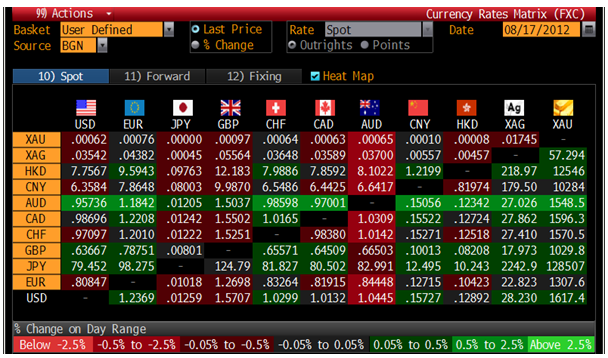

Today's AM fix was USD 1,616.50, EUR 1,306.05, and GBP 1,028.57 per ounce.

Yesterday’s AM fix was USD 1,603.50, EUR 1,306.74 and GBP 1,021.34 per ounce.

Gold rose $9.90 or 0.62% in New York yesterday and closed at $1,614.00/oz. Silver surged to a high of $28.275 and finished with a gain of 1.37%.

Gold continued gains on Friday receiving a boost from Angela Merkel’s comments saying she supported ‘Super’ Mario Draghi’s pledge “to do whatever it takes” to save the euro.

While this sentiment lifted markets and some investors hope ECB action is sooner rather than later - it is also creates the risk of currency debasement and could lead to further falls in the euro.

At the beginning of August, the European Central Bank said that it might buy Spanish bonds if the government first applied for the European Financial Stability Facility (EFSF) support. The ECB has said that specific committees within the bank would design the appropriate mechanisms for the bond purchases in the coming weeks, suggesting a possible green light within a few weeks.

EFSF bond purchases require the vote of all member states, including ratification by the German Parliament. Many investors are waiting on the sidelines until more concrete news from the ECB and US Fed is conveyed.

Certainly any more monetary stimulus is positive for gold as policy makers’ favourite choice for bolstering sagging economies risks devaluing currencies.

Barrick Gold Corp, the world's top gold miner, is currently in negotiations with China Gold Corp, China’s top gold producer, about selling part or all of its holdings in its African business. This shows how China is eager to secure a greater source of global supply in order to be able to supply the voracious Chinese market.

Mark O'Byrne, executive director of GoldCore, talked about the outlook for gold prices and the merits of purchasing the physical metal over derivative products with Linzie Janis on Bloomberg Television's "Countdown" today.

He warned regarding the various “gold ponzi schemes” that have come to light recently and advocated owning physical gold and if storing to own gold in an allocated or segregated manner.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

NEWSWIRE

(Bloomberg) -- Standard & Poor’s Warns Re South Africa Violence Spreading

Standard & Poor’s is “concerned” about violent clashes between labor union members and police at South African platinum mines, which added to negative perceptions of the country, Business Day reported, citing Konrad Reuss, managing director of S&P South Africa.

S&P has no plans to revise its negative outlook for the country in the near term, Reuss told the Johannesburg-based newspaper. S&P reduced the outlook on South Africa’s BBB+ credit rating to negative from stable in March, following similar actions by Fitch Ratings in January and Moody’s Investors Service in November.

(PTI) -- China set to overtake India in gold imports in 2012

China is likely to overtake India as the largest importer of gold this year on the back of huge demand for the precious metal for jewellery and investment in the world's second-largest economy, World Gold Council (WGC) said today.

"In the first half, China's demand for gold stood at 417 tonne surpassing India's 383.2 tonne in the same period," WGC Managing Director (India and Middle East) Ajay Mitra told reporters here.

Looking at the current trends, WGC expects China to overtake India as the largest importer of gold.

In the first quarter of 2012 (January-March), China's gold import stood at around 136 tonnes, lower than India that imported 209 tonne in the same quarter.

"China is a much bigger economy than us and their demand, especially for jewellery and investment, is growing. The country's own supply will not be able to meet this demand growth and the imports will rise," he said.

The fastest-growing major economy in the world consumed roughly 761 tonne gold in 2011.

In the April-June quarter this year, China's jewellery and investment demand declined 7 per cent to 144.9 tonne from 156.6 tonne in the corresponding quarter of 2011, due to lack of direction of gold prices and slowdown in domestic GDP growth. However, steady growth in Chinese gold jewellery demand is expected to resume in the third quarter as economic growth is expected to pick up following monetary easing implemented during the second quarter.

China is the world's largest gold producer and mines about 350 tonne of the precious metal annually.

(Bloomberg) -- Turkey Raises Foreign Exchange, Gold Banks Can Keep in Reserves

Turkey’s central bank increased the proportion of required lira reserves lenders can keep in foreign exchange to 60 percent from 55 percent and the part that can be kept in gold to 30 percent from 25 percent.

The change for the foreign currency portion of lira reserves will be effective from Aug. 31 and the gold portion from Sept. 14, the bank in Ankara said in a statement on its website today.

The changes may add as much as $7.3 billion to the central bank’s foreign exchange reserves and supply up to 5.6 billion liras of liquidity to the market, it said.

Below You May Find The Video.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

“Gold Ponzi Schemes” Revealed - Physical Gold Favored Over Derivatives

Published 08/17/2012, 03:14 AM

Updated 07/09/2023, 06:31 AM

“Gold Ponzi Schemes” Revealed - Physical Gold Favored Over Derivatives

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.