Despite the generally recovering iron ore Spot prices, a recent 6% slip is revitalising fears for the metal’s future. While this relatively small dip may not be a huge worry at present, prevailing market trends paint a grim picture for Australia’s chief export. Moreover, the country’s close relationship with China leaves it exceptionally exposed to changes in the Chinese demand for iron ore imports.

China is the largest global consumer of Iron ore, using around 65% of the total global output. Consequently, it will come as little surprise that Australia’s trade relationship with China has grown steadily closer as iron ore remains the country’s largest export. As a result of this close relationship, changes in China’s demand for ore are felt much more sharply by the Australian economy than by other trading partners.

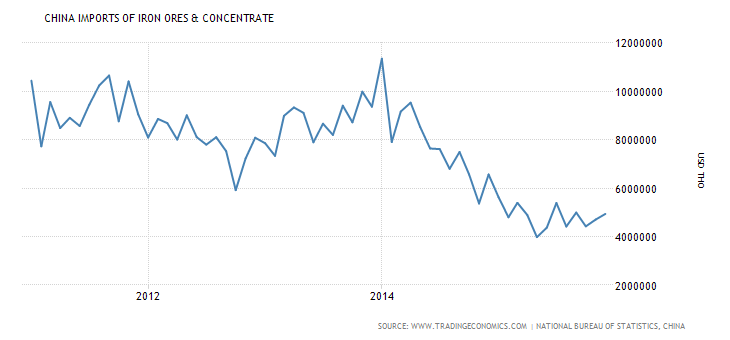

China’s economic slowdown and pivot away from manufacturing has had myriad effects for Australia, but the reduction in iron ore import demand could be the most devastating. Since 2014, Chinese imports of the ore have slumped significantly as is shown in the below graph. What’s more, supply has been increasing, which could herald lower long-term prices in coming months.

Amid faltering demand for its key export, Australia will be keeping a watchful eye on the yearly increases in global iron ore production. Between 2013 and 2014 for instance, global output increased to 3220 million tonnes, a build of 110 million. A result of continued increases in global production—a supply glut not dissimilar from the one currently plaguing oil markets—may see the price of iron ore remain depressed for a long time yet.

If a supply glut does occur, prices below the important $55USD level may become the new norm and this will have serious implications for the Australian governmental budget. $55USD is the price the most recent government budget was forecasting for the commodity. As a result, falling prices could prevent the Australian government from balancing its books and cause some serious economic stress for the country.

Due to its tendency to follow commodity prices, the flow-on effect of weaker iron ore prices might see the Australian dollar fall significantly lower in the long run. Consequently, the bearish downtrend might be ready to resume and test some new lows over the next number of months.

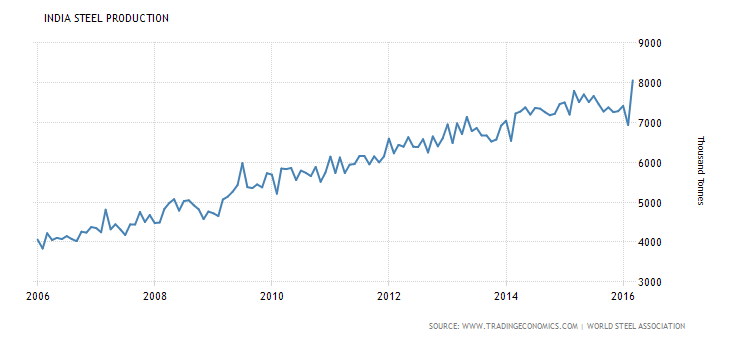

However, one saving grace could be increasing steel production in the world’s aspiring manufacturing powerhouse, India.

Iron is, of course, a vital component in steel production and India’s steel output is climbing steadily. As China can no longer support Australia’s export requirements, growth in this key developing market could provide the excess demand for Australian ore.

Additionally, Indian iron ore production has actually been falling recently, which now makes the large Asian economy a hotspot for the commodity. However, until Australia finalises a pending trade agreement with India, we can’t count on Indian steel to save the country’s main export.

Ultimately, the future of iron ore prices and by extension the AUD will hinge on how well India can pick up where China left off. Currently, relatively small dips in the commodity’s price are causing a knee-jerk reaction, but if prices fail to recover we could see the AUD follow ore prices lower. In the long-term, it is likely that the AUD remains bearish for as long as dwindling global demand for iron ore is outpaced by increasing stockpiles of the base metal.