Stock Market News: April 13, 2019

Markets:

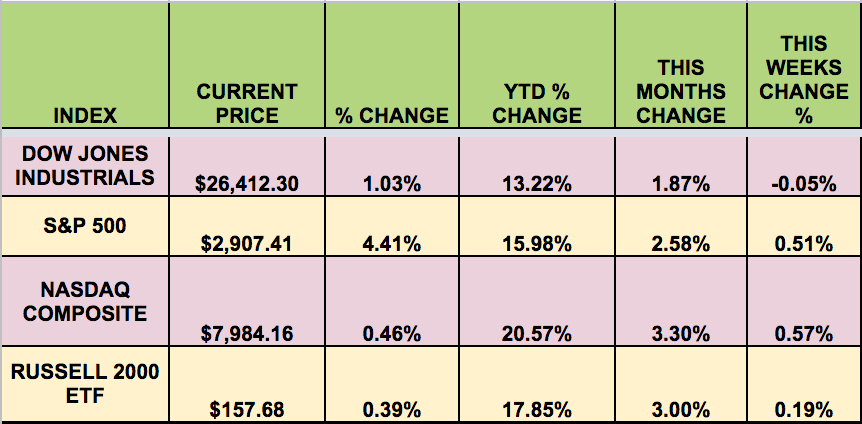

It was a mixed week for the market, with the NASDAQ and the S&P 500 posting good gains. The DOW and RUSSELL trailed. The market was buoyed on Friday by a positive earnings report from JPMorgan (NYSE:JPM) and PNC; and the unveiling of its pricing for its new streaming service from Disney. Oil also gained this week.

“Global stocks edged up after JP Morgan’s results began the corporate earnings season in style. Chinese data showed exports rebounded last month, helping to offset weaker imports and reports of another reduction in Germany’s growth forecasts. The earnings season’s opening is likely to divert attention from the ongoing U.S.-China and U.S.-Europe trade war.”

Market Breadth:

20 out of 30 DOW stocks rose this week, vs. 23 last week. 82% of the S&P 500 rose, vs. 23 last week.

Volatility:

The VIX fell 6.3% this week, ending the week at $12.01.

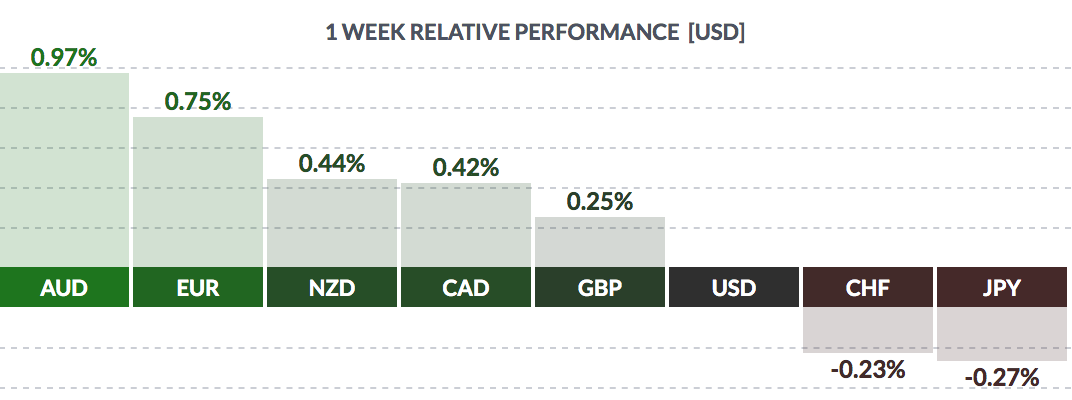

FOREX:

The USD fell vs. most major currencies this week, excepting the Swiss franc and the yen.

