Technical Outlook:

- Yesterday marked an extremely boring an inconsequential day of trading

- In the final hour of trading, S&P 500 gave up all of its gains on the day and finished nearly flat.

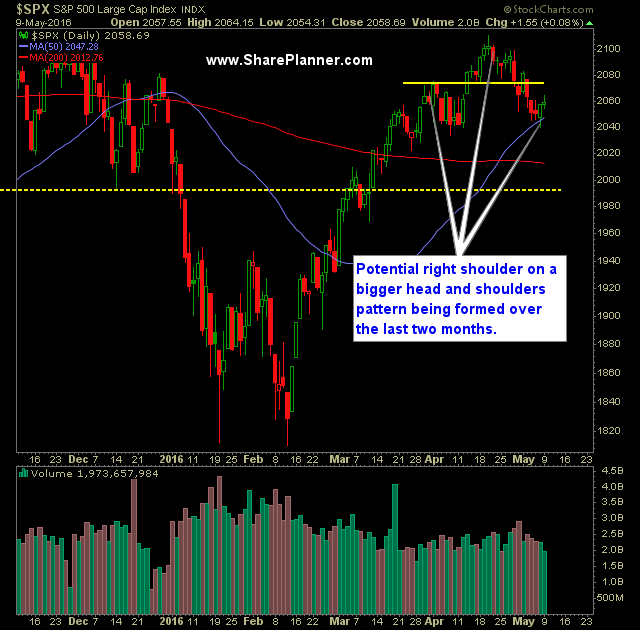

- The big concern for me on the chart is that there is now a very obvious head and shoulders pattern that is forming on S&P 500 daily over the past two months. Confirming the move would take price down into the 1900's fairly quickly.

- I believe at this point, profits have to be taken aggressively, and avoid the tendency to let the profits run.

- 50-day moving average is holding strong, but the doji candle formed on SPX yesterday wasn't entirely convincing of a follow through-like candle.

- SPY (NYSE:SPY) volume was less than what was seen on Friday and below recent averages.

- SPX 30 minute chart did manage to put in a higher-high and stop the series of lower-highs.

- VIX sold off 1% yesterday after being up nicely early on. At this point, it appears more inclined to test the low $13's than it does to test 16.40 again.

- The number one objective for the bears coming into today is to break price back below last weeks lows of 2039. Do that and you have the head and shoulders pattern.

- Bulls need to get price back over the highs from yesterday and then reclaim the 20-day moving average again.

- Historically the May through October time frame is much weaker than the rest of the year.

My Trades:

- Did not add any new positions yesterday.

- Covered Mastercard Incorporated (NYSE:MA) at $97.03 for a 0.7% loss.

- Covered Financial Select Sector SPDR (NYSE:XLF) at 23.11 for a 0.1% oss.

- Currently 30% Long / 70% Cash

- Remain Long: Johnson & Johnson (NYSE:JNJ) at $112.65, AAPL at $92.79 and GM at $31.03

- Will look to add to my long exposure if the market can put together a rally today.