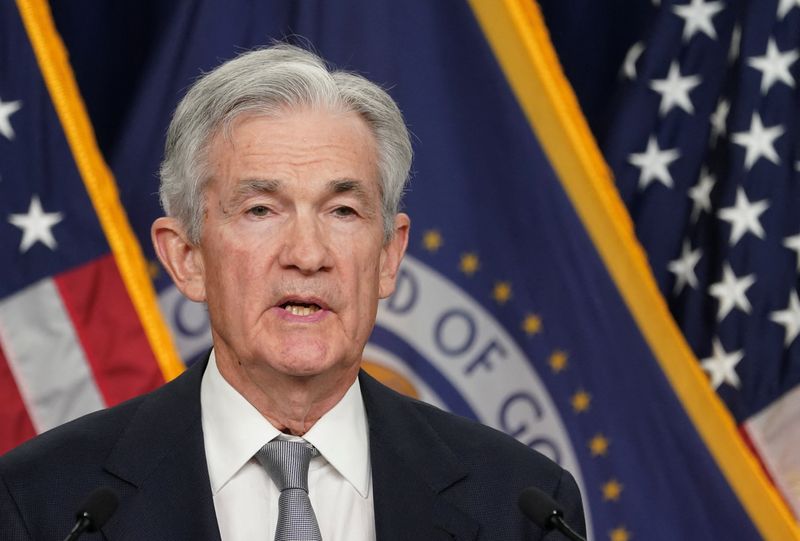

Investing.com -- Upcoming economic data could provide Federal Reserve chairman Jerome Powell with some comfort, but the underlying signs of sticky inflation and above trend growth will likely prevail, forcing the Fed chief to eventually capitulate and ditch his easing bias.

"We will see some data ebb the other way to give Powell some some comfort, but I think the underlying trend over the next six months is going to be firmed," forcing the Fed to put the discussion of a rate hike on the table, Phillip Colmar, managing partner and global strategist at MRB Partners told Investing.com's Yasin Ebrahim in a recent interview.

The recent slew of economic data since the turn of the year hasn't helped the Fed chief's view that rates are restrictive enough to rein in growth and inflation.

Against the backdrop of above-trend economic growth and sticky inflation, the Fed chief has leaned heavily into the belief that time is needed for the current high level of interest rates to eventually work its way through economy and bring inflation back to the 2% target.

"What that [the recent higher inflation readings] has told us is that we’ll need to be patient and let restrictive policy do its work," Powell said during a speech at the annual general meeting of the Foreign Bankers’ Association in Amsterdam on Tuesday.

But if policy isn't restrictive, but accommodative, then time doesn't work in favor of the Fed's goal to curb growth and inflation, but rather against it.

"The problem is that he's probably got the balance wrong," Colmar added. "Powell thinks policy is restrictive, but we're still mildly accommodative... so time is working for the economy, not against it.

"Everything in the markets and everything in the data is telling you that it is not true that rates are restrictive" Colmar added, forecasting that rates are likely to remain on hold before a hike next year amid expectations for the economic data and inflation to remain firmer than the Fed's expects.

"I think the Fed is more likely to hold rates through this year, at least through the election, and then look towards the hike next year if the data continues to stay firm, as we expect," Colmar said.

But there is a way for the Fed to have its easing cake and eat it too, or maintain its easing basis even if the data continues to run hot: Raise the inflation target to 3%.

Powell, however, has appeared relunctant to entertain the idea of lifting the 2% inflation target.

"If he's not comfortable with 3%, if he won't be easy with that, then we should be talking about potential rate hikes, not cuts, later this year going into next," Colmar added.