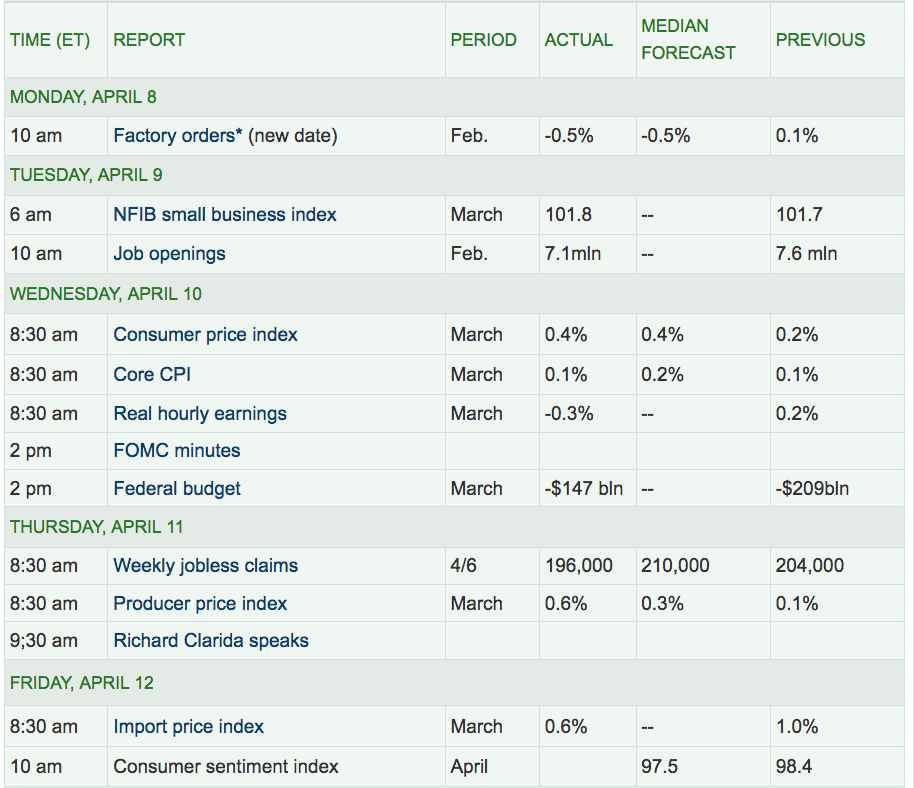

Economic News:

“The European Union has forced Britain to accept a six-month delay to the intractable Brexit process, with an option to leave earlier if the UK Parliament can agree a deal, at a tense summit of divided European leaders in Brussels. After a working dinner that dragged long into the evening, leaders of the 27 remaining nations agreed another delay to Britain’s scheduled withdrawal from the EU, this time until October 31.” (CNN)

“Federal Reserve officials said on Wednesday they’re prepared to move interest rates higher or lower as needed, but an unusual mix of risks means they could remain on hold all year. Despite an economy that is forecast to grow above trend with low unemployment, policy makers are worried about external drags such as slowing European growth, the potential of a disruptive Brexit and the ongoing trade war. Domestically, they are concerned about an inflation rate that is decelerating despite a labor market that is below their estimates of full employment. The result is an interest-rate policy that is on hold and might remain so even if some of these risks resolve into a more optimistic outlook. That’s basically the message in the minutes of the Federal Open Market Committee’s March 19-20 policy meeting released in Washington.”

