The world of prostate imaging received a shake-up with the recent US$450m buyout offer for Blue Earth from Bracco. Blue Earth’s revenue derives primarily from its prostate imaging agent, Axumin (US$140m Q1–Q319, according to Bracco), which we expect to offer competition for illumet. Blue Earth is also developing a PSMA positron emission tomography (PET) agent, although it is only in Phase I. Serendipitously, a study was recently initiated at Emory University to investigate Axumin vs illumet in a 140-person, head-to-head study.

Blue Earth deal additional evidence of value in space

The Blue Earth buyout highlights the steadily increasing interest in prostate imaging and radiopharmaceuticals. It followed the other recent acquisition of Endocyte by Novartis to acquire the former’s 177Lu-PSMA-617 radiopharmaceutical. Blue Earth is also investigating a PSMA targeted imaging agent/therapeutic, which we believe is an important part of the Bracco deal, as it provides a follow-on candidate to the company’s more established Axumin.

Investigator-initiated trial to compare illumet/Axumin

Although it is becoming generally accepted that PSMA targeting provides benefits over other PET agents, Telix Pharmaceuticals (ASX:TLX) recently entered into a collaboration with Emory University to test illumet against Axumin in a randomized, 140-person prospective clinical study. Telix’s only financial obligation is to provide sufficient illumet test kits. We expect the initial study treatment portion of the trial to be complete in 2020.

Diagnostics make regulatory progress

Telix recently announced that it had completed a pre-IND meeting with the FDA regarding its plan to include US patients in its ongoing ZIRCON Phase III study of TLX250-CDx for clear cell renal cell carcinoma (ccRCC). Telix will need to submit an IND (targeting Q319) and has guided to complete enrolment by the end of 2019. The company also met with EU authorities to finalise the approval pathway for TLX591-CDx and confirmed that it will seek a decentralised MAA. The company plans to complete its MAA requirements in six months.

