Is The Lazy-Bull Strategy Worth Considering? Part II

I started this article by highlighting how difficult some 2021 strategies seemed for many Hedge Funds and Professional Traders. It appears the extreme market volatility throughout 2021 took a toll on many systems and strategies. I wouldn’t be surprised to see various sector ETFs and Sector Mutual Funds up 15% to 20% or more for 2021 while various Hedge Funds struggle with annual returns between 7% and -5% for 2021.

After many years in this industry, and having built many of my own strategies over the past decade, I’ve learned one very important facet of trading strategy development—expect the unexpected.

A friend always told me to “focus on failure” when we developed strategies together. His approach to strategy design was:

“you develop it to do well in certain types of market trends and volatility. By focusing on where it fails, you’ll learn more about the potential draw-downs and risks of a strategy than ignoring these points of failure.”

I tend to agree with him.

In the first part of this research article, the other concept I started discussing was how traders/investors might consider moving away from strategies that struggled in 2022.

What if the markets continue trending with extreme volatility throughout 2022 and into 2023? Suppose your system or strategy has taken some losses in 2022, and you have not stopped to consider volatility or other system boundaries as a potential issue? In that case, you may be looking forward to a very difficult 12 to 14+ months of trading in 2022 and 2023.

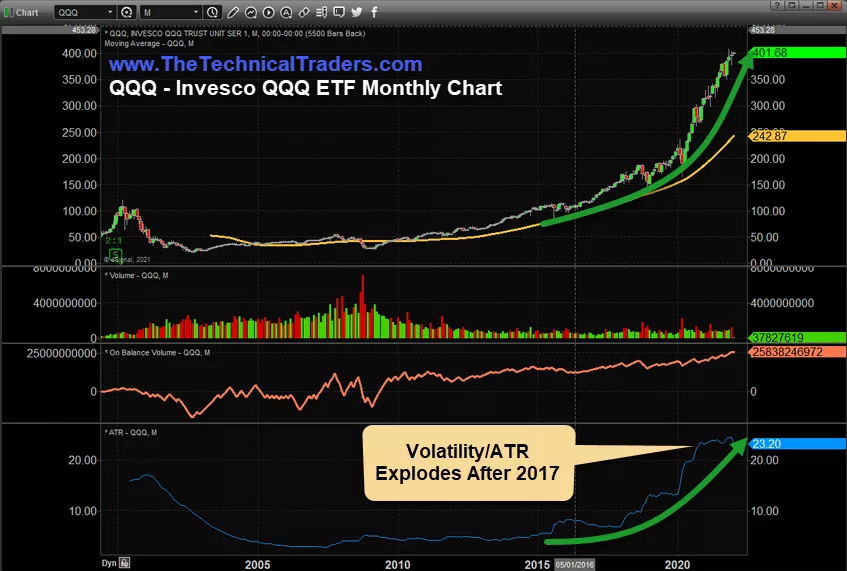

Volatility Explodes After 2017

Current market volatility/ATR levels are 300% to 500% above those of 2014/2015. These are the highest volatility levels the US markets have ever experienced in the past 20+ years. The current ATR level is above 23.20—more than 35% higher than the DOT COM Peak volatility of 17.15.

As long as the Volatility/ATR levels stay near these elevated levels, traders and investors will likely find the markets very difficult to trade with strategies that cannot properly adapt to the increased risks and price rotations in trends. Simply put, these huge increases in price volatility may chew up profits by getting stopped out on pullbacks or by risking too much in terms of price range/volatility.

The increased volatility over the past 5+ years directly reflects global monetary policies and the COVID-19 global response to the crisis. Not only have we attempted to keep easy money policies for far too long in the US and foreign markets, but we’ve also been pushed into a hyperbolic price trend that started after 2017/18, which has increased global debt consumption/levels to the extreme.

2022 and 2023 will likely reflect a very strong revaluation trend which I continue to call a longer-term “transition” within the global markets. This transition will probably take many forms over the next 24+ months—but mostly, it will be about deleveraging debt levels and the destruction of excess risk in the markets.

In my opinion, that means the strongest global economies may see some strength over the next 24+ months—but may also see extreme price volatility and extreme price rotation as this transition takes place.

Expect The Unexpected In 2022 And 2023

The US major indexes had an incredible 2021—rallying across all fears and COVID variants. The NASDAQ and S&P 500 saw the biggest gains in 2021—which may continue into early 2022.

Yet I feel the US markets will continue to transition as the global markets continue to navigate the process of unwinding excess debt levels and potentially deleveraging at a more severe rate than many people expect.

Because of this, I feel the US markets may continue to strengthen as global traders pile into the US dollar-based assets in early 2022. Until global pressures of deleveraging and transitioning away from excesses put enough pressure on the US stock market, the perceived safety of US assets and the US dollar will continue as it is now.

Source: www.StockCharts.com

Watch For Sector Strength In Early 2022 As Price-Pressure And Supply-Side Issues Create A Unique Opportunity For Extended Revenues/Profits

I believe the US markets will see a continued rally phase in early 2022 as Q4:2021 revenues, earnings, and economic data pour in. I can’t see how any global economic concerns will disrupt the US markets if Q4:2021 data stays stronger than expected for US stocks and the US economy.

That being said, I do believe certain sectors will be high-fliers in Q1:2022 and Q2:2022—at least until the supply-side issues across the globe settle down and return to more normal delivery expectations. This means sectors like Automakers, Healthcare, Real Estate, Consumer Staples and Discretionary, Technology, Chip manufacturers, and some Retail segments (Construction, Raw Materials, certain consumer products sellers, and specialty sellers) will drive a new bullish trend in 2022.

The US major indexes may continue to move higher in 2022. They may also be hampered by sectors struggling to find support or over-weighted in symbols that were over-hyped through the end of 2020 and in early 2021.

I have been concerned about this type of transition throughout most of 2021 (particularly after the MEME/Reddit rally phase in early 2021). That type of extreme trending usually leads to an unwinding process. I still don’t believe the US and global markets have completed the unwinding process after the post-COVID extreme rally phase.

Source: www.StockCharts.com

Will The Lazy-Bull Strategy Continue To Outperform In 2022 And 2023?

This is a tricky question to answer simply because I can’t predict the future any better than you can. But I do believe moving towards a higher-level analysis of global market trends when the proposed “transitioning” is starting to take place allows traders to move away from “chasing price spikes.” It also allows them to position for momentum strength in various broader market sectors and indexes.

I suspect we’ll start to see annual reports from some of the biggest institutional trading firms on the planet that show feeble performance in 2021. This recent article caught my attention related to Quant Funds in China.

I believe we will see 2022 and 2023 stay equally distressing for certain styles of trading strategies while price volatility and an extreme deleveraging/transitioning trend occur. Trying to navigate this type of choppy global market trending on a short-term basis can be very dangerous. I believe it is better to move above all this global market chop and trade the bigger momentum trends in various sectors and indexes.

Part III of this research article will focus on Q1 through Q4 expectations for 2022 and 2023. I will highlight broader sector/index trends that may play out well for investors and traders who can move above the low-level choppiness in the US and global markets.

Over the next 12 to 24+ months, I expect very large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase and may begin a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern start to drive traders/investors into Metals.