It was never easy being a central banker and the job has become much more difficult over the course of the last five years or so, but right now the task of guiding monetary policy and juggling the myriad of threats to economic stability is particularly daunting.

Take the Fed, for instance. The current policy statement calls for $85 billion of bond purchases each month, until the unemployment rate is below 6.5%, as long as inflation expectations do not rise above 2.5%.

At some point, however, the Fed will have to taper its bond purchases and ultimately begin selling some of its bond holdings. The big questions surround when to begin reversing course and how dramatic the increments will be in those policy changes.

With the unemployment rate and rate of inflation highlighted as the key data points for determining the timing and magnitude of the policy changes, the task of slowing and ultimately reversing the quantitative easing policy seems reasonably straightforward, at least in theory.

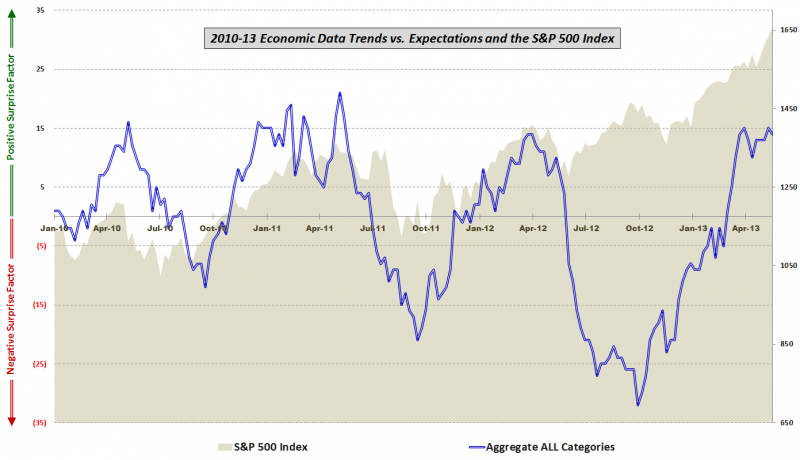

One big problem is that the unemployment rate may not be a very good gauge of the health of the economy. The chart below shows economic data reports relative to expectations over the course of the last 3 ½ years. Note that up until about a year ago, there was a very strong correlation between the performance of the S&P 500 index and whether economic data beat or missed consensus estimates. The correlation resumed when economic data turned up in the end of September, but a new divergence arose when economic data began stalling about two months ago, while stocks have been making new highs.

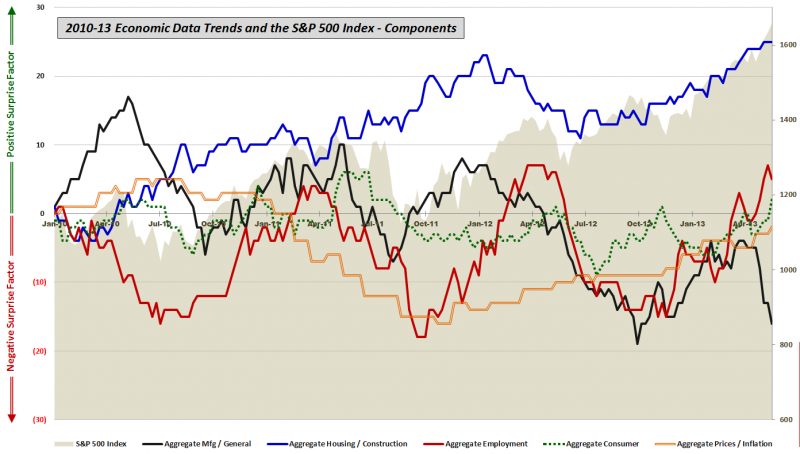

Looking at the five components of the economic data, one can see that for the past eight months or so there has been a favorable trend in housing/construction, employment, the consumer, and prices/inflation. As the graphic below illustrates, the one category that has been consistently missing expectations, particularly over the course of the last five weeks, has been manufacturing and general economic data, a category that includes reports such as GDP, ISM, Industrial Production, Capacity Utilization, Durable Goods, Factory Orders, Regional Fed Indices, Productivity, etc.

The problem for the Fed is that even though the consumer, housing / construction and aggregate unemployment rates all suggest an improving economy, the manufacturing sector and employment measures such as the labor force participation rate (official BLS graphic) paint a picture of continuing economic weakness.

As an investor, one has to guess how the Fed will handle this evolving conundrum. My general sense is that bulls will be rewarded if the economic data continue to fall slightly short of expectations and help to persuade the Fed that maintaining or perhaps even increasing bond purchases is the best policy approach – all of which should be a positive for stocks.

Should economic data, particularly the employment component, begin to top estimates on a regular basis, then we are left with the likely conclusion that the Fed will begin to remove the QE safety net relatively quickly. At the other end of the spectrum, if data fall well short of expectations going forward, the more perplexing conclusion is that even with its expanding toolbox, efforts by the Fed to prop up the economy are having at best a temporary effect and are also demonstrating diminishing returns.

For investors, the data sweet spot going forward – or Goldilocks zone, if you will – is likely to be a series of near misses that extends the current policy indefinitely.

[For those seeking more details on the specific economic data releases which are part of my aggregate data calculations, check out Chart of the Week: The Year in Economic Data (2010).]

Disclosure(s): none

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Fed, QE, The Economy And Goldilocks 2.0

Published 05/19/2013, 12:41 AM

Updated 07/09/2023, 06:31 AM

The Fed, QE, The Economy And Goldilocks 2.0

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.