By Doina Chiacu and David Lawder

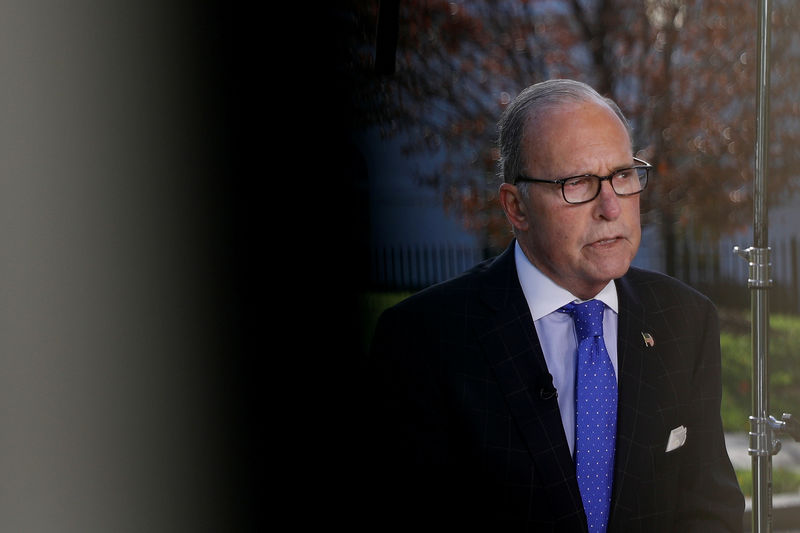

WASHINGTON (Reuters) - Top White House economic adviser Larry Kudlow said on Friday that a Dec. 15 deadline is still in place to impose a new round of U.S. tariffs on Chinese consumer goods, but President Donald Trump likes where trade talks with China are going.

With about a week to go before the deadline amid "intense" negotiations, Kudlow said Trump would make the final decision on the import tariffs, which would hit Chinese-made cellphones, laptop computers, toys and clothing.

"There's no arbitrary deadline here ... but that fact remains December 15 is a very important date with respect to a no-go or go-on tariffs," Kudlow, the director of White House's National Economic Council, told CNBC. "It's going to be totally up to POTUS (the U.S. president). But December 15th is an important date."

China earlier on Friday said it will waive import tariffs for some soybeans and pork shipments from the United States, contributing to a more positive tone in financial market sentiment about the talks.

Kudlow, speaking to reporters at the White House, described the waivers as "good mood music" for the negotiations between the world's two largest economies.

Washington and Beijing are trying to reach agreement on a 'phase one' trade deal that would cool a 17-month trade war that has roiled financial markets, disrupted supply chains and weighed on global economic growth.

China has demanded that some of the existing U.S. tariffs imposed on about $375 billion worth of its exports be removed, in addition to cancellation of the Dec. 15 tariffs on some $156 billion of its remaining exports to the United States.

Trump has demanded that China commit to specific minimum purchases of U.S. agricultural products, among other concessions on intellectual property rights, currency and access to China's financial services markets.

"We've all learned that if he is not satisfied with these talks ... then he would not hesitate to increase tariffs," Kudlow told Bloomberg Television.

Kudlow said the two sides have talked almost daily, but there are currently no plans for in-person talks or a signing ceremony between Trump and Chinese President Xi Jinping.

"None of those decisions have been made ... let's get a deal first and then we'll figure out how, when and where they'll do the signing."

Trump struck an upbeat tone on Thursday even after Chinese officials reiterated their stance that existing tariffs must come off as part of an interim deal to de-escalate the U.S.-China trade war.

Financial markets have been bouncing up and down for weeks on shifts in rhetoric about the trade negotiations. On Friday, the mood was positive, helped by a strong jobs report and the more positive tone from Trump.

At midday, the major U.S. stock indexes were all up around 1%, nearing the record highs they touched last week.