How can you not remember this! A 20% move in a currency overnight. It crushed traders and hedge funds, forcing many closings. Currencies are just not supposed to move that much. Well at least not currencies from rock steady long standing developed countries. Chocolate and fine watch makers were going to be ruined as their product became too expensive. Even Rodger Federer was going to stop buying them.

It is still fresh in my mind like it was yesterday. Maybe that is because it was like yesterday. This happened only 1 month ago. So what has been going on with the Swiss Franc while you are worrying about Greece and watching the US markets hit new all time highs?

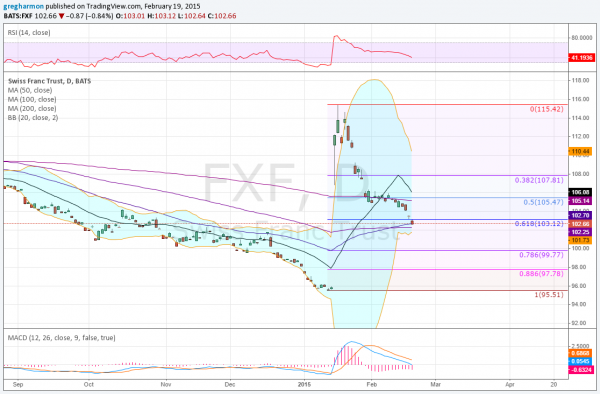

The chart above shows the Rydex CurrencyShares Swiss Franc (NYSE:FXF), the ETF for the Swiss France. The overnight move January 15th blew out the Bollinger Bands® and took momentum indicators well into overbought territory. But only one month later, the Swiss Franc has given up over 61.8% of that move higher. In fact, within a week it has lost half of that move and is just recently starting lower again. How low will it go?

The momentum indicators suggest that the reversal is not over yet, with the RSI and MACD both heading lower. The 50 and 100 day SMA’s are right here so a slight overshoot of them would not be out of the question. It had been running below them for a long time before the spike. What interests me the most about this chart is the lower Bollinger Band®. It is running flat at 101.50 as the upper one is driving down to meet it. Will it act as a brake or maybe the 100 level? Seems we will find out very soon. And if not look for the 78.6% and 88.6% retracements to give it some pause. I guess the crisis was not that big a deal after all.