Gold is more money-like and silver is more commodity-like. Consequently, the relationships that we follow involving the gold/GNX ratio (the gold price relative to the price of a basket of commodities) also apply to the gold/silver ratio. In particular, gold, being more money-like, tends to do better than silver when inflation expectations are falling (deflation fear is rising) and economic confidence is on the decline.

Anyone armed with this knowledge would not have been surprised that the collapse in economic confidence and the surge in deflation fear that occurred during February-March of this year was accompanied by a veritable moon-shot in the gold/silver ratio*. Nor would they have been surprised that the subsequent rebounds in economic confidence and inflation expectations have been accompanied by strength in silver relative to gold, leading to a pullback in the gold/silver ratio. The following charts illustrate these relationships.

The first chart compares the gold/silver ratio with the IEF/HYG ratio, an indicator of US credit spreads. It makes the point that during periods when economic confidence plunges, the gold/silver ratio acts like a credit spread (credit spreads rise (widen) when economic confidence falls).

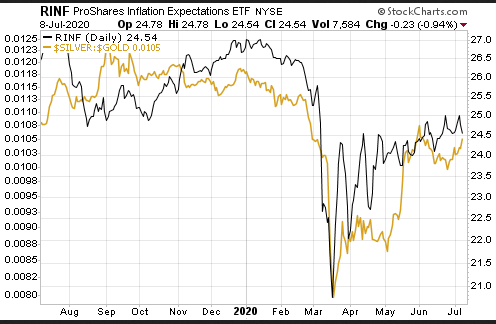

The second chart compares the silver/gold ratio (as opposed to the gold/silver ratio) with the ProShares Inflation Expectations ETF (NYSE:RINF). It makes the point that silver tends to outperform gold when inflation expectations are rising and underperform gold when inflation expectations are falling.

We are expecting a modest recovery in economic confidence and a big increase in inflation expectations over the next 12 months, meaning that we are expecting the fundamental backdrop to shift in silver’s favor. As a result, we are intermediate-term bullish on silver relative to gold. We don’t have a specific target in mind, but, as mentioned in the 16th March Weekly Update when the gold/silver ratio was 105 and in upside blow-off mode, it isn’t a stretch to forecast that at some point over the next three years the gold/silver ratio will trade in the 60s.

Be aware that before silver commences a big up-move in dollar terms and relative to gold there could be another deflation scare. If this is going to happen it probably will do so within the next three months, although we hasten to add that any deflation scare over the remainder of this year will be far less severe than what took place in March.

*The gold/silver ratio hit an all-time intra-day high of 133 and daily-closing high of 126 in March of this year. This was one of the many unprecedented market/economic events of 2020.