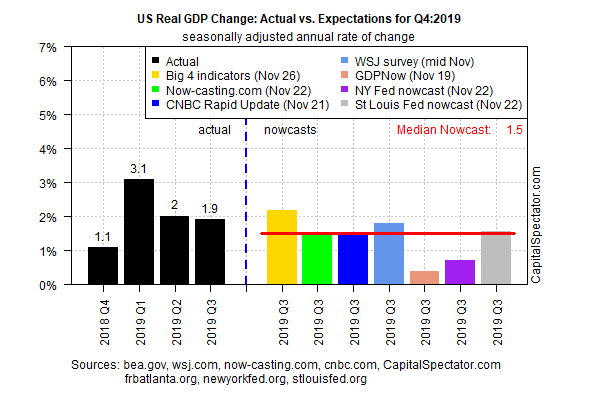

Tomorrow’s revised GDP data for the third quarter is expected to hold at a 1.9% increase, according to the consensus point forecast via Econoday.com. That’s a moderate gain but it may be a bridge too far based on estimates for Q4 via a set of nowcasts compiled by The Capital Spectator.

The median for the October-through-December quarter is a 1.5% gain, which marks another slowdown from Q3’s 1.9% rise. The good news is that the nowcast is unchanged from the previous Q4 estimate published two weeks earlier. But today’s median Q4 nowcast anticipates that economic activity will tick down for a third straight quarter and ease to the slowest pace since the 1.1% gain in 2018’s Q4.

A 1.5% advance is enough to keep the US out of recession, but it’s weak enough to gin up chatter that the economic stagnation awaits in early 2020. But if there’s reason to worry, Fed Chairman Jerome Powell chose to look past any clouds in his remarks yesterday and emphasize an upbeat outlook.

“At this point in the long expansion, I see the glass as much more than half full,” Powell said. “With the right policies, we can fill it further, building on the gains so far and spreading the benefits more broadly to all Americans.”

Those benefits may be a bit harder to come by in the Q4 GDP report, which is scheduled for release on January 30. But all’s not lost, at least not yet, according to survey data for November. The US Composite PMI – a GDP proxy — ticked up in this month’s flash estimate, IHS Markit reports. The modest rise lifts PMI to 51.6, a four-month high. But it’s hard to overlook that the latest print is still close to the neutral 50 mark that separates growth from contraction.

Nonetheless, “a welcome upturn in the headline index from the flash PMI adds to evidence that the worst of the economy’s recent soft patch may be behind us,” advised Chris Williamson, chief business economist at IHS Markit, in last Friday’s release. He added that it’s too early to declare victory, reminding that “the picture of current business conditions remains subdued by standards seen over the past decade and the business mood is sombre in relation to prospects for the year ahead. The latest survey results are indicative of GDP rising at a modest annualized rate of just 1.5%, with payrolls rising at a monthly clip of approximately 100,000.”

Meanwhile, yesterday’s October update of the Chicago Fed National Activity Index suggests the economy weakened at the start of the fourth quarter. The benchmark’s three-month average slipped to -0.31. That’s still modestly above the -0.70 mark that signals recession. But using this data as a guide suggests that disappointing data in upcoming reports could leave the economy perilously close to contraction.

Optimists, however, can point to the latest run of encouraging news on US-China trade talks. The on-again-off-again discussions appear to be on again, based on a phone call earlier today between China’s top negotiator on trade and US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin. “Both sides discussed resolving core issues of common concern, reached consensus on how to resolve related problems (and) agreed to stay in contact over remaining issues for a phase one agreement,” a statement from China noted, according to CNBC.

A resolution (or even a partial resolution) to the US-China trade conflict would likely deliver an economic boost of some degree. Of course, deciding if this scenario will play out requires navigating the tricky politics of Trumpism and so all the by-now-familiar caveats apply.

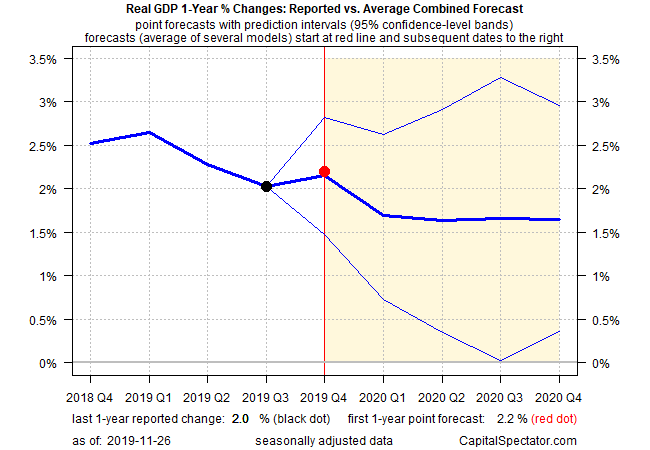

Meanwhile, projecting GDP in year-over-year terms continues to show that the trend in Q4 will tick up. Unfortunately, the expected bounce in Q4’s annual change is still projected to fade next year, based on The Capital Spectator’s average point estimate via a set of combination forecasts.

For now, the longest US expansion on record will likely roll on. Deciding if it survives in a battered-and-bruised state or ramps up to something stronger is probably closely linked with what happens with US-China trade negotiations.