have a new paper out that tries to decode the essence of the low risk anomaly with reference to a vague assertion by respected dead economist Paul Samuelson that markets are macro inefficient and micro efficient. Samuelson noted one can arbitrage relative prices via derivatives, long/short portfolios, but if the aggregate market is too high or low, it's basically unarbitragable. Big bubbles like the housing and internet bubble lasted for longer than anyone anticipated, and those who saw this all coming in early on would surely have lost their capital by the time the end-game rolled around, even though trends were pretty much in place years prior. Fair enough.

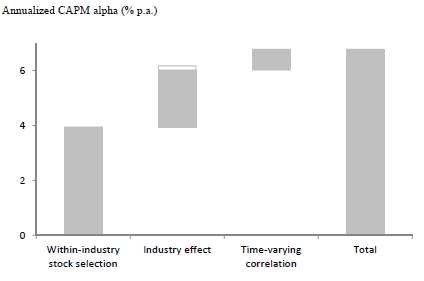

Figure 3 from The Low Risk Anomaly: A Decomposition into Micro and Macro Effects

Above is the gist, Figure 3, that the "alpha" from low vol investing is from stock-specific effects, secondly industry or country risk (the do it using either).

Alas, they frame everything in terms of alpha from a CAPM model. This model basically states that expected returns should increase linearly as beta increases,

E(Ri)=Rf+Βi(Rm-Rf)

Yet, as they show in their first figure in their paper (not pictured in this post), this model has a sign error, with higher beta stocks have lower returns. That is, if, charitably, the SML is flat, then

E(Ri)=Rm

Then alphas are just inversely related to betas in sample

α= (1- Βi)(Rm-Rf)

It's only worse if the returns are negative in beta as they appear to be. As the equity premium (Rm-Rf) is positive in sample, framing things in terms of alpha is basically framing things in terms of their betas, and so they sort by and then present the resulting betas. The misspecified . It would be much more revealing if they showed raw returns, and showed a cross-tab for returns by industry and firm beta.

Like Frazzini and Pedersen, their theory is based on the premise that the Security Market Line is too flat (thus the alpha for low vol), but it is still positively sloped. However, they also document the the Security Market Line is negatively sloped: higher beta stocks have lower returns, not just lower-than-CAPM-predicted returns. That's not a minor inconsistency.

Here's where it gets convoluted: in their model, like in Roll (1992) and Frazzini and Pedersen (2010), they have managers reaching for beta to outperform in absolute their benchmark, because they think that higher beta stocks have higher returns. But then they state that micro selection against the benchark lowers risk because some investors like the alpha in low volatility stocks. This 'micro' story explains the