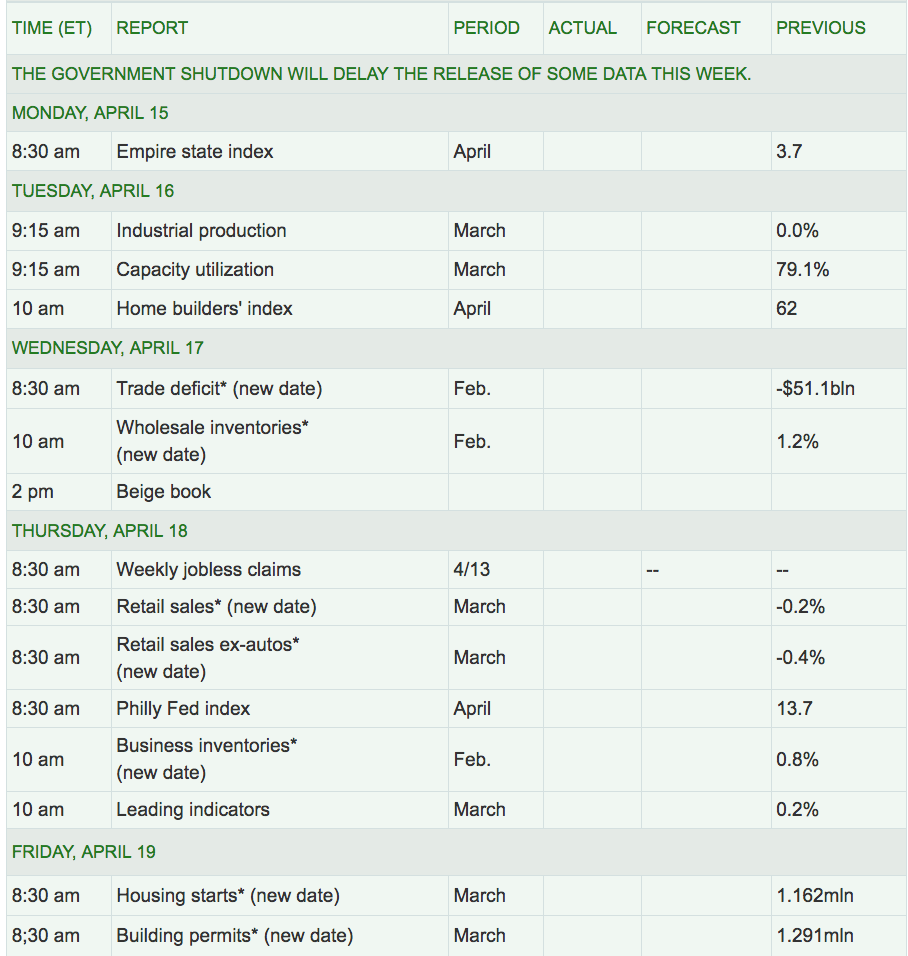

Week Ahead Highlights:

The market will be closed on Friday, in observance of the Good Friday/Easter holiday. Q1 Earnings season gathers some steam, with DOW components GS, JNJ, IBM, and UNH reporting. C and BAC will also report.

Next Week’s US Economic Reports:

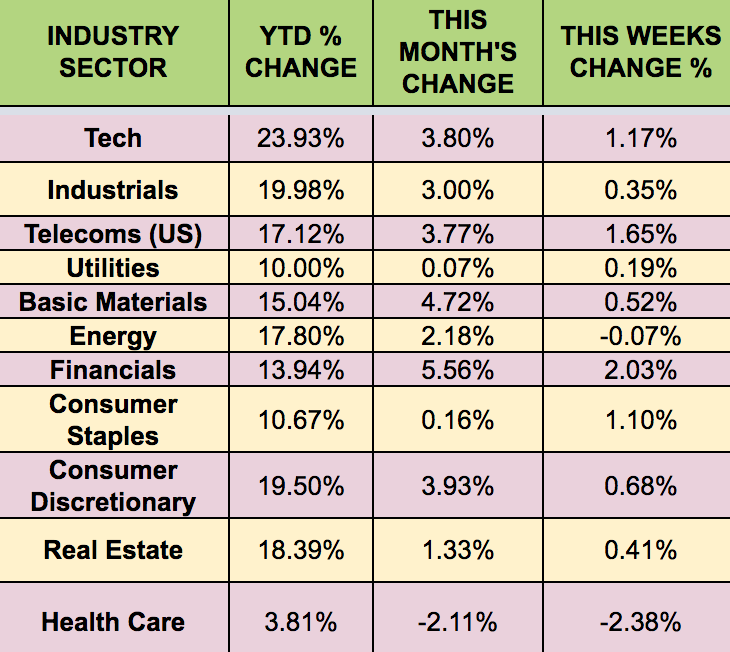

SECTORS:

Financials was the leading sector this week, aided by positive earnings reports from big banks, while the Energy sector lagged. Tech still leads year to date.

