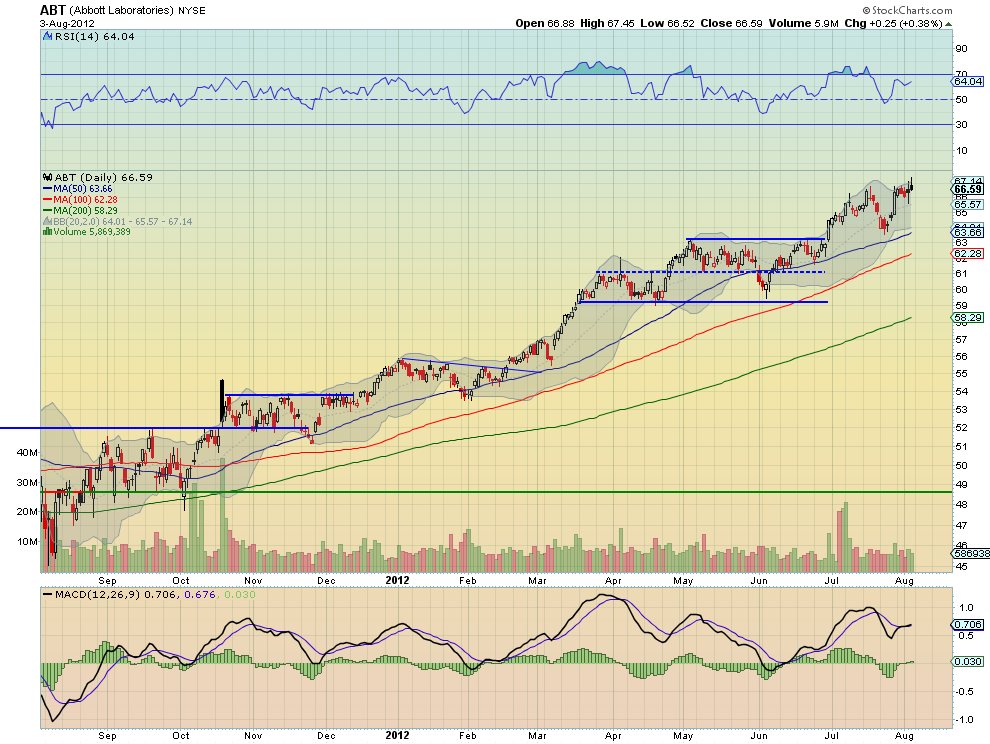

Abbott Laboratories (ABT) is testing resistance at 67 with a rising and bullish Relative Strength Index (RSI) and a Moving Average Convergence Divergence indicator (MACD) that is starting to grow more positive. A break over 67 carries a Measured Move to 69 but it has a price objective on the 3-box reversal Point and Figure chart (PnF) of 94 above that.

Agrium (AGU)

Agrium (AGU) is building a bull flag with a top at 97.50 and base at 92.50 after a long run higher. It has a bullish RSI that is curling back higher with a MACD that is diverging, rolling negative. Normal for a consolidation. A move over the flag carries a target of 115, slightly above the PnF price objective of 111.

