Vectron (DE:V3SG) saw a continuation of the weak demand environment for its point-of-sale (POS) solutions in H119, although revenues have improved every quarter since the trough in Q318 and management expects regulatory tailwinds to boost demand from Q4. More digital services partnerships were signed in H1 and the company launched a bundled POS system/digital services offering in June as part of its plan to shift to a digital business model and build a base of recurring revenues.

H119 saw further revenue decline and wider loss

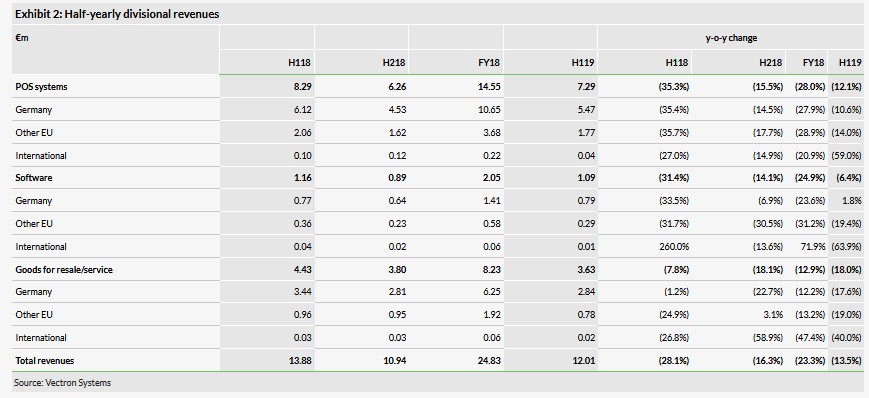

Revenues declined 13.5% y-o-y to €12.0m in H119, as demand for Vectron’s POS systems remained weak. We note, however, that H119 revenues were 9.7% higher than in H218. This resulted in an EBITDA loss of €1.0m, compared to a loss of €0.9m a year ago. The company noted that a third of employees are focused on the development of the new digital business model. Management expects the imminent application of new German cash register regulations to support an uptick in demand from Q4.

Partnership model to provide digital services

Last year the company decided it was too expensive to develop digital services such as loyalty, reservations and ordering from scratch. Instead, it is partnering with third-party providers, integrating their services with its POS systems. During H1, it signed up table reservation and food ordering providers and in June launched a bundled service that integrates them alongside the DeutschlandCard loyalty scheme with its Duratec POS system to provide a comprehensive service to customers. The company aims to reduce the dependence on one-off POS system sales and increase the level of recurring revenues from the provision of digital services to its customer base.

