- To call Q3 “challenging” is an understatement. Growth momentum is increasingly absent.

- Most metals were relentlessly forced downwards in Q3. Gold declined .13% (almost wiping out its gains YTD), silver fell .11% (down 13% YTD), and copper swooned 4.96% (down 9.42%YTD).

- Rather than pinpoint an “elephant in the room”, there are multiple negative catalysts including slower growth in China, a relentlessly stronger US Dollar, and excess commodity supply.

- Geopolitical events including the downing of Malaysian airline’s MH17, the potential spread of the Ebola epidemic, and the “rise” of ISIS have not had a significant effect on metals prices. The “metals” disconnect has many analysts, myself included, puzzled.

- It raises the question of whether or not the current downturn is structural rather than a “normal” cyclical downturn from which we always expect to recover.

- Q4 themes and catalysts may include a stimulus package in China aimed at boosting consumption, continued US Dollar strength (negative for gold and a deflationary precursor) , an announcement of QE in the Euro Zone, and the end of QE in the US.

- As QE ends in the United States, can the nascent growth profile be sustained and proliferate without Federal Reserve support?

- Can China deflate a housing bubble, tighten credit access, and manage to attain its growth targets? Why is the head of China’s central Bank under pressure from the Politburo now?

- Will geopolitical issues including an outbreak of Ebola, a democracy crackdown in Hong Kong, or an attack on Western soil by ISIS cause significant economic damage and filter through to boost precious metals prices?

- Will the recent strength we’ve seen in the US Dollar continue, implying higher real interest rates and pressuring gold and silver down? This downward pressure is a trend that appears likely to continue.

- With respect to Energy Metals, where will more consolidation take place? Lithium and graphite appear to be the most obvious candidates.

- What are the catalysts to bring investor interest back to the metals and when? How soon will enough de-leveraging take place to allow us to turn the corner?

In Deflation’s Grasp?

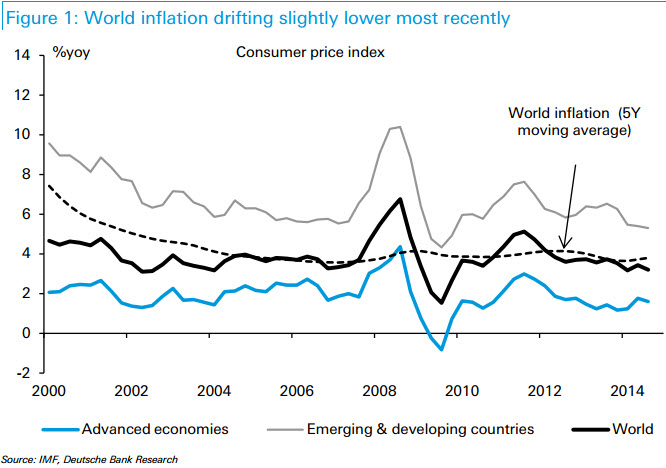

We have discussed the inflation/deflation debate many times in the past. It now seems clear that deflationary forces are predominant. Falling commodity prices, sparked by excess global supply and muted demand, aging societies, a stagnant velocity of money, and the ubiquity of technology continue to conspire to suppress and overwhelm the Federal Reserve’s attempts to stoke inflation.

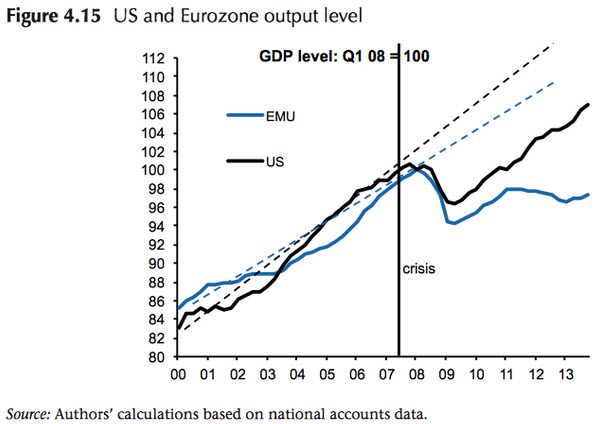

To be clear, there is inflation in the global economy (primarily in financial assets). Each country maintains its own fiscal and monetary policies in response to different inflationary pressures. An ominous but very real challenge to the developed world (the US, EU, and Japan) is reckoning with high debt loads relative to GDP - also known as Deleveraging. In the US, for example, private debt has fallen but is still above 100% of GDP.

