Market movers today

The data calendar brings no tier 1 releases in today's session and the primary market focus will remain on the unfolding earnings season amid US President Trump's recent reminder that the truce in the US-China trade war may quickly be called off.

On paper, the most prominent events today are Fed's Williams (NYSE:WMB) and Bostic speaking this evening and afternoon, respectively. However, given the recent communication from FOMC board members including Fed Chair Powell we doubt these speeches will have much market impact (see selected market news).

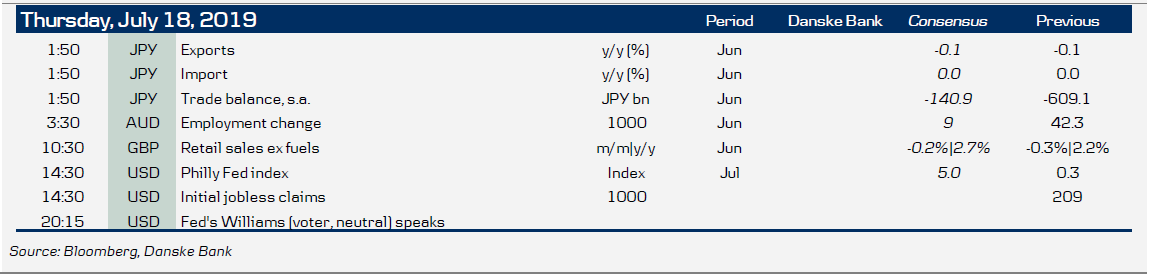

In the US, we get the weekly jobless claims figures that as always will receive attention given the importance of the labour market to the Fed. After a rebound in April, initial jobless claims have since been fluctuating around 220,000. After last week's drop to 209,000, we expect a modest rebound to a level just below these 220,000. If right, this would suggest that the labour market - albeit a lagging indicator - remains healthy.

Selected market news

This morning most Asian equity indices have followed US counterparts into red territory. The souring risk appetite reflects a few poor earnings reports - most notably rail operator CSX (NASDAQ:CSX) - and additional stories that progress in the US-China trade negotiations has stalled. US 10Y treasury yields have moved below 2.04%, while FX havens in JPY and CHF have seen moderate gains overnight. Japanese stocks are the big loser with the negative effect of the stronger JPY further amplified by disappointing Japanese trade data as both exports and imports fell short of analyst estimates.

The Fed Beige Book - based on anecdotal information from the regional Feds up until 8 July - released yesterday painted a 'positive' outlook for the coming months 'with expectations of continued modest growth, despite widespread concerns about the possible negative impact of trade-related uncertainty' . This underpins the challenge for the Fed, with domestic data staying at least decent but rising downside risks and continued subdued inflation at the same time. We think the downside risk for the Fed of staying on hold is now larger than the risks associated with delivering insurance monetary policy easing. With Donald Trump's recent reminder to markets that the trade truce may quickly end, we think it is fair that markets price a slight probability of a 50bp cut at the end of this month even if we ultimately expect a 25bp cut. Markets fully price 25bp with an additional 30% probability mass of a 50bp cut.

While posting a small rebound this morning oil has traded heavy over the last sessions with Brent crude now back below USD64/bbl. Yesterday, inventory data from the US Energy Information Administration (EIA) showed an unexpected large build in inventories of gasoline and distillate fuels of 9.25 m/bbl. As we are in the middle of the driving season, the inventory figures have contributed to the bearish oil momentum initiated Tuesday when Secretary of State Mike Pompeo raised the possibility of easing Iran sanctions.

In Sweden, Valueguard/HOX house prices this morning showed a roughly flat housing market m/m when adjusting for seasonality (no market impact). Looking ahead, we pencil in a housing market that at best will develop in line with disposable income growth (3-4% per year).

Key figures and events