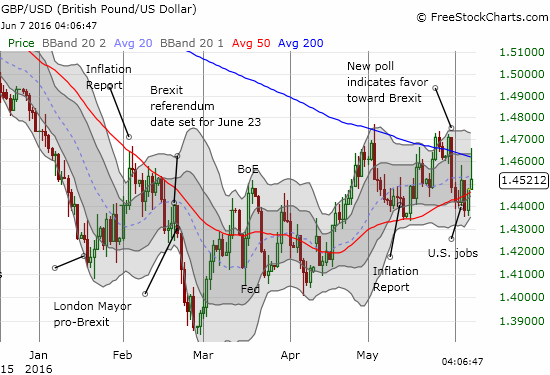

At least I expected to have a lot of commentary on the British pound going into the June 23rd referendum on the United Kingdom’s membership in the European Union (EU) aka “Brexit.”

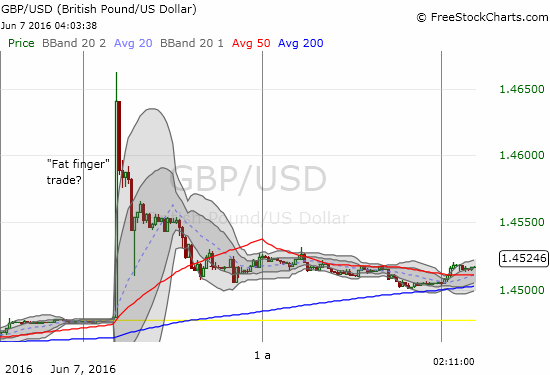

In the blink of an eye, the British pound soared against all major currencies. For emphasis, I show a 1-minute chart along side the daily chart.

It took just a minute or less for some trader(s) to send the British pound (Guggenheim CurrencyShares British Pound Sterling (NYSE:FXB)) soaring.

On the daily chart, GBP/USD rushed through its 200-day moving average (DMA) before fading back.

A quick scan of the social media posts on StockTwits and Twitter did not turn up any verifiable explanation for this blip. A “fat finger” trade then becomes the presumed cause. A fat finger describes the appendage of a trader whose clumsiness caused an errant trade of large enough size to temporarily distort trading – in this case, a rush to go long the British pound.

The impact carries across all pairs since trading programs and the like rush to grab the pound wherever it can be found and market makers drive up offers accordingly. If such a simultaneous move did NOT occur, an odd arbitrage opportunity would appear where the pound would be offered for much cheaper than on the pair suffering from the fat finger trade.

The subsequent fade from the errant trade unfolds much slower than the rush higher because traders need some time to seek out a satisfactory explanation for the sudden rush to buy the pound. (of course, a good and trade-able explanation may yet appear after I post this piece!). In the meantime, some traders are also rushing to readjust positions after programs tripped stops like GBP/USD shorts stopping out on a break of 200DMA resistance.

As I stated earlier, my trading strategy features fading rallies. Unfortunately, I happened to be away from the screens when this surge occurred and I was very late in putting on some fades. This big move has also dissuaded me from getting more aggressive on pound shorts by chasing any breakdowns. I have to assume the event risk on the British pound going into the Brexit vote is bi-directional!

Be careful out there!

Full disclosure: net short the British pound