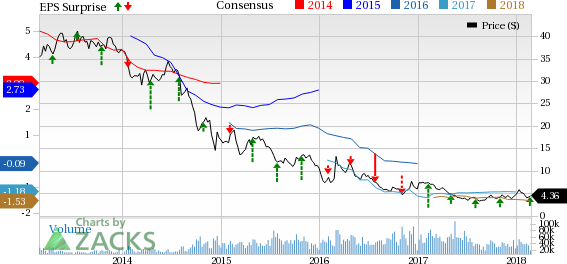

Noble Corporation (NYSE:NE) reported fourth-quarter 2017 loss of 29 cents per share, narrower than the Zacks Consensus Estimate of a loss of 32 cents. However, the figure was wider than the year-ago quarter’s loss of 15 cents.

Total revenues in the quarter declined to $329.6 million from $410.2 million in the comparable quarter last year. However, quarterly revenues beat the Zacks Consensus Estimate of $284 million. Contract Drilling Services plunged 20% year over year and contributed $321.1 million to total revenues.

Lower dayrates for drillships as well as lesser utilizations for drillships and jack ups affected the results.

In 2017, the company reported a loss of $1.14 per share, narrower than the Zacks Consensus Estimate of a loss of $1.15. The leading contract drilling company reported a loss of 5 cents in 2016.

Total revenues for the full year declined to $1,236.9 million from $2,302.1 million in 2016. Nonetheless, the figure beat the Zacks Consensus Estimate of $1,200.0 million.

Q4 Operating Highlights

Net loss from continuing operations was $13 million, much narrower than the net loss of $1,283.2 million in the fourth quarter of 2016. Total rig utilization declined to 58% from the year-ago quarter’s level of 62%. The overall average dayrate declined to $213,664 from $238,704 in the year-ago quarter.

The average dayrate for drillships of $378,709 was substantially lower than $474,462 in the prior-year quarter. Average capacity utilization was 60% compared with 73% in the year-ago quarter.

The average dayrate for the company's jackups was $134,413 compared with $124,470 in the prior-year quarter. Average capacity utilization declined to 76% from the year-ago quarter’s level of 86%.

The average dayrate for the company's semi-submersibles was $261,661 compared with $166,253 in the prior-year quarter. Average capacity utilization increased to 17% from the year-ago quarter’s level of 13%.

Backlog

As of Dec 31, 2017, total backlog was approximately $3 billion.

Financials

At the end of the fourth quarter, the company had a cash balance of $663 million and long-term debt of $3,795.8 million, with debt-to-capitalization ratio of 41.8% compared with 38.4% in the year-ago quarter.

Q4 Price Performance

Noble’s shares have lost 1.7% during the quarter as against the industry’s 7.1% rally.

Zacks Rank and Key Picks

Noble currently carries a Zacks Rank #4 (Sell).

A few better-ranked players in the same sector are EOG Resources (NYSE:EOG) , Pioneer Natural Resources Company (NYSE:PXD) and ConocoPhillips (NYSE:COP) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Houston, TX-based EOG Resources is a major independent oil and gas exploration and production company. The company delivered an average positive earnings surprise of 40.94% in the preceding four quarters.

Headquartered at Irving, TX, Pioneer Natural Resources Company is an independent oil and gas exploration and production company. The company delivered an average positive earnings surprise of 66.92% in the preceding four quarters.

ConocoPhillips, based in Houston, TX, is a major global exploration and production company. The company delivered a positive earnings surprise of 144.45% in the preceding four quarters.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Noble Corporation (NE): Free Stock Analysis Report

Pioneer Natural Resources Company (PXD): Free Stock Analysis Report

EOG Resources, Inc. (EOG): Free Stock Analysis Report

ConocoPhillips (COP): Free Stock Analysis Report

Original post