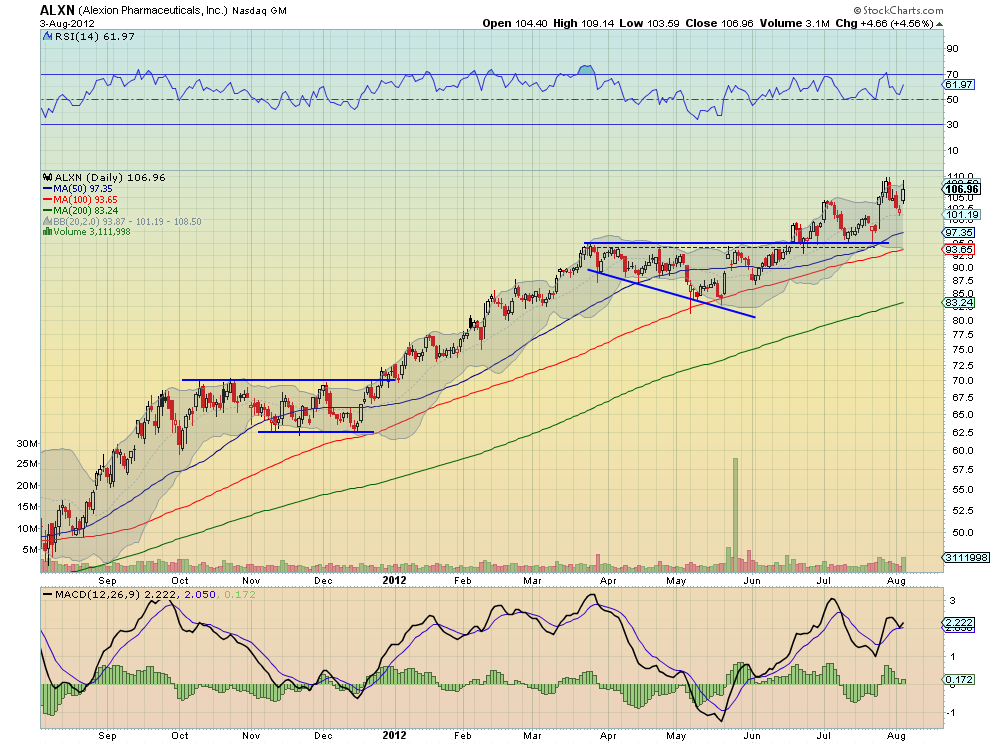

Alexion Pharmaceuticals (ALXN)

Alexion Pharmaceuticals (ALXN) broke above the expanding wedge several weeks ago and held on the retest. it is moving higher now with resistance at 110. A break over that carries a Measured Move to 116.30. The PnF price objective is above that at 124. The bullish and rising RSI and positive MACD support more upside.

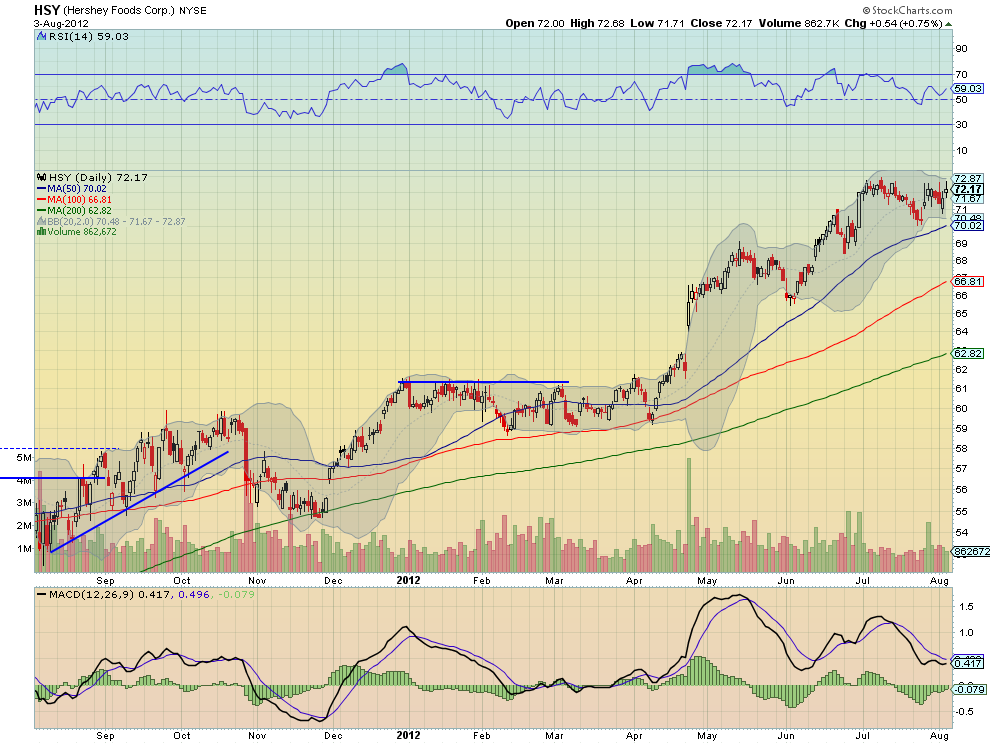

Hershey Foods (HSY)

