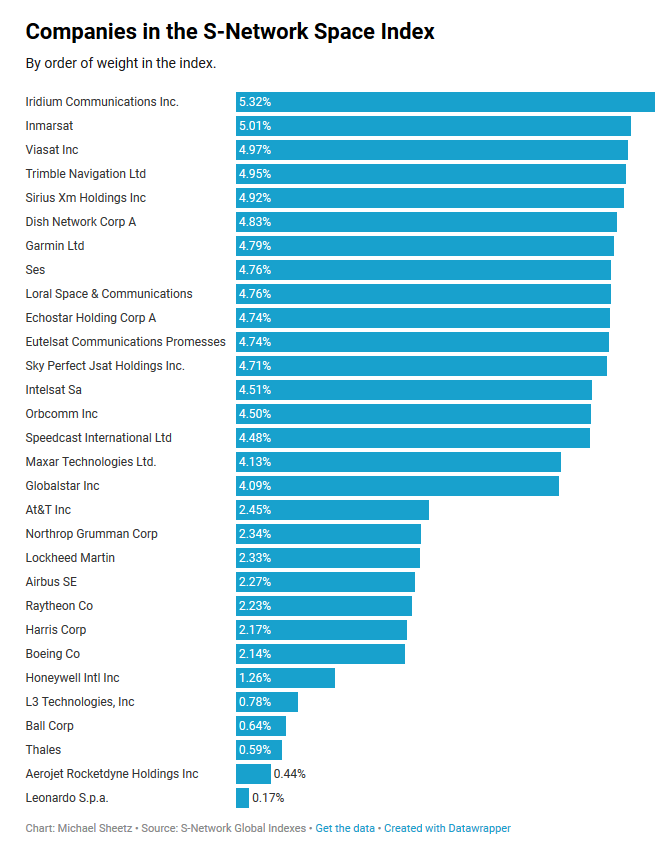

The Procure Space ETF (Ticker: UFO) of 30 companies gives market players a way to invest in the burgeoning space economy.

The fund, launched on April 11, includes everything from satellite communications firms – such as Iridium Communications, Inmarsat, Viasat – to industrial manufacturers – Garmin, Airbus, Honeywell (NYSE:HON) – and more.

According to Andrew Chanin, co-founder and CEO of ProcureAM, UFO focuses as much as possible on “pure play” space companies, with around 80% of the constituents deriving most of their revenue from space businesses.

“UFO provides, compared to other types of investment vehicles, a relatively low cost and diversified away to invest in this specific theme,” Chanin said.

UFO is up nearly 4% since its inception.

YOLO

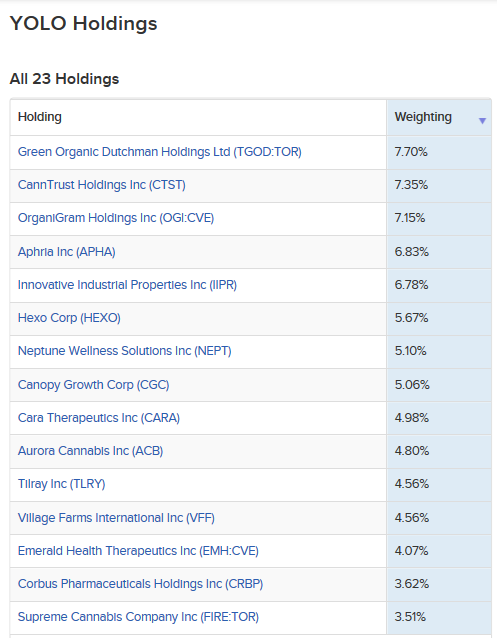

The AdvisorShares Pure Cannabis ETF (Ticker: YOLO) is an actively managed marijuana-themed exchange-traded fund with nearly $15 million assets under management.

The ETF, which made its trading debut on April 17, is backed by BNY Mellon. It will typically hold between 20 and 40 stocks and focus on mid- and small-cap companies involved either directly or tangentially in the cannabis space, such as Aurora Cannabis, Canopy Growth, and Tilray.

The fund "seeks long-term capital appreciation by investing in both domestic and foreign cannabis equity securities", according to Maryland-based AdvisorShares. "YOLO is designed to fully-invest for pure cannabis exposure under the guidance of a deeply experienced portfolio management team navigating the emerging cannabis marketplace."

It might be too soon to judge the performance of this ETF — YOLO has gained roughly 1% since it began trading.

IPO

The Renaissance IPO ETF (Ticker: IPO), with $37 million in assets under management, is designed to provide investors with exposure to a portfolio of U.S.-listed newly public companies ahead of their inclusion in core equity portfolios, according to Renaissance Capital.

The fund holds the largest, most liquid newly-listed U.S. publicly-traded companies. "Sizable" IPOs, such as the recently-listed Pinterest (NYSE:PINS) and Zoom, are added on a fast entry basis. Companies are then removed from the ETF two years after their initial trade date, when they become seasoned equities.

Its top holdings include Elanco Animal Health, VICI Properties, Okta, and Spotify (NYSE:SPOT) Technology.

IPO is up around 51% since it began trading back in October 2013.

What all this means to you…

When taking all of the above into consideration, some of these so-called “strange” ETFs are definitely worth a look and should be on your radar. Just be sure to do your research beforehand and are fully aware of the risks as well as the potential rewards of making such an investment.

No matter what, you can be sure of one thing: any investment that’s as unique as some of these are could be fun to follow.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.