Back in early February 2017, we posted an article about how our analysis showed a very strong potential for larger price swings with the potential for a massive explosion in the VIX indicator based on a price cycle pattern we had been studying.

As of right now, only 10 days into our proposed “VIX Spike Window” (from March 12 to April 15), we thought it would be a good idea to review some of our analysis before we enter the heart of the VIX expansion window (March 25 to April 8).

As you may recall, we expect a roughly five-month cycle of expanding VIX volatility to continue within the time-frames mentioned above. The peak of this volatility will likely happen between March 25 and April 8 – what we are calling the “heart of the window”. This will likely be a very tumultuous and volatile period where massive rotations in price could occur. Additionally, new or reversal trends would also be key components of this type of expanded volatility. This means active traders have an opportunity to generate some fantastic returns from these moves.

Based on my original analysis from early February, lets summarize how things are expected to play out over the next few weeks for a few key symbols.

As you review our earlier analysis, pay attention to the details we laid out for each symbol. We expected “key top” levels to be reached when the article was published, followed by price rotation/retracements, followed by more price trending. Pay special attention to the details we discussed for each of these symbols in the first article.

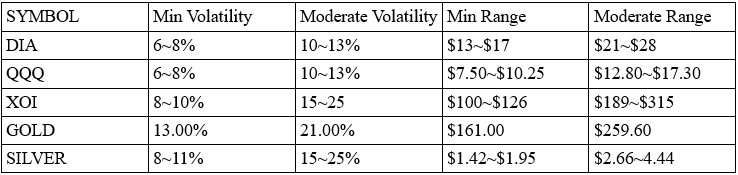

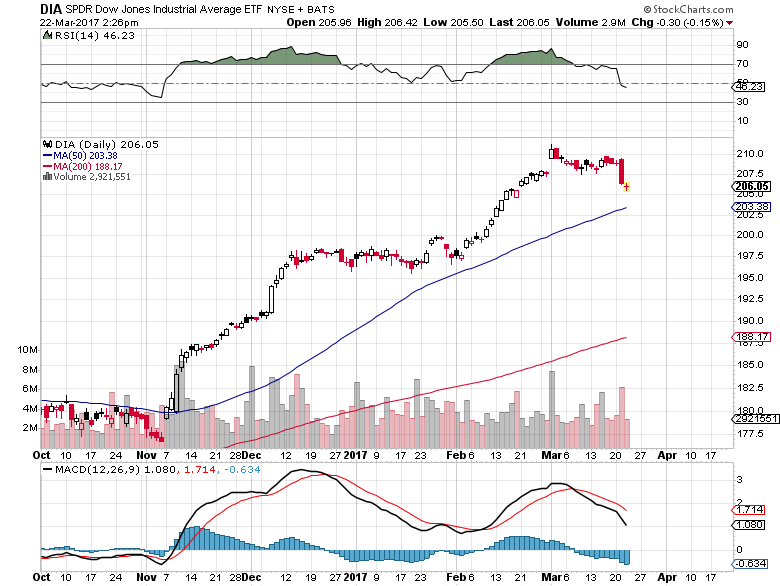

- DIA pulled back near 6% (Min Volatility target reached) from recent highs and we are expecting more volatility before any future moves

- QQQ pulled back 2.6% and we are expecting a deeper pullback as the volatility explodes in the near future.

- XOI has fallen an additional 4.33% and we are expecting this move to continue to near $1075 (an additional -$81.50) before attempting to find a bottom.

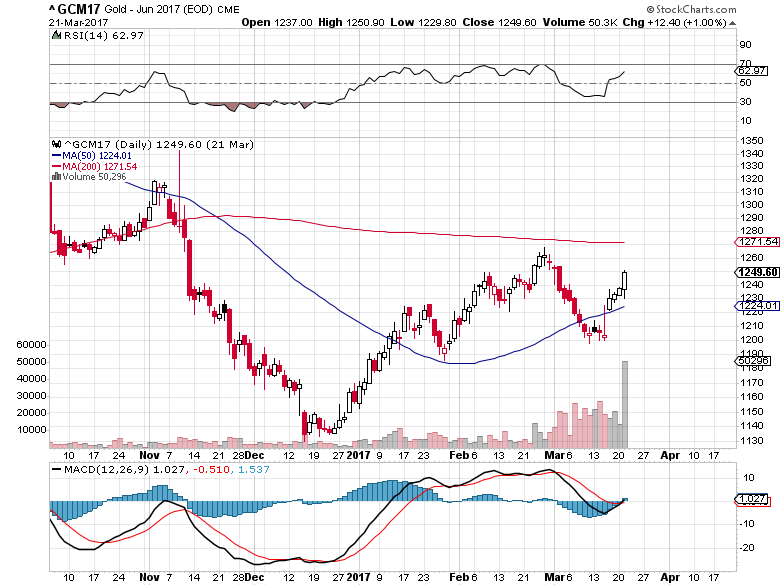

- Gold retraced just over 5% from near $1265 and is currently in a solid uptrend. Our current projection is for a move above $1310, followed by a pullback below $1280 (where we want to try to buy), followed by further upside moves to above $1350.

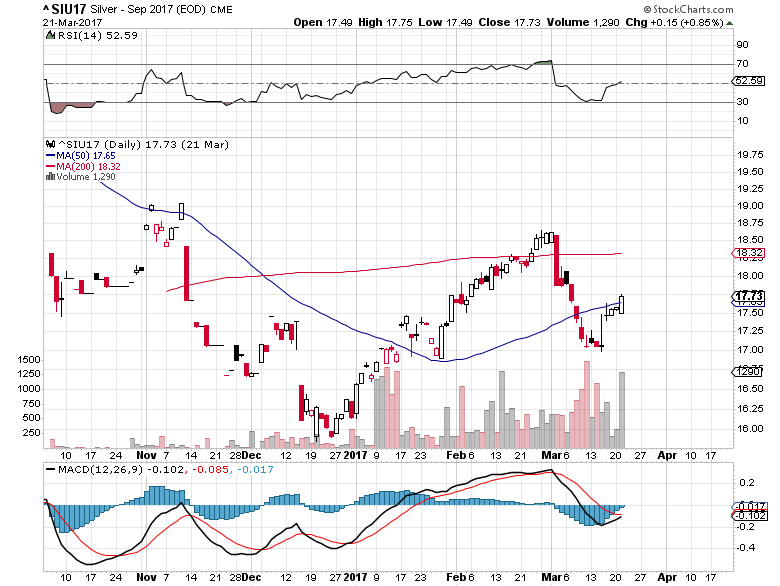

- Silver has retraced nearly 9% (Min Volatility Target Reached) from recent highs and is setting up potential move back above $18.00 or higher.

At this point, we should be very cautious to consider only highly probable trading signals because the expected volatility in the global markets should become more violent and unpredictable. This makes for great short-term Momentum Reversal trades, though.

Our recent Momentum Reversal Trades have shown fantastic results like UGAZ 74% and NUGT 112%. The possibility of seeing exploding volatility over the next few weeks in combination with massive potential rotation in prices will allow us to find some incredible opportunities for followers of our work and trades.

Remember, the heart of the volatility window should be from March 25, 2017 to April 8, 2017.