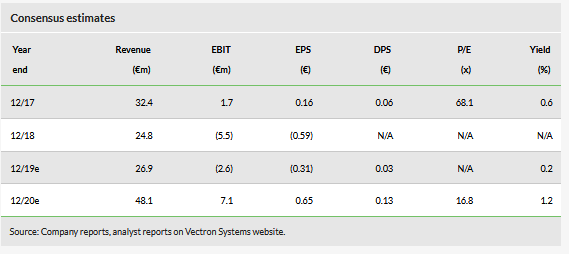

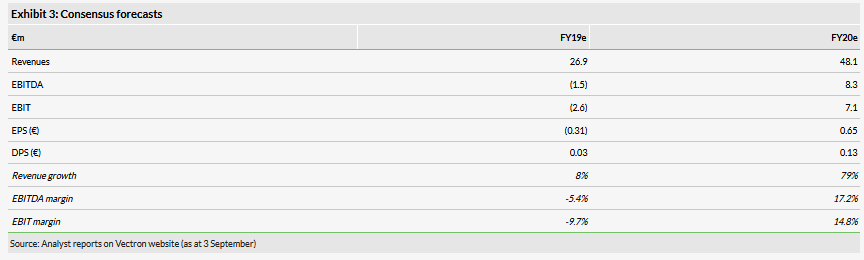

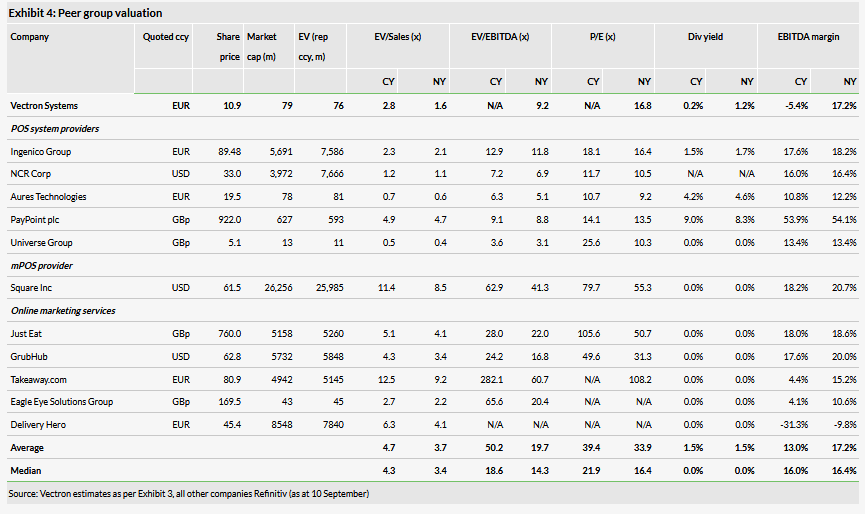

Valuation: Factors in improved demand in FY20

Consensus forecasts for FY19 have been reduced post-results to reflect the level of demand and profitability in H119. FY20 estimates are unchanged, we believe reflecting a step up in demand for POS systems as well as a growing contribution from digital services. On an FY20 basis, Vectron trades in line with POS system providers. We feel that evidence of a pick-up in demand for POS systems and/or evidence of increasing adoption of digital services should act as triggers for share price upside.

Edison Investment Research provides qualitative research coverage on companies in the Deutsche Börse Scale segment in accordance with section 36 subsection 3 of the General Terms and Conditions of Deutsche Börse AG for the Regulated Unofficial Market (Freiverkehr) on Frankfurter Wertpapierbörse (as of 1 March 2017). Two to three research reports will be produced per year. Research reports do not contain Edison analyst financial forecasts.

Vectron reported a 13.5% revenue decline year-on-year in H119. While quarterly revenues declined on a year-on-year basis (Q119 -21%, Q219 -5%), on a sequential basis, revenues were 5% higher in both quarters.

Lull before next stage of regulation kicks in

Regulation is being introduced in many countries to reduce the incidence of tax fraud arising from the under-reporting of sales made via electronic cash registers (known as fiscalisation). In Germany, from the start of 2017 new GoBD1/GDPdU2 legislation imposed rules on the production and storage of financial materials such as electronic receipts and ensures verifiability of all the documents that are produced. At the end of 2016, the law on the protection against manipulation of digital background recordings (Gesetz zum Schutz vor Manipulationen an digitalen Grundaufzeichnungen) came into force. This prescribes that all cash registers must be fitted with a certified technical security device (TSE) from 1 January 2020. Under transitional arrangements, systems that cannot be retrofitted may be used until the end of 2022. Detailed technical requirements for this law were in draft format for some time, with the final version only published in August. This has meant that TSE manufacturers have not been able to finalise the design and certification of their devices until now – they are predicting their devices will be available from Q419.

The Austrian government approved similar measures as of 2016; it requires all taxable businesses to issue customers with a receipt and maintain a data collection log of all transactions. Furthermore, since April 2017 all POS systems must be protected against manipulation by a tamperproof security device.

All new Vectron POS products are fully compliant with both sets of regulations. Many older Vectron systems can be made compliant via a software upgrade. Those customers using very old Vectron machines may need to upgrade to new machines (we note that Vectron systems have a typical life of seven to 10 years). The first phase of upgrades was seen in 2016 and 2017, with demand reverting back to previous levels in 2018 and H119. To meet the 2020 regulations, the company expects a proportion of its customer base will need to upgrade their existing POS infrastructure to remain compliant.

