Major US indices sustain their 4th biggest percentage daily decline since 2011 as the escalating outbreak of the coronavirus in Italy and rapidly rising numbers in South Korea emphasize the gravity of the situation.

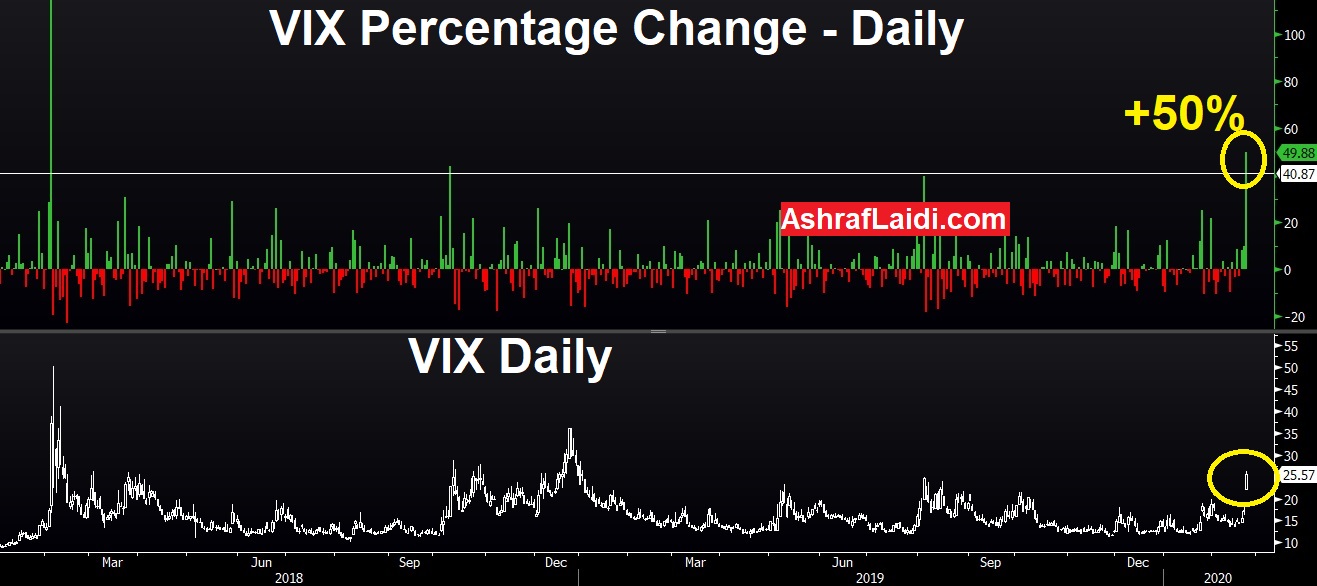

10-year yield hit a fresh 4-year low at 1.35%. The VIX jumped 50% today. JPY is the best performer of yesterday, followed by euro (due to unwinding of the euro funding carry trade), while CAD and GBP were the worst performers.

New coronavirus cases in China continued to sag with only 409 newly announced on Sunday but the market has shifted its attention to other possible outbreaks. The situation in Iran remains murky and could be severe but it's Italy and South Korea that have spooked the market.

Confirmed cases in Italy jumped from only 3 on Friday morning to 155 by Sunday and the country took dramatic action as it seeks to find the source, including banning public events in some areas near Milan. Italy's top football league canceled at least three games and schools have been closed for two weeks.

Similarly, cases in South Korea have jumped to 763 early Monday from just 31 on February 18 and officials have raised the public alert system to its highest level.

The WTO said there was still a chance to contain the virus outside of China but that “the window of opportunity is narrowing”. What's particularly worrisome is the number of cases that have no clear link to China or other clusters of cases.

Many markets have seemingly ignored the risks around the virus until fears kicked up late on Friday. However bonds have been consistent in flagging fears. The biggest losing shares of the day have been American Airlines (NASDAQ:AAL) -9.8%, NorwegianCruiseLines -9.2%, Carnival (NYSE:CCL) -8% and RoyalCarribean -8%.

Gold surged $30 to 1689

With virus fears and outbreaks widespread many market participants are struggling to understand what currencies to buy and avoid, especially in light of the squeeze in the yen last week. The dollar remains a solid bet but is subject to Fed risk. The more straight-forward trade continues to be gold as it breaks out technically and with central banks and fiscal authorities increasingly likely to loosen policy.