Anyone who has recommended small cap stocks this year has likely been wrong. The name of the game this year has been large cap stocks, whether it was in tech, healthcare, finance, or even during some of the bounces we've seen in other industries. 2014 has been a defensive year for the big money. Whether that is leading to a bear market remains to be seen. Some people are claiming that overvaluation in stocks is going to setup the next bear market. Overvalued seems to keep getting more overvalued though in the meantime.

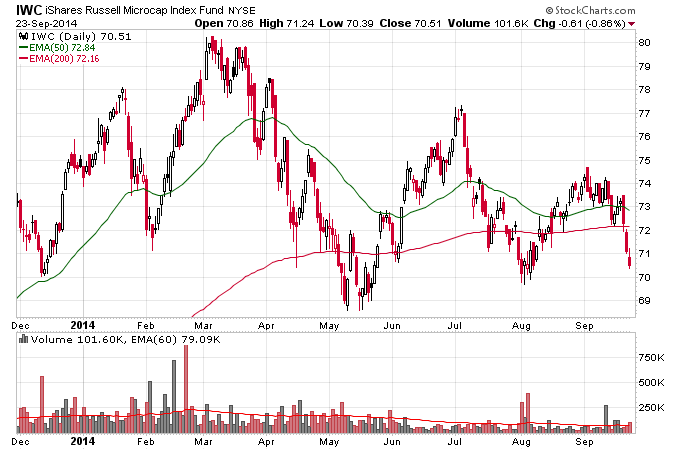

Take a look at iShares Russell Microcap Index (NYSE:IWC) shown below. This chart reminds me very much of Market Vectors Gold Miners (ARCA:GDX) when it topped in 2011 for the mining stocks, which I'm showing right below IWC. Look how it's just been a volatile mess all year. That isn't the sign of a healthy market. Thrashing often precedes a bear market or a major top. Notice how we have 3 lower highs now, but we aren't quite making lower lows yet. We're spending a lot of time below the 200 day moving average now though.

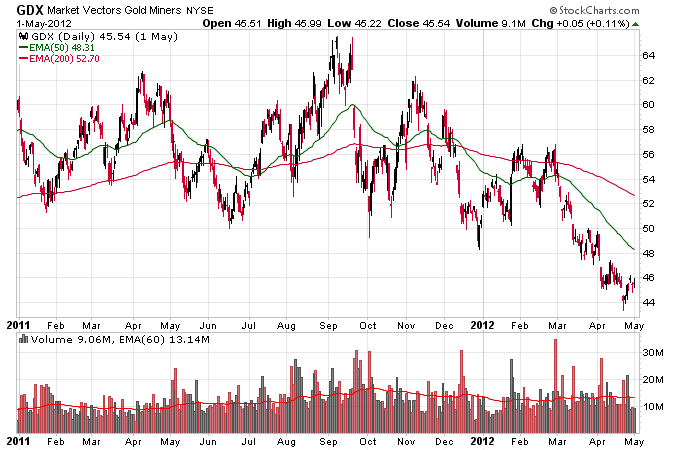

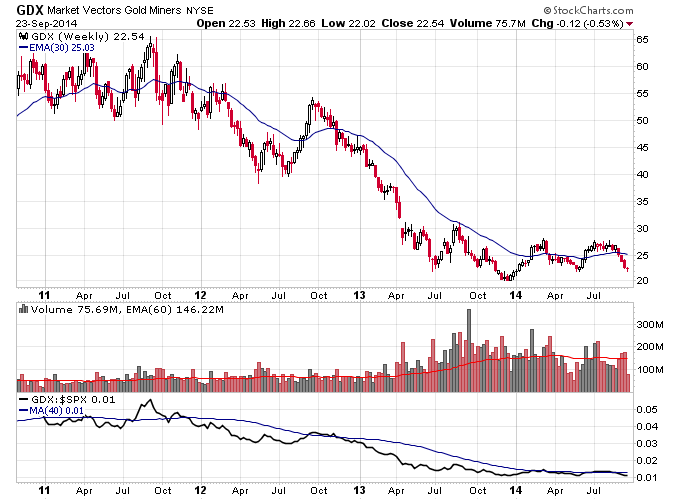

GDX was a complete mess during 2011 while gold was very strong. This was a harbinger of bad things to come for gold stocks. Again thrashing preceded the bear market in mining stocks. It took a whole year for GDX to top which is quite a while to frustrate bulls and bears.

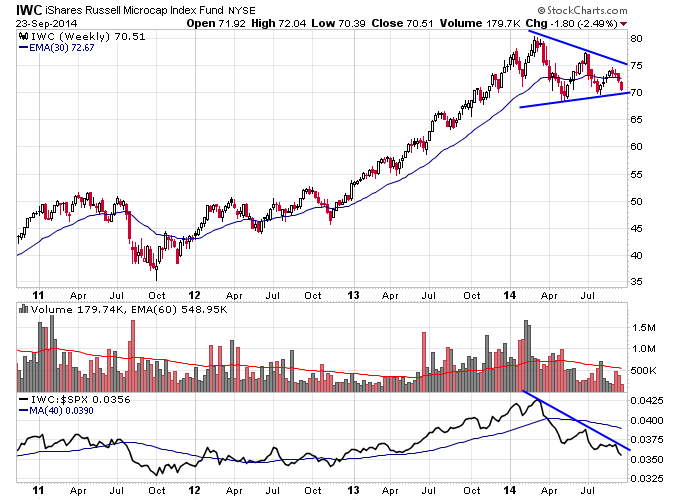

IWC from a weekly perspective looks like a classic Stage 3 top. Notice how on the latest move higher we didn't test the top of that triangle. That is not a good sign. That means that support could fail quicker than you think here.

GDX had a final Stage 3 to Stage 4 breakdown in late 2011 and early 2012. Then it was a Stage 4 downtrend with fake rallies along the way down.

Small caps are acting eerily similar to gold stocks in 2011, which is bad for the overall market if they are forecasting a bear market or major correction for stocks. Keep an eye out for a Stage 4 breakdown in IWC.