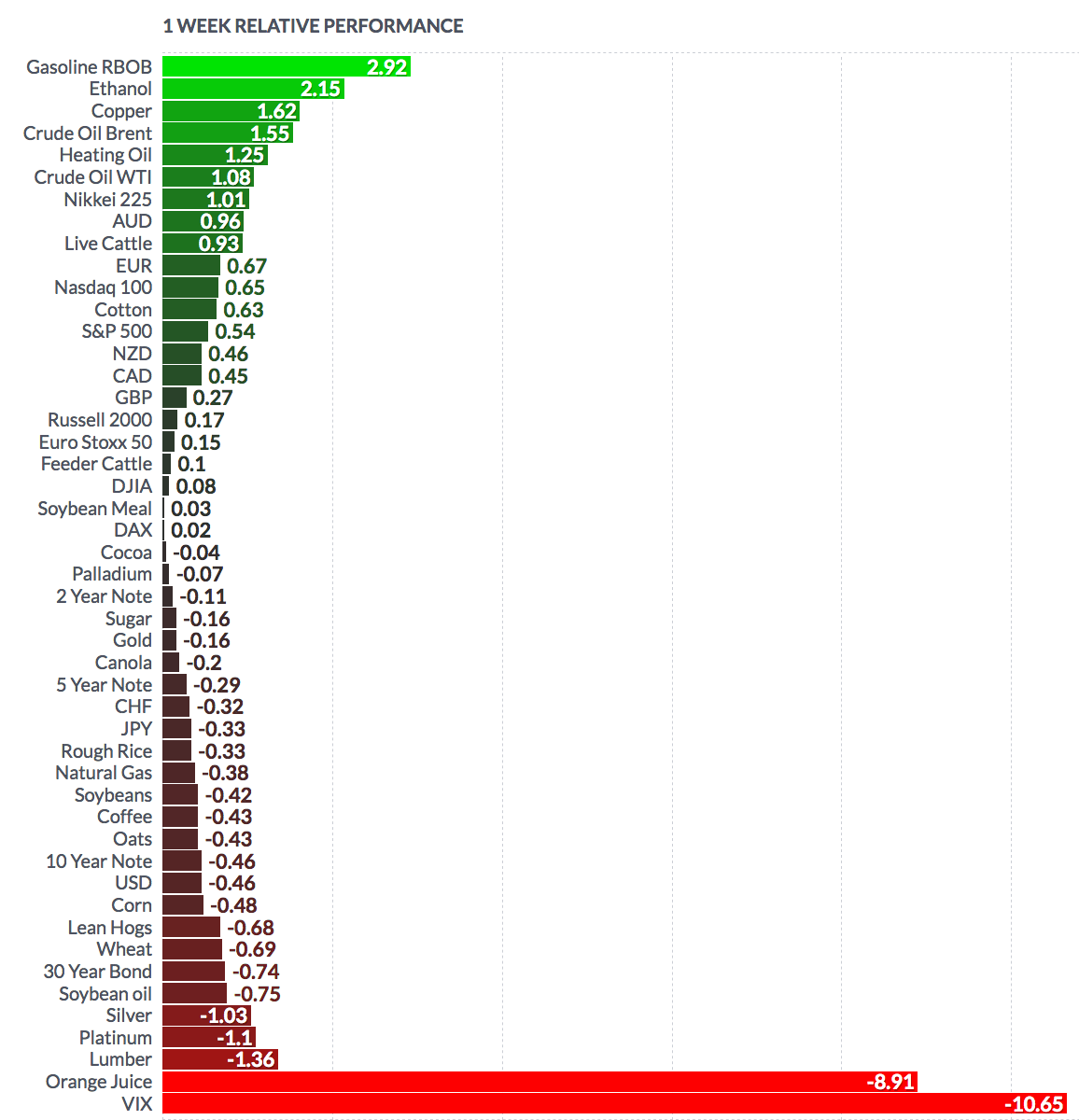

FUTURES:

WTI Crude rose 1.08% this week, finishing the week at $63.76, while Natural Gas fell again, down -.38%. “Signs of stabilization in China’s economy and a weaker dollar helped oil markets to their best run in more than three years on Friday."

“Oil prices rose to a five-month high on Monday, driven by expectations that global supplies would tighten due to fighting in Libya, OPEC-led cuts and U.S. sanctions against Iran and Venezuela. Traders said prices extended gains after data from market intelligence firm Genscape showed crude stockpiles at Cushing, Oklahoma, the delivery point for WTI, fell by about 419,000 barrels last week.

Investors already were focused on supply during the session as fighting in oil-rich Libya threatened to disrupt exports. Eastern forces were advancing on the country’s capital, disregarding global appeals for a truce.” (Reuters)“American drivers will probably pay less to fill up this summer as oil prices are forecast to be lower than last year. Retail gasoline prices are expected to average $2.76 a gallon, down from $2.85 last year, according to the Energy Information Administration. Brent crude, the world benchmark, is seen averaging $7 a barrel lower this season than last. Lower pump prices are expected to spur more highway travel this season, driving gasoline demand near the record level set during the summer of 2017. Meanwhile, exports of gasoline are seen averaging almost 90,000 barrels a day during the period, making the U.S. net exporter of gasoline for the first summer since 1960, according to the EIA.”