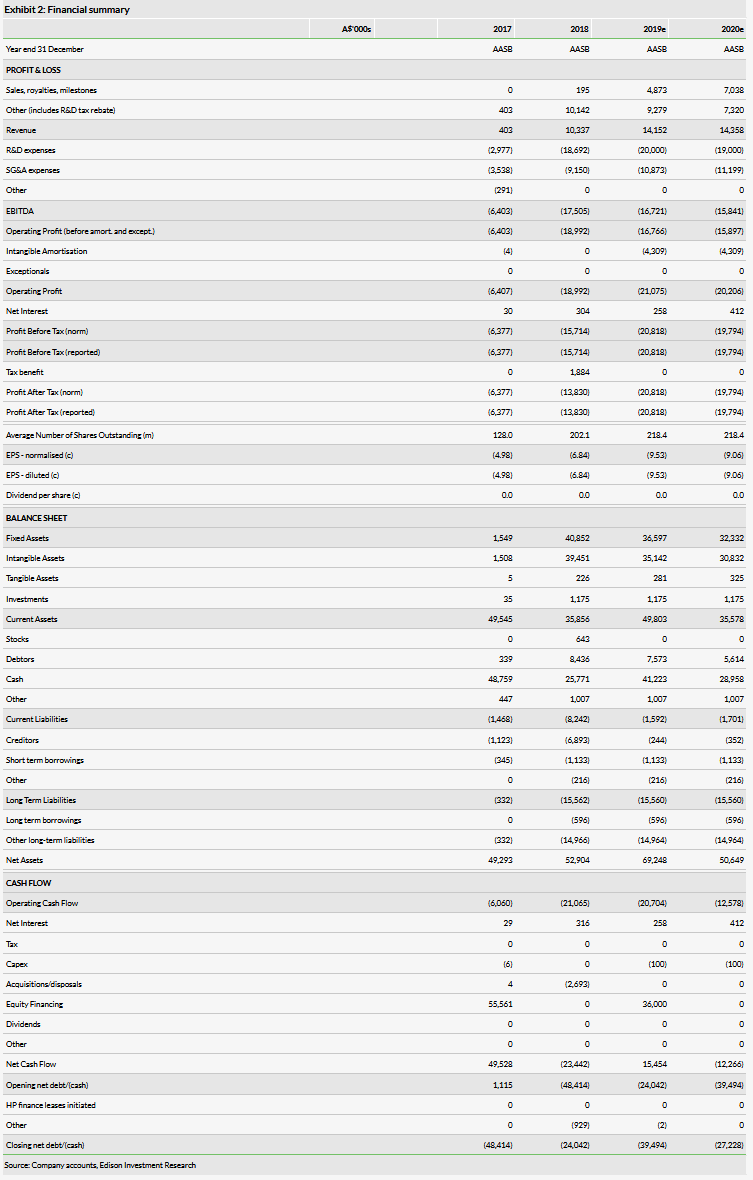

Valuation: Increased to A$443m from A$380.2m

We have increased our valuation to A$443m or A$1.78 per share, from A$380m or $1.74 per share. The increase is driven by rolling forward our NPVs and an increase in net cash associated with the July offering (30.8m shares at A$1.30), and offset by a slight increase in SG&A expenses.

Business description

Telix Pharmaceuticals is a Melbourne-headquartered global biopharmaceutical company focused on the development of diagnostic and therapeutic products based on targeted radiopharmaceuticals or molecularly targeted radiation.

Blue Earth buyout highlights programme value

On 27 June 2019, Bracco Imaging announced that it would acquire outstanding Blue Earth Diagnostics equity for a US$450m valuation (plus an estimated US$25m in closing adjustments). Blue Earth is a privately held developer of diagnostic imaging agents, with approximately $140m in revenue expected in the first three quarters of 2019 (according to the announcement). Blue Earth’s current revenues come from its prostate PET imaging agent, Axumin, which was approved by the FDA in 2016. Axumin is an amino acid-based imaging agent, which labels cancer cells based on their amino acid demands, but lacks the specificity of a truly targeted agent. Therefore, the company is also developing a prostate-specific membrane antigen (PSMA) targeted PET diagnostic (denoted 18F-rhPSMA-7), similar to Telix’s illumet (TLX591-CDx), as a follow-on technology. The imaging agent is currently in Phase I testing, and the antibody is being investigated in preclinical studies for therapeutic purposes.

We believe that 18F-rhPSMA-7 is a significant contributing factor to the value of the deal. Blue Earth has established a market using Axumin, but there is reason to believe that PSMA targeted agents will command increasing market share in the space and the development of 18F-rhPSMA-7 is an important follow-on product to maintain the company’s market share. The European Association of Urology (EAU) recently updated its prostate imaging guidelines to specifically recommend the use of PSMA imaging agents, without any mention of Axumin or other PSA agents.

Interesting, Blue Earth released some early proof of concept data on its PSMA agent at the same time as the deal announcement. The data were largely retrospective, but highlight sensitivities of 64% to 94% depending on cancer stage and PSA levels. A sensitivity of 72% and a specificity of 93% were seen in patients with high-risk primary tumours (vs histology), which is roughly on par with other PSMA imaging agents that have been reported.1

This deal highlights the potential value in prostate PET imaging irrespective of the underlying technology. The prostate imaging market is developing exceptionally quickly and has proven that it has a viable market. We expect PSMA targeted agents to be increasingly important going forward and we anticipate this merger to raise the profile of the space. The deal is planned to close in Q319.

Illumet to go head-to-head with Axumin in IIT

Telix announced that a team of researchers at Emory University will be starting an investigator-initiated trial (IIT) to compare illumet with Axumin in a head-to-head Phase II study. The study will be prospective in nature, randomized and include 140 patients. Telix’s commitment to the study is limited to providing illumet kits, and otherwise will be funded by the university. A 68Ga-PSMA agent has previously been compared against Axumin in a retrospective study of 10 patients, which suggest that 68Ga-PSMA could provide improved results: 68Ga-PSMA identified significantly more patients with cancer, and even more lymph node metastases.2 We note that this Emory-led study is prospectively defined and may provide a much more robust indication of which agent is superior and in which circumstances.

It is worth noting that as this is an IIT, Telix does not have operational control over the study, and that the study’s sponsors do not have a commercial interest in the outcome. However, if they do indicate superiority for illumet, this could potentially be used in future marketing materials outside of the product’s approval package. The study consists of an initial comparison period followed by a five-year observation period. Although few details are provided, given the statutory end date of December 2025, we expect the initial evaluation period to be complete some time in 2020.

