On Monday, trading on the US stock exchanges was rather reconciliatory, as the Dow Jones Industrial Average (+0.38%), Nasdaq 100 (+0.36%), and S&P 500 (+0.31%) all recorded gains. However, the DAX lagged behind with -0.16%. Those who opted for the right stock strategy, on the other hand, were able to outperform the market.

The InvestingPro ProPicks strategies all performed better than the S&P 500 on Monday:

- Value Vault: +1.50%

- S&P500 Samurai: +1.06%

- Dow Detectives: +0.77%

- Tech Stars: +0.39%

- The Best of Buffett: +0.38%

- Mid Cap Marvels: +0.35%

The 20 stocks in the Value Vault strategy all gained except for Gap Inc (NYSE:GPS) and Cognizant Technology Solutions (NASDAQ:CTSH).

Vistra Energy (NYSE:VST) rose by 7.24% to $77.97. Morgan Stanley rated the stock as "Overweight" with a target price of $86 on April 23. On April 17, analysts' target price was $83, and on March 26, it was $78. Since being included in the Value Vault strategy in March, the energy specialist from Irving, Texas, has risen by 43.32%.

Tenet Healthcare (NYSE:THC) recorded a gain of 3.14% on Monday, with the closing price at $99.15. Tuesday morning saw the stock rise by more than 10% after quarterly earnings showed EPS at $3.22, $1.77 above the analyst estimate of $1.45. Deutsche Bank issued a buy recommendation with a target price of $126 on April 12, and Truth Securities followed on April 15 with a target price of $120. The ProPicks AI had already determined on April 1 that Tenet had the potential to outperform the market. Yesterday's monthly performance was disappointing at -5.01%, but this should be offset by today's increase.

Other stocks from the Value Vault portfolio that gained more than 2% at the start of the week include Cincinnati Financial (NASDAQ:CINF) (+2.40%), Tapestry (NYSE:TPR) (+2.27%), and Charter Communications Inc (NASDAQ:CHTR) (+2.02%).

Tapestry is trading on Tuesday morning at $40.45 and seems to have further upside potential. The InvestingPro Fair Value is $48.42, while Wells Fargo Fargo rated the company as "Overweight" with a target price of $60 on April 18.

Charter Communication also looks promising, as there is an interesting gap of around 30% between the price of $260 and the Fair Value of $342. However, analysts are not quite as optimistic, as in the past 24 hours, Rosenblatt, Loop Capital, JPMorgan, Wells Fargo, and BofA Securities have issued ratings ranging from "Neutral" to "Hold" to "Equal Weight", with target prices ranging from $260 to $285 and $292 to $300.

Yesterday's winners with gains of more than +1% include Exxon Mobil (NYSE:XOM), NetApp (NASDAQ:NTAP), Jabil Circuit (NYSE:JBL), MGM Resorts International (NYSE:MGM), United Therapeutics (NASDAQ:UTHR), Williams-Sonoma (NYSE:WSM), and PayPal Holdings Inc (NASDAQ:PYPL).

