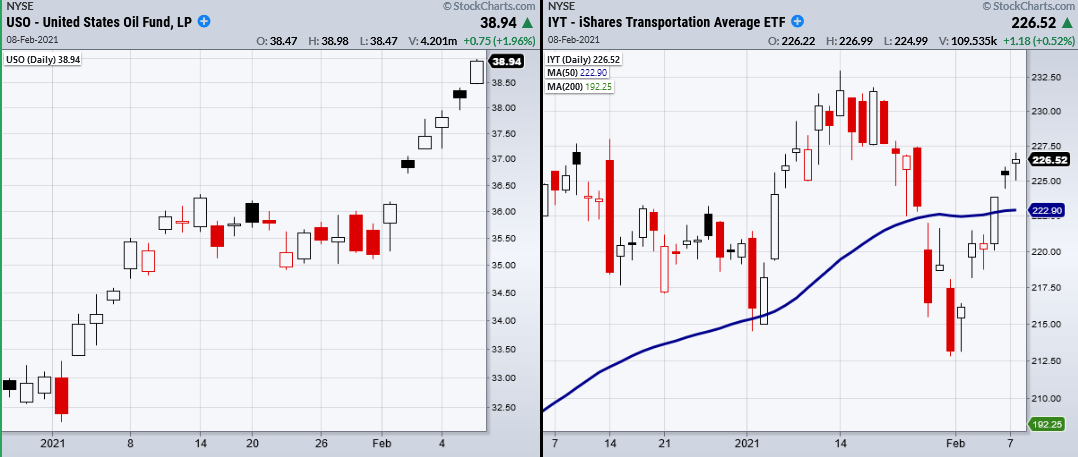

Oil has blasted off with the rest of the market in the last 5 trading days. And that is after it cleared the key 50-week moving average 4 weeks ago. This bodes well for the market and economy for now, as oil signifies a economic recovery is on the way. Since oil has a direct impact on the transportation sector (NYSE:IYT)), that too was able to break back over its 50-DMA last week. We have been watching IYT as an indicator for market demand, with strength showing a healthy movement of goods.

By watching both oil and transportation we can better keep track of the long-term picture for market recovery. Though IYT is holding over an important moving average, the volume has been low and the movement small.

Comparatively, all 4 major indices have broken new all-time highs on Monday. If IYT continues to trade sideways and the rest of the market continues upward, it would show stagnation in price movement and ultimately serve as a sobering reminder that the market is running too far ahead of itself. With oil moving upward, the notion that |inflation is also moving up could become worrisome, especially if the transportation sector does not follow. This scenario could lead to an inflationary period as prices of goods increase while their demand goes down. With that said, these things can take time to play out and does not mean we should be running for the exits if they happen.

Some sideways consolidative price action might even be healthy, as the Fed begins to rollout more stimulus money.

- S&P SPY New highs. 385 new support.

- Russell 2000 IWN New highs. Support 218

- Dow DIA New Highs. 312 support area.

- NASDAQ QQQ New highs. 330 support.

- KRE (Regional Banks) Needs to hold 60.

- SMH (Semiconductors) 246.79 resistance. Support 223.08

- IYT (Transportation) support 223 the 50-DMA

- IBB (Biotechnology) New Highs

- XRT (Retail) 75.28 support. 80.43 resistance.