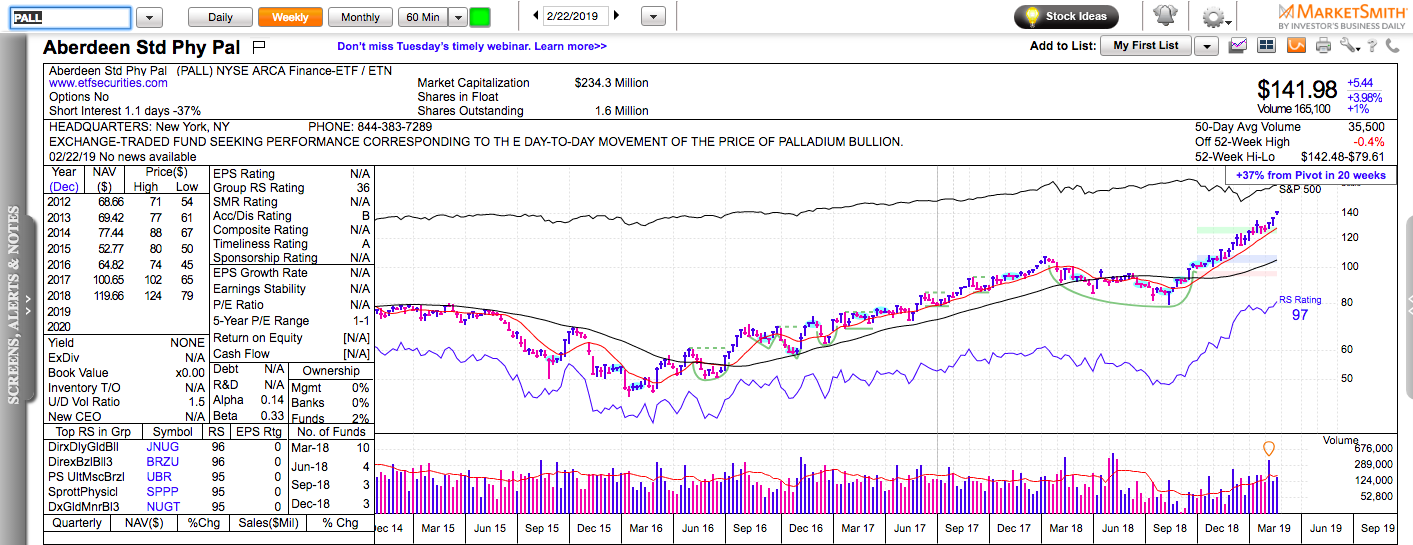

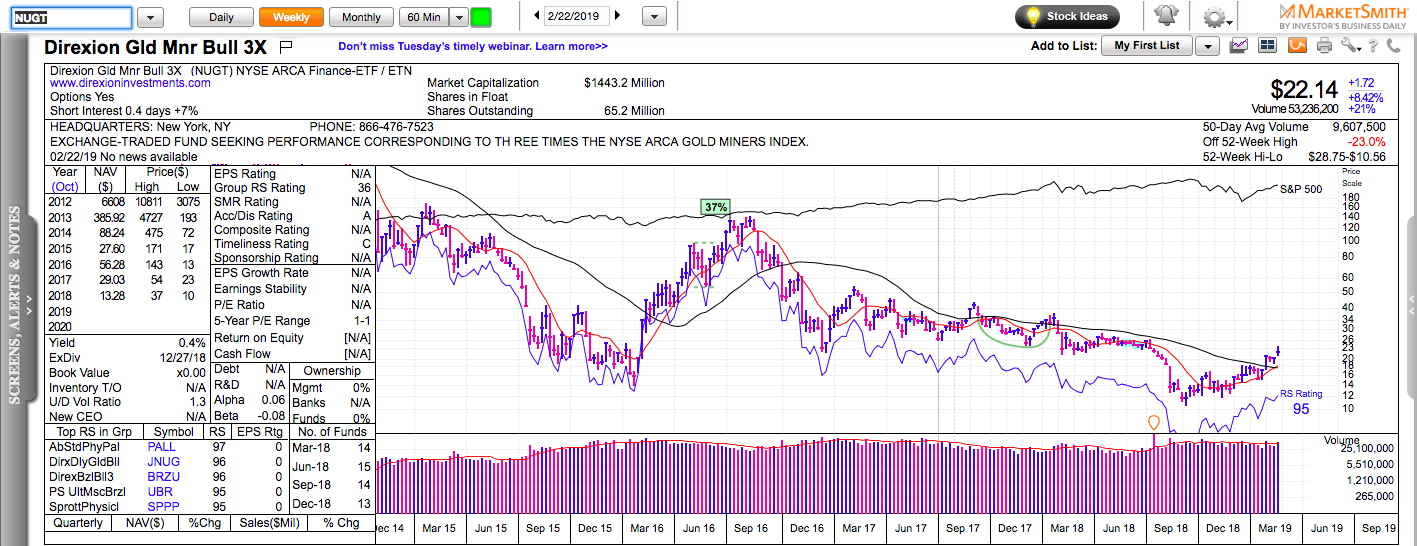

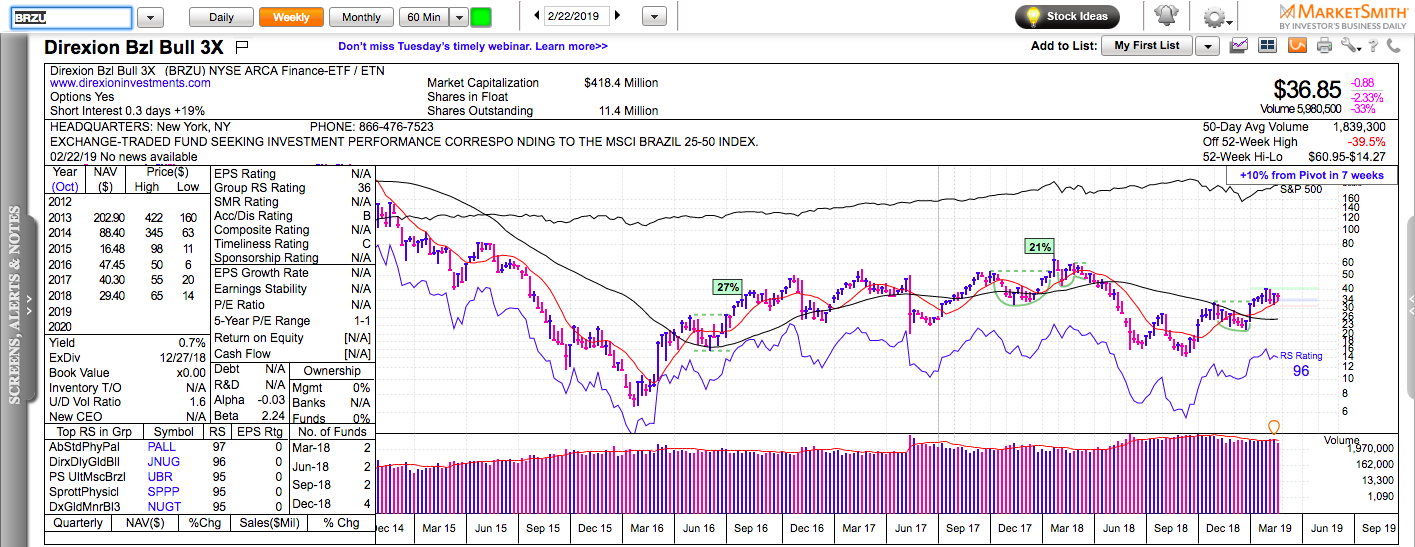

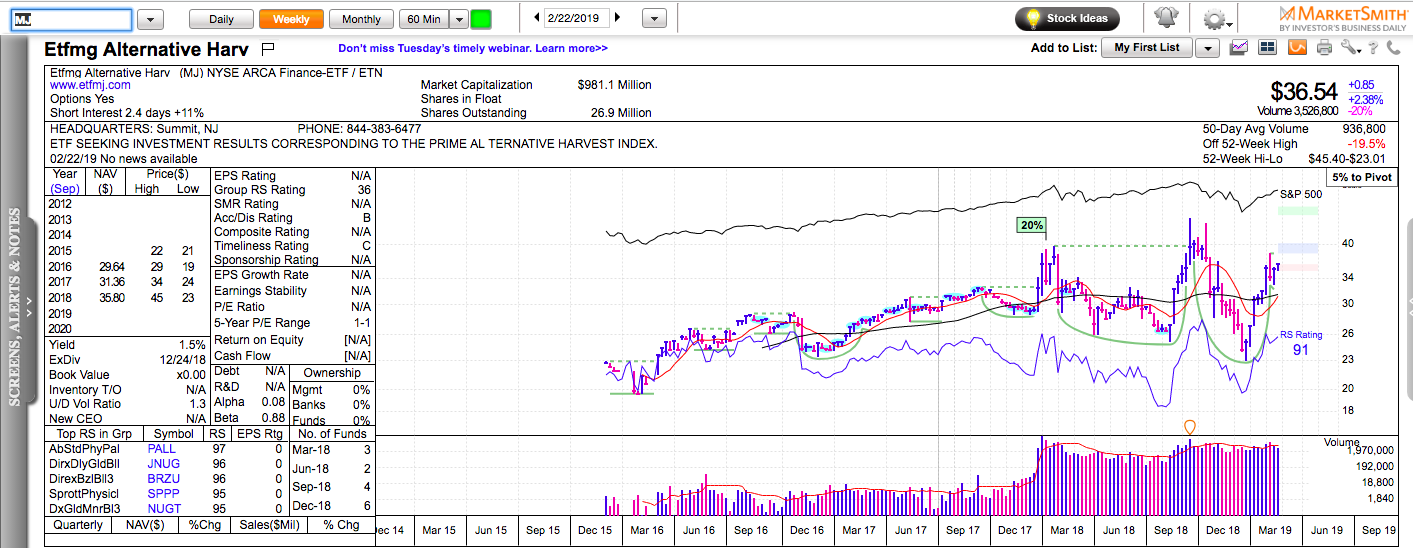

I ran a screen looking for relatively liquid ETFs with a relative strength above 90. A few themes stand out: palladium, gold, Brazil, marijuana, and software. This list can tell us how financial markets are seeing the world in the next six to twelve months.

Two of the leaders are precious metals that typically go up when inflation and political turbulence expectations rise. What’s even more interesting is that palladium and gold have risen despite a relatively strong U.S. dollar.

