- US nonfarm payrolls rise more than expected to 216,000

- Tokyo Core CPI expected to ease to 2.1%

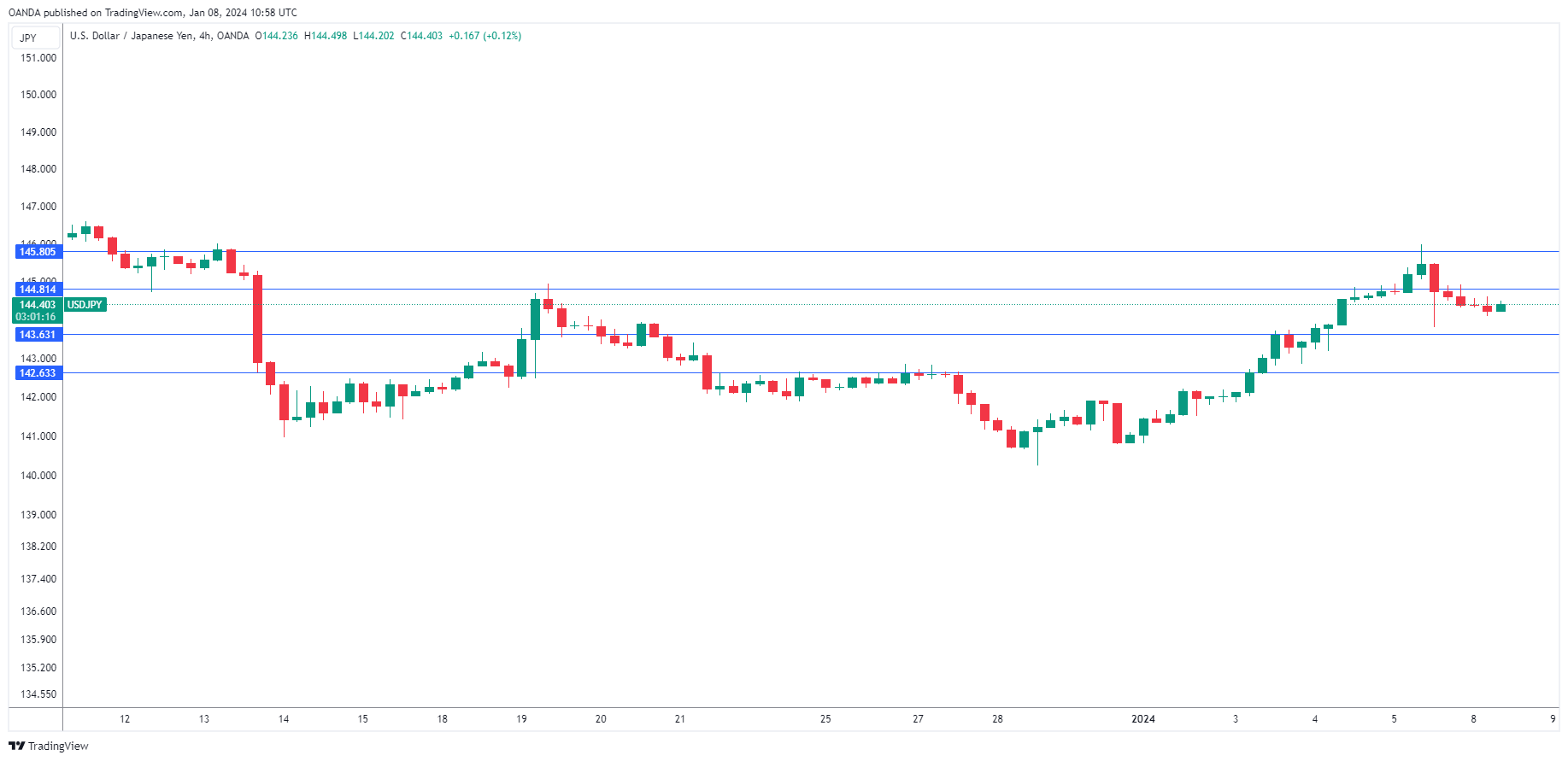

- 144.80 and 145.80 are the next resistance lines

- There is support at 143.60 and 142.63

The Japanese yen has started the week with slight gains and is trading at 144.39 in the European session, up 0.16%. It was a rough week for the yen, which declined 2.5% against the US dollar, which has looked sharp against most of the majors since New Year’s.

US Nonfarm Payrolls Stronger Than Expected

US nonfarm payrolls ended 2023 on a strong note. The economy added 216,000 jobs in December, compared to November’s downwardly revised 173,000 and above the estimate of 170,000. The unemployment rate remained at 3.7%, below the estimate of 3.8%. As well, wage growth rose 0.4% m/m and 4.1% y/y, higher than the estimates of 0.3% and 3.9%.

The employment report was stronger than expected, which could lead the Fed to delay plans to lower rates. Job growth remains resilient and the wage growth data indicates that inflation remains strong in the labor market and is still too high for the Fed. The Fed fund futures markets reacted to the employment report by lowering the odds of a March rate cut to 64%, compared to 68% just prior to the employment report.

The Fed has acknowledged that it plans to trim rates but failed to provide any details of timing in the minutes of the December meeting. The Fed may decide to prolong the pause in rates until the second half of the year unless there is a significant drop in inflation or unforeseen weakness in the US economy. The Fed does not seem in any rush to cut rates and the markets may be getting ahead of themselves by pricing an initial rate cut in March.

Japan’s Tokyo Core CPI, which will be released on Tuesday, is expected to ease in December to 2.1% y/y, compared to 2.3% in November. Core inflation has exceeded the Bank of Japan’s 2% target for 18 straight months, but the central bank has insisted that it will not tighten monetary policy until wage growth rises.