U.S. economic growth has slowed but signs that the macro trend is stabilizing suggest that the recent downshift won’t lead to a recession in the immediate future. Nonetheless, the expansion appears to be increasingly vulnerable. Another round of shocks, expected or otherwise, could push the economy over the edge. For the moment, however, the numbers show that slow growth prevails.

Keep in mind that positive surprises could do wonders at this point. In particular, a breakthrough in the U.S.-China trade war would likely provide much-needed stimulus to counter the recent slowdown that’s taken a bite out of economic activity. Unfortunately, a meaningful resolution isn’t on the horizon, or so it seems via today’s headlines, which suggest that the Trump administration may be inclined to raise tariffs again.

Meantime, the latest nowcasts for fourth-quarter GDP are worrisome. The Atlanta Fed’s GDPNow model is currently estimating growth at a near-stagnant 0.4% (as of Nov. 19). That’s also the New York Fed’s Q4 nowcast at the moment (Nov. 15). Both nowcasts reflect substantial downgrades from the 1.9% increase in Q3.

The Philadelphia Fed’s ADS Index, a real-time business cycle benchmark, warns that the economic trend has faltered to a level that’s just barely above the tipping point that marks a recession. As of Nov. 15, the ADS Index print was -0.68, or just above the -0.80 threshold that a San Francisco Fed research paper identified as a signal that a US recession has started. Using the ADS data as a guide suggests that US economy will contract if incoming data weakens further.

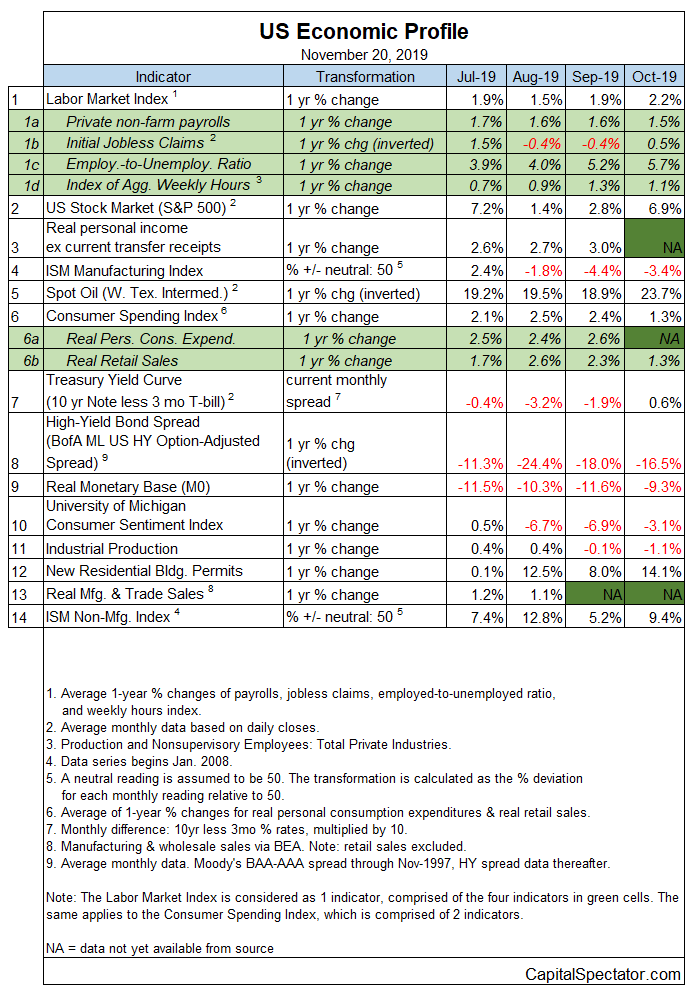

The good news is that the latest numbers overall still reflect an economy that’s holding on to a slow-growth trend. But as today’s update reminds, there’s already a fair amount of red ink in the economic profile and so the macro trend is on the defensive (see table below). Growth is strong enough to keep the expansion alive, but the margin of safety has become dangerously thin. (For a more comprehensive review of the macro trend with weekly updates see The US Business Cycle Risk Report.)