ETFS Physical Palladium Shares (NYSE:PALL)

Direxion Daily Gold Miners Bull 3X Shares (NYSE:NUGT)

Direxion Daily Brazil Bull 3X Shares (NYSE:BRZU)

Brazil has a new President, who is supposedly pro-business.

ETFMG Alternative Harvest ETF (NYSE:MJ)

Marijuana is a brand new industry that is just entering the investable universe of many money managers. It could also be just another fad. No one really knows. Things always look easy and clear in hindsight.

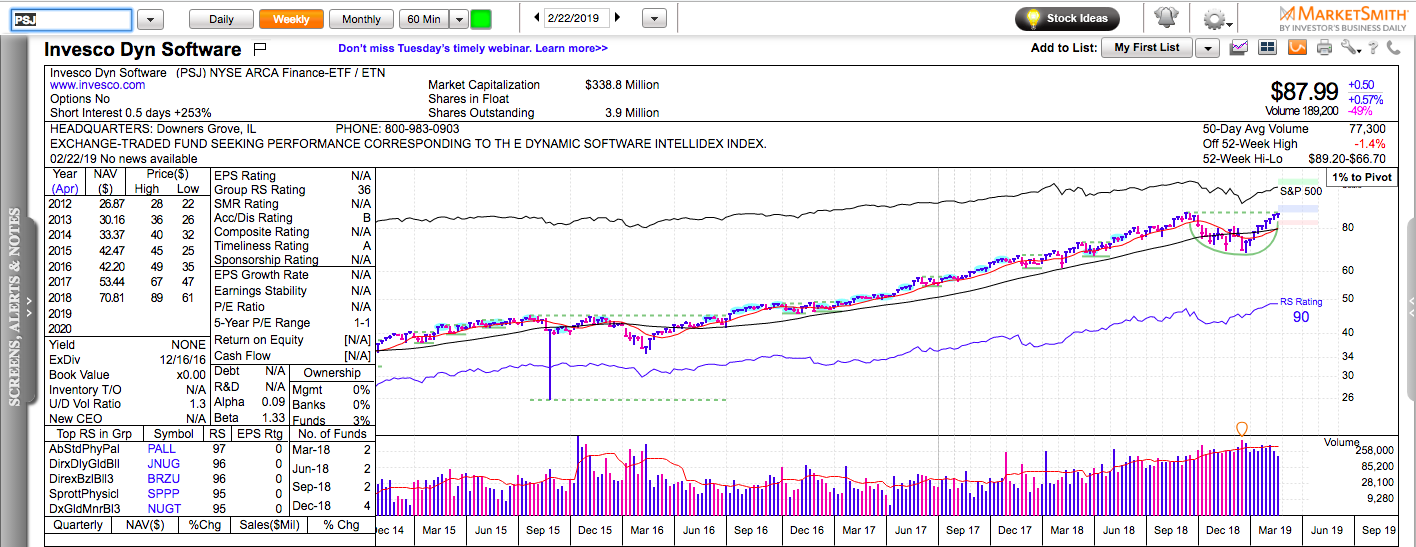

PowerShares Dynamic Software (NYSE:PSJ)

And software, which has been leading since early 2018. – the upgrade cycle in the corporate world continues with full force. One sector’s rising expenses are always another sector’s rising revenues. Enterprise software companies have been big beneficiaries in the past year or so.

Summary

Keep in mind that MJ and PSJ are the only non-leveraged ETFs on the list. Leveraged ETFs are good short-term trading instruments. They are rarely good long-term investment vehicles. In fact, all leveraged ETFs are structured to lose money over time.