However, it is very difficult to predict the timing of the revenue opportunity, as many customers may wait as long as possible to upgrade their current POS systems before they are deemed non-compliant by the German or Austrian authorities. In addition, due to delays in the availability of TSEs, it is possible the government may delay the enforcement of the law until later in 2020.

Costs contained despite digital investment

Despite H1 revenues being €1.88m lower y-o-y, the EBITDA loss only increased by €0.16m, partly due to lower material costs but also due to lower staff and other admin costs. Around one-third of employees are engaged in the development of the new digital business model, making up c €1.9m of costs in H119. Overall, the company reported a net loss of €1.34m, slightly higher than the net loss of €0.77m reported a year ago.

The company closed H119 with gross cash of €13.8m and net cash of €3.0m, having raised €5m from the issue of 661k shares in February and paid €0.2m at the beginning of H1 to buy out the remaining 25% of Posmatic.

Business update

Launch of combined digital offering

In May, Vectron signed partnerships with two digital companies: resmio for table reservations and rbNext Systems (Restablo.de) for food ordering. In both cases, the partners’ online services will be integrated into Vectron’s POS systems.

In June, Vectron formally launched its digital offering. This combines Vectron’s Duratec POS system (its value brand targeted at the lower and mid-price segments) with resmio and Restablo.de as well as Deutschlandcard for loyalty. The overall cost to customers should be less than buying each component separately in the open market.

Vectron is also developing a digital offering for its main Vectron-branded POS system. The company wants to transition all of its customers to the combined digital offering to expand its recurring revenue stream.

bonVito turns a profit

Vectron has a subsidiary, bonVito, which operates Vectron’s online services platform. This enables customers to offer loyalty schemes, couponing, vouchers, reservations, orders and online payment solutions integrated with their Vectron cash registers. bonVito is used in more than 5,200 stores (up from 4,972 at end FY18) and has four million regular loyalty card users. Vectron has not historically consolidated bonVito, instead accounting for it as a financial investment. The company announced that for H119, bonVito became profitable for the first time, generating EBITDA of €0.3m.

New data-archiving partnership

In June, Vectron signed a co-operation agreement with DATEV, a German financial accounting software and services provider. This will enable Vectron’s customers to digitally transfer their POS data to DATEV’s accounting software in the correct DFKA3 taxonomy, making it easier for them to meet legal requirements for cash management (according to the GoBD legislation companies are required to archive their cash data for a period of 10 years). Vectron will charge a monthly fee for this service.

Outlook and forecasts

Management expects demand to improve from Q419. This is partly due to the timing of the regulations coming into force in 2020 and because the company will only have access to the TSEs required that make POS systems compliant from Q4.

Consensus forecasts for FY19 were cut post results, with FY19 revenues reduced by 7% and EBITDA reduced from -€0.4m to -€1.5m. Based on H119 revenues of €12.0m, this implies H219 revenues of €14.9m. As Q2 revenues were higher than Q1 revenues and management expects demand to pick up from Q4, in our view this appears reasonable. FY20 forecasts clearly factor in a pick-up in demand for POS systems and we expect there is also an element of digital services factored into forecasts.

Valuation

On an EV/EBITDA and P/E basis, in FY20 Vectron is trading more in line with POS providers than with online marketing services providers. This assumes that Vectron can achieve consensus revenues and profitability, which we believe factor in a combination of increased demand for POS systems and a growing digital services business. Evidence of either is likely to be the main trigger for share price upside.

1. GoBD: Grundsätze zur ordnungsmässigen Führung und Aufbewahrung von Büchern, Aufzeichnungen und Unterlagen in elektronischer Form sowie zum Datenzugriff (Principles for the proper management and retention of books, records and records in electronic form and for data access)

2. GDPdU: Grundsätze zum Datenzugriff und zur Prüfbarkeit digitaler Unterlagen (Principles of data access and the auditability of digital documents)

3. DFKA: Deutscher Fachverband für Kassen- und Abrechnungssystemtechnik e.V. (German association for cash and accounting system technology)