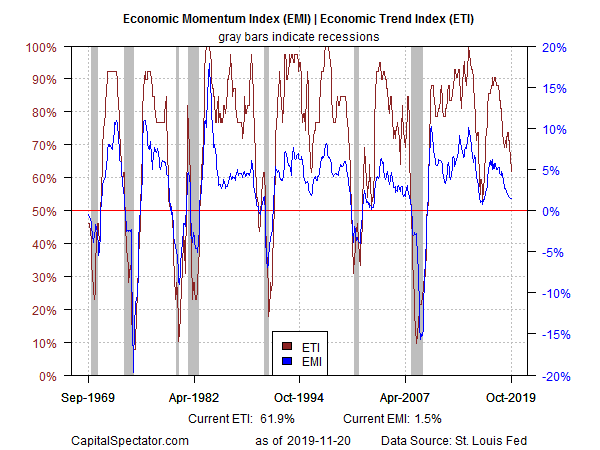

Aggregating the data in the chart above provides context for interpreting the broad trend, which is the goal of two proprietary benchmarks. Note that the Economic Momentum Index (EMI) edged up to 1.5% in October (blue line). That’s still close to the lowest level in three years but it appears to be stabilizing. By contrast, the Economic Trend Index (ETI) continued to slip, dropping to 61.9% last month (red line). Although EMI and ETI remained above their respective tipping points that mark recession (50% for ETI and 0% for EMI), a downside bias prevails. The good news, as we’ll see below, is that a projection of ETI through December suggest that this index will hold steady, albeit at a low level. (For details on the design and interpretation of ETI and EMI, see my book on monitoring the business cycle.)

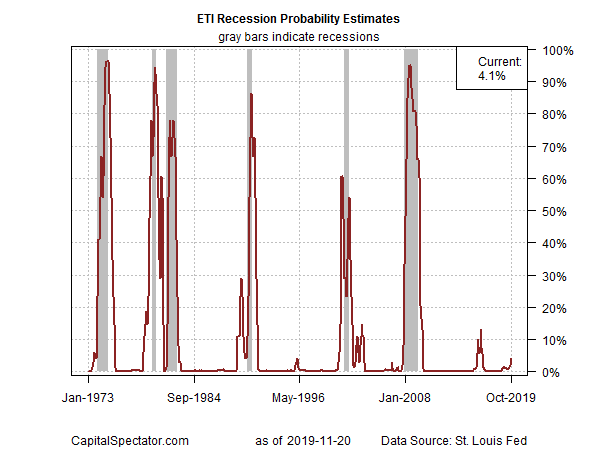

ETI’s latest decline indicates that recession risk has increased modestly in October, although the current 4.1% probability tells us that it’s unlikely that the economy was contracting last month. Translating the index’s historical values into recession-risk probabilities with a probit model points to low business-cycle risk at the moment. Analysis through this lens indicates that the odds remain low that NBER will declare October as the start of a new recession. Note, too, that a probit-model reading of EMI (not shown) also shows a relatively low probability (7%) that the economy was contracting last month.

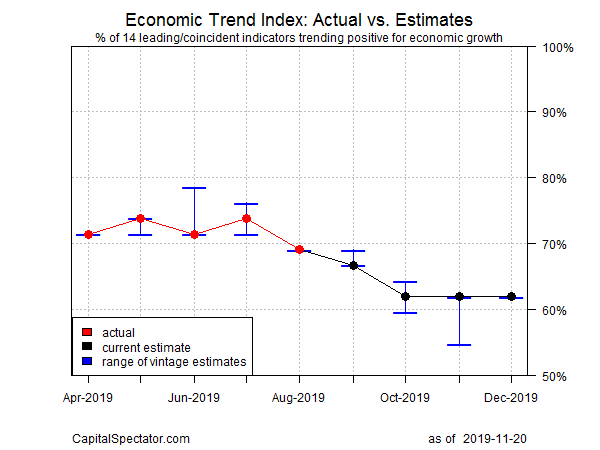

Now let’s consider how ETI may evolve as new data is published. One way to project values for this index is with an econometric technique known as an autoregressive integrated moving average (ARIMA) model, based on default calculations via the “forecast” package in R. The ARIMA model calculates the missing data points for each indicator for each month — in this case through December 2019. (Note that August 2019 is currently the latest month with a complete set of published data for ETI.) Based on today’s projections, ETI is expected to hold steady for a second month in December, modestly above the critical 50% mark. A reading below 50% would formally indicate that NBER is likely to declare the month as the start of a recession.

Forecasts are always suspect, but recent projections of ETI for the near-term future have proven to be reliable guesstimates vs. the full set of published numbers that followed. That’s not surprising, given ETI’s design to capture the broad trend based across multiple indicators. Predicting individual components in isolation, by contrast, is subject to greater uncertainty. The assumption here is that while any one forecast for a given indicator will likely be wrong, the errors may cancel out to some degree by aggregating a broad set of predictions. That’s a reasonable view, based on the generally accurate historical record for the ETI forecasts in recent years.

The current projections (the four black dots in the chart immediately above) suggest that the economy will continue to expand through next month, albeit at a slow pace. The chart also shows the range of vintage ETI projections published on these pages in previous months (blue bars), which you can compare with the actual data (red dots) that followed, based on current numbers.

For more perspective on the track record of the ETI forecasts, here are the vintage projections for the past three months:

Note: ETI is a diffusion index (i.e., an index that tracks the proportion of components with positive values) for the 14 leading/coincident indicators listed in the table above. ETI values reflect the 3-month average of the transformation rules defined in the table. EMI measures the same set of indicators/transformation rules based on the 3-month average of the median monthly percentage change for the 14 indicators. For purposes of filling in the missing data points in recent history and projecting ETI and EMI values, the missing data points are estimated with an ARIMA model.