Hershey Foods (HSY) is hitting resistance at 73 and has been consolidating there for nearly a month. A break higher carries a Measured Move to 77 and the PnF has a price objective of 94. Lots of potential upside. The rising and bullish RSI and MACD that is trending higher toward zero support the move higher.

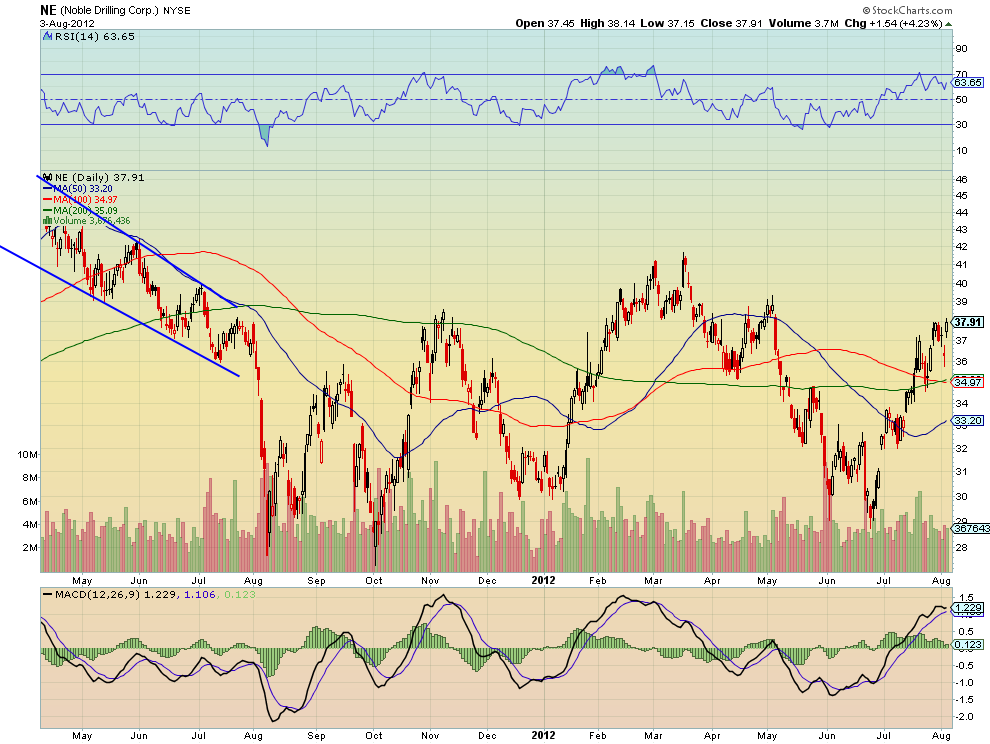

Noble Drilling (NE)

Noble Drilling (NE) is breaking a bull flag higher over 38 and carries a target of 41 on the Measured Move higher. The PnF suggests it can go as high as 57. The RSI is bullish and the MACD is positive, both support a push higher.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Saturday which, as the dog days of August begin has the markets looking better. Gold and crude oil are poised to consolidate with a bias for an upside move on a break. The US Dollar Index and Treasuries seems content to move continue to pullback in their uptrends.

The Shanghai Composite really looks ugly but may have a reprieve for a few days and Emerging Markets are poised to move higher. Volatility looks to remain low and possibly make new lows setting the stage for the Equity Index ETF’s SPY, IWM and QQQ, to continue to run higher. The inter-market view with the lower bias for Treasuries and the US dollar, and higher bias for crude oil also support more upside for Equities. Use this information as you prepare for the coming week and trade’m well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post.