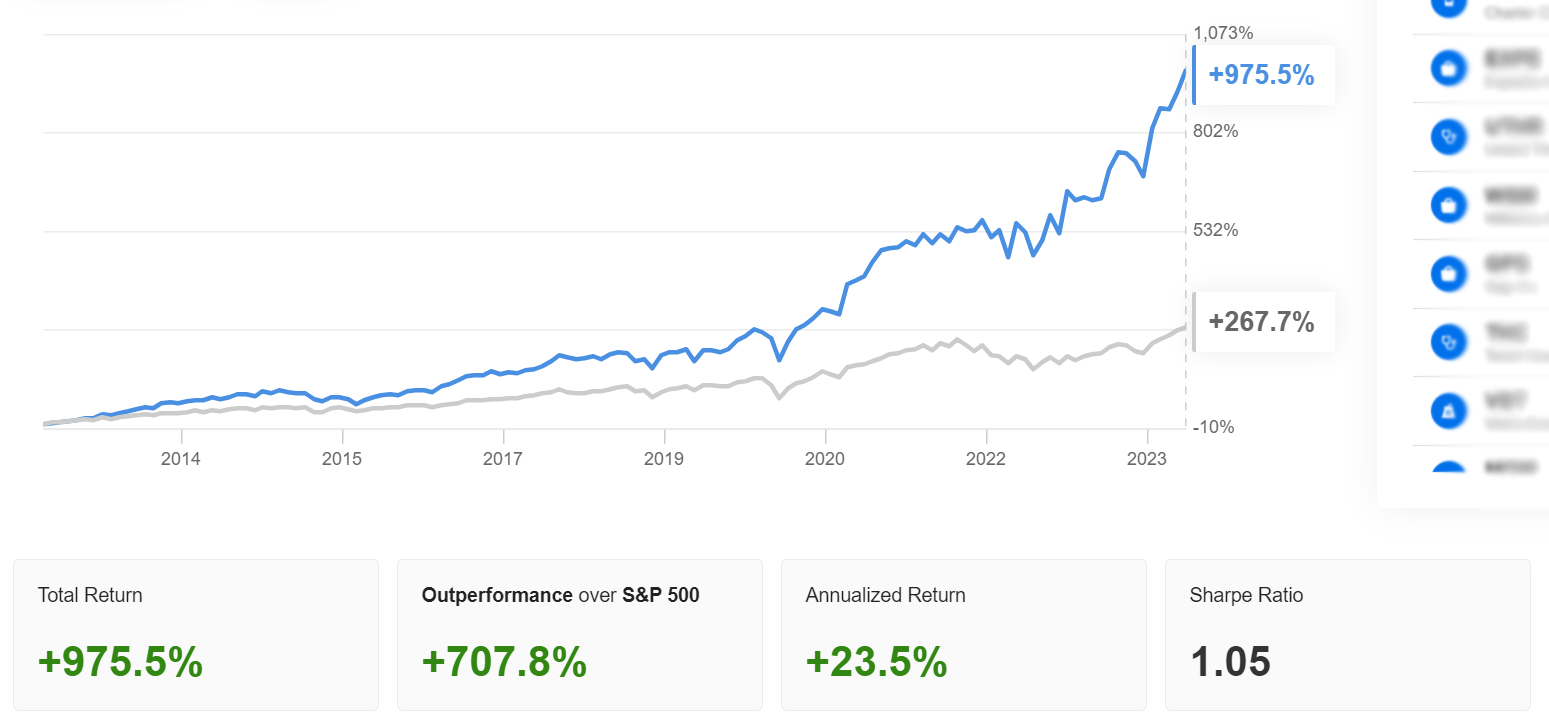

On a monthly basis, in April, the stocks that incurred losses outnumbered the gainers, so there might be a larger reshuffling in May, as the AI is always hunting for the outperformers. Its success is evident from its performance since 2013. The total return is 975.5%, surpassing the S&P 500's relatively meager 267.7% by a considerable 707.8%.

Whether the mentioned stocks will also be part of the Value Vault strategy in May remains uncertain. On May 1st, the AI will decide which 20 stocks from the US market have the greatest potential to outperform the market in the new month.

Those who want to know in advance which players will be taken off the field and who will be coming in as replacements should quickly secure their InvestingPro subscription.

It's worth it multiple times over because in addition to the AI strategies, which have achieved outstanding performance since 2013 (Dow Detectives 629.8%, S&P 500 Samurai 1083.9%, Value Vault 975.5%, The Best of Buffett 375.0%, Tech Stars 1779.8%, and Mid Cap Marvels 643.0%), there are also plenty of other useful tools (stock screeners, ProTips, and more). Plus, with an InvestingPro subscription, annoying ads disappear.

Various packages are available. The entry-level version is InvestingPro, and InvestingPro+ is the big package for real pro traders who don't want to compromise. All of them include the 6 AI strategies, so now everyone is able to beat the market. With the discount code "ProTrader," you get an additional 10% off the following packages: