Real estate is one of the most widely-followed sectors of the U.S. economy. Recent metrics released by the U.S. Census Bureau and Department of Housing and Urban Development show New Home Sales in December 2020 were 842,000, up 1.6% month-over-month from a revised 829,000 in November 2020.

However, the number missed the forecast sales of 865,000. Yet, the seasonally-adjusted annual rate in December 2020 was 15.2% higher than the rate in December 2019. Overall, new home sales had a healthy 2020. Spending on housing is one of the largest expenditures for a large number of Americans. The average sales price of new houses sold in December 2020 was $394,900.

Given the low interest rate, investors wonder if Real Estate Investment Trusts (REITs) could be appropriate for buy-and-hold portfolios. REITs, which own, operate or finance income-generating real estate, typically offer the potential for passive income from dividends and some capital appreciation.

Different countries have different regulations regarding REITs. In the U.S., they are obliged to distribute at least 90% of their taxable income annually to shareholders. As a result, their dividends tend to be stable and relatively high.

However, 2020 saw retail, leisure and office rental properties suffer due to pandemic-related lockdowns and increasing 'stay-at-home, work-from-home' trends. As a result, parts of the sector have seen margins squeezed.

In 2021, REITs, especially those with a commercial focus, could require further patience on the part of long-term investors. Revenues of housing and other real estate companies may still be adversely affected in the coming months.

Nonetheless, history shows that housing and other real estate demands eventually pick up, and growth returns to the sector. Investors looking for broad exposure to real estate may consider exchange-traded funds (ETFs). Let's take a look at two of them.

1. iShares Residential and Multisector Real Estate ETF

Current Price: $69.52

52-Week Range: $44.34 - $82.19

Dividend Yield: 3.12%

Expense Ratio: 0.48%

The iShares Residential and Multisector Real Estate ETF (NYSE:REZ) invests in U.S.-based residential, health care and self-storage real estate equities.

REZ, which tracks the FTSE NAREIT All Residential Capped Index, has 44 holdings. Since its inception in May 2007, net assets have grown to $427 million.

Residential REITs in the fund top the list with more than 49%. Next are health care REITs (31.88%) and specialized REITs (18.93%), like student-housing REITs. On a side note, health care REITs are typically among the highest-yielding sub-sectors. Readers who would like to avoid certain real estate sub-sectors, such as retail, commercial or office, may find this ETF appropriate for their portfolios.

Close to 60% of the funds are in the top 10 names. They include: Public Storage (NYSE:PSA), one of the largest self-storage services; Welltower (NYSE:WELL), which concentrates on housing for seniors and outpatient medical properties; and multi-family apartment landlord AvalonBay Communities (NYSE:AVB).

Since early February 2020, REZ is down about 12%. But it has recovered more than 50% after seeing a 52-week low in March 2020. We would look to buy the ETF, especially if there were a decline toward $65.

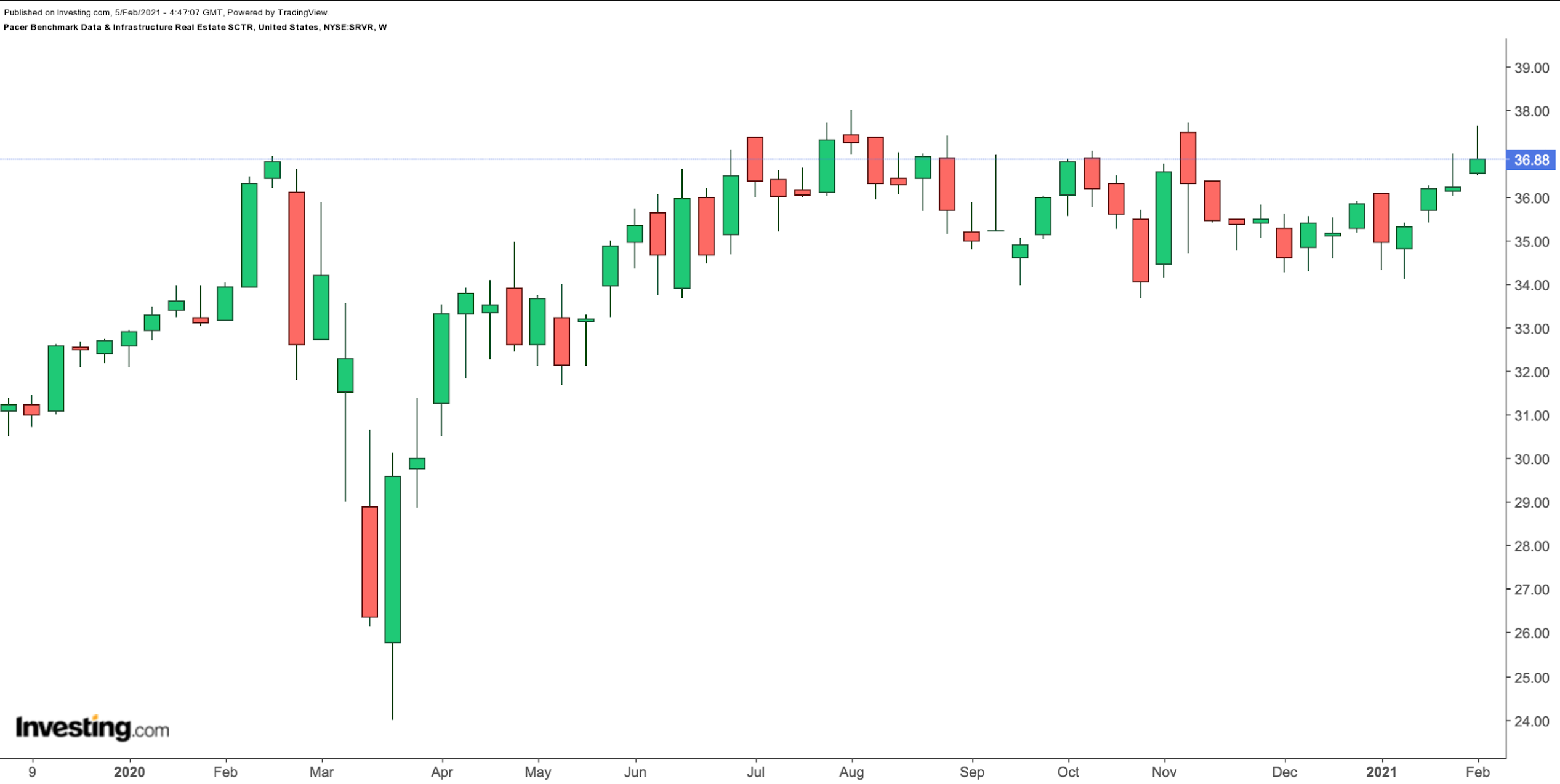

2. Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF

- Current Price: $36.88

- 52-Week Range: $23.99 - $37.99

- Dividend Yield: 1.49%

- Expense Ratio: 0.6%

Our second fund gives access to specialized REITs. The Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (NYSE:SRVR) offers exposure to global REITs that focus on the data and infrastructure sector.

The increased digitalization and rollout of the 5G infrastructure have significantly boosted the shares of data center providers and cell tower owners.

SRVR, which holds 24 stocks, tracks the returns of the Benchmark Data & Infrastructure Real Estate SCTR Index. The fund started trading in May 2018 and has more than $1 billion in net assets.

In terms of sub-sectoral breakdown, data infrastructure and tech infrastructure (telecommunications) get the lion’s share with 49.75% and 43.56%, respectively.

The top 10 holding constitutes 75% of the ETF. California-based data center REIT Equinix (NASDAQ:EQIX), Massachusetts-headquartered wireless and broadcast communications REIT American Tower (NYSE:AMT) and Texas-based wireless infrastructure REIT Crown Castle International (NYSE:CCI) are the leading names in the fund.

Over the past year, the fund returned more than 11% and saw a record-high in early August. In recent months, investors have been ready to pay a premium to invest in technology-related stocks.

As a result, REITs in SRVR have also benefitted. Therefore, there could be profit-taking in the fund in the near-term, especially if the technology sector comes under short-term pressure. Yet, we believe the fund could appeal to those who want to combine digitalization trends with the yield of REITs. Those potential investors could consider buying the dips in SRVR.