Nasdaq Closes At Record

US markets extended gains Monday led by technology shares. The S&P 500 gained 0.5% to 2746.87 with seven of its 11 sectors finishing higher. Dow Jones industrial advanced 0.7% to 24813.69. The NASDAQ Composite index climbed 0.7% to record high 7606.464. The dollar weakened: live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slid 0.2% to 94.004 but is rising currently. Stock index futures point to higher openings today.

Market sentiment remained upbeat after positive May jobs report Friday, which showed unemployment fell to 18-month low of 3.8%. Treasury yields rose. Traders of fed funds futures are pricing in a 93.8% probability of a rate hike at June 12-13 Fed meeting as the increase in average hourly earnings at 2.7% over a year ago was better than an expected 2.6% steady gain. There will be no Federal Reserve speeches as the central bank is in its so-called 'blackout' period ahead of its June meeting. Economic data were weak: factory orders fell by above expected 0.8% in April due to a decline in commercial aircraft.

FTSE 100 Leads European Indices

European stock indices extended gains on Monday. The British Pound turned lower against the dollar while euro climbed, with the two currencies moving in opposite directions of their yesterday moves currently. The Stoxx Europe 600 index gained 0.3%. The DAX 30 added 0.2% to 12749.45 and France’s CAC 40 ended 0.4% higher. UK’s FTSE 100 rallied 0.9% to 7768.22. Indices opened flat to 0.3% lower today.

Societe Generale (PA:SOGN) shares rose 0.7% after a Financial Times report that the French bank was in early stage talks with the Italian lender UniCredit SpA (SIX:CRDI) about a possible merger. Economic data were weak: producer prices in euro-zone remained steady when 0.3% gain was expected, and Sentix’s investor confidence index for the euro economy came in at 9.3, down from 19.2 in May, marking a fifth straight decline.

Asian Indices Mixed

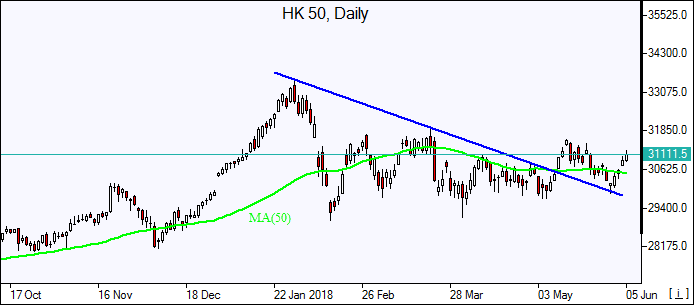

Asian stock indices are mixed today against the background of a breakdown of US-China trade talks over the weekend with no agreement. Nikkei rose 0.3% to 22539.54 as yen slide against the dollar slowed. Chinese stocks are rising as Caixin China reported its services purchasing managers index remained unchanged at 52.9 in May: the Shanghai Composite Index is up 0.8% and Hong Kong’s Hang Seng Index is 0.3% higher. Australia’s All Ordinaries Index however is down 0.5% despite the Australian dollar’s turn lower against the US dollar.

Brent Up

Brent futures prices are higher today. Prices fell Monday on concerns that the Organization of Petroleum Exporting Countries could lift its crude output curbs at the meeting later this month. August Brent crude settled 2% lower at $75.29 a bar