Regulatory update for TLX250-CDx and TLX591-CDx

Telix had a meeting with the FDA on 17 June to discuss its clinical trial design of the ZIRCON Phase III study of TLX250-CDx (NCT03849118). The company is developing TLX250-CDx as a PET imaging agent for the diagnosis of ccRCC, and the ZIRCON study is currently ongoing, but Telix sought FDA guidance before including US patients in the programme. The FDA confirmed that the clinical trial design as presented would be sufficient to file for marketing authorisation in the US. The product previously received a Special Protocol Assessment (SPA) from the FDA for the earlier Phase III study of the 124I version of the product (124I-girentuximab), which had positive efficacy results (86% sensitivity 87% specificity). Telix replaced the 124I label with 89Zr because it significantly improves signal to noise. The company stated in its recent announcement that the FDA had reviewed its new sensitivity and specificity targets for the ZIRCON study and the 89Zr labelled agent and provided ‘positive feedback’ (although the details of these changes were not provided). Given that the product previously had positive results and the FDA has signed off on the protocol and did not oppose the changes, we are encouraged by the chances of approval if there are no surprises in the new study. The FDA meeting was an important step in the product’s development because the US is the largest target market with over 65,000 patients per year. Telix is expected to file an IND in Q319 and begin enrolment of US patients and has previously guided towards the target enrolment of 250 (across all geographies) being complete around end of 2019 or early 2020. We expect that it may be able to launch as early as 2021.

Similarly, the company met with regulatory authorities in Europe to finalise its development plan for TLX591-CDx. It met the Danish Medicines Agency, which serves as a competent authority for drug and device approvals, and which agreed with the company’s plan for the application. Telix will be pursuing a decentralised approval process, in which TLX591-CDx will be approved in individual member states. The product is already available in Europe as an investigational product, but MAA approval would allow Telix to market the product directly for prostate cancer diagnosis. The company stated that it would complete the requirements for the MAA in six months, and we expect it to be filed shortly thereafter, and subsequently filed with other competent authorities in Europe on a rolling basis.

Valuation

We have increased our valuation to A$443 or A$1.78 per share from A$380.2m $1.74 per share. The increase is driven by rolling forward our NPVs and an increase in net cash associated with the July offering. We have also slightly increased our SG&A expense to align with recent company spending (impact of negative A$0.05 per share from A$0.03). Our other assumptions remain unchanged. We may update our valuation in the future to reflect the TLX591 go/no-go decision (reviewed in our recent Outlook note) or clinical results from any of the ongoing studies.

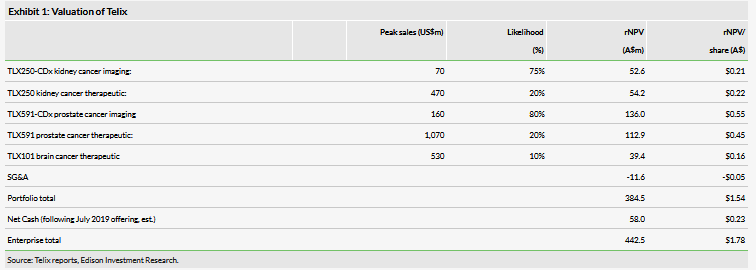

Financials

Telix reported global sales of illumet of $1.64m for H119. Although this value is small in absolute terms it is a strong signal of interest in the product, considering it is currently marketed for ‘investigational’ purposes only. We have adjusted our accounting to reflect illumet sales as top-line revenue, consistent with company reporting. We expect revenue from the product to continue to increase throughout 2019, as it enters more markets, and currently forecast sales of A$4.8m in 2019. Telix has been establishing a large number of distribution and manufacturing agreements in different geographies to execute on this strategy. Greater than the immediate revenue from the product is the foundation that these early adopters establish for the eventual clearance of the agent. These initial sales are roughly within our projections and we have not changed our forecasts at this time, although we have slightly increased SG&A costs going forward ($10.9m in 2019 from $9.4m). We estimate current net cash of approximately $58.0m following the July offering of A$40m gross from 30.8m shares at A$1.30. We expect this to be sufficient for Telix to reach profitability in 2022.