These debt loads act as a drag on growth and impede achieving escape velocity for GDP growth. Failure to achieve the necessary growth rate tends to diminish global quality of life, the focus so prevalent in our writing over the years. This is not to say that inflation is “dead,” but it isn’t the predominant force in the global economy despite every Central Banker’s wish. Inflation appears to remain dormant.

This debt and deleveraging drag has served to push most commodity prices down to five year lows. While global central banks attempt to reflate their respective economies, the heady days of 2006 or 2010 for commodity demand appear to be a thing of the past for now.

Indeed 10-Year bond yields in the US have ticked "up".

Source: Bloomberg

Interest rates globally are still extremely low on a historical basis. The German 10-Year Bund yield is below 1% this morning. Echoes of the Japanese economic experience post 1989 now reverberate around the developed world.

As the US Dollar has aggressively strengthened, gold has been under pressure. Will this divergence last?

Source: Bloomberg

This is not to say that ALL commodities are doomed - a point I have made in past notes. I remain bullish on lithium and cobalt in the current environment. It appears that the soft commodities, including corn and wheat stocks, are plentiful due to favorable weather which can change seasonally. Demand in a number of metals is still forecast to increase in the coming years. However, generating positive investment returns in the foreseeable future is going to remain challenging.

The real challenge we now face in most of the metals markets is structural rather than cyclical. Any cyclicality will be secondary and worked through over a much longer time horizon that initially thought.

A case study of interest is iron ore. Major iron ore producers show per tonne production costs as low as $20 and are planning on increasing production amidst oversupply. Think about that for a moment….adding supply to an already over-supplied market.

The takeaway is clear: the iron ore exploration and development space will remain ugly indefinitely.

Energy Metals Update

There was surprisingly little to say about the Energy Metals complex in Q3.I think this is positive overall. Prices, volatility, and momentum, the most important indicators of a healthy market, generally remained firm (specifically for lithium and cobalt). Uranium spot prices, in particular, shot form a low of around $28 per pound to over $36 before settling lower. This good news hasn’t translated into higher uranium share prices, however, as the industry continues to choke on excess supply as I wrote about last week.

Reports out of China indicate that stockpiling of strategic metals continues apace with no significant upward pressure on prices. The rare earth element market continues to remain dormant, though the release of a PFS by Mkango Resources (MKA:TSXV) and a PEA by Namibia Rare Earths (TO:NRE) showed very promising results providing a reminder than there are still attractive investment opportunities in the rare earth sector, but patience is key.

My preference is still a focus on near-term production stories or those investment opportunities with disruptive advantages embedded in their business models. Examples include Argex Titanium (TO:RGX) and Lithium Americas (TO:LAC). I have written extensively on each of these in the past.

The take out of Big North Graphite (TO:NRT) by Flinders Resources (TO:FDR) was a welcome sign and a faint glimmer of hope that this is the beginning of much needed junior consolidation in the space. FDR’s attaining commercial production is also a welcome sign and I’ll be watching the financials closely here in the coming quarters to see how soon they can generate free cash flow.

I have also written about researching investment opportunities across entire value chains. One example is the solar industry. If the International Energy Agency (IEA) is right, solar promises to be an exciting industry to better understand and invest in going forward. I own shares in the Guggenheim Solar ETF (ARCA:TAN) to gain exposure here. The growth in this sector has been breathtaking and should continue as China pushes forward with its torrid pace of deployment.

There are a number of competing solar cell technologies (c-Si, perovskite, CIGS, etc), but currently with 80 tonnes of silver necessary to generate one GW of solar power, should solar really become ubiquitous, a steady and increasing demand driver for silver is in place.

Issues Of Concern in Q4

The stage is set for a very challenging Q4 for the metals. Mixed growth in the US and China with the Euro Zone flirting with deflation don’t inspire a great deal of confidence. With these issues in mind, here are several issues I’ll be watching as we head in to 2015:

The massive disconnect between Wall Street (index and financial asset valuations) and Main Street (flat real wages, slow growth, stagnant employment) still exists. A change in some or all of the issues listed above could slowly begin to reconnect the real and financial economies. Central Banks appear to hold “all the cards” with respect to guiding global growth and are at a critical point 6 years after guiding the global economy from the depths of the Great Recession. Or do they hold the cards? Are central bankers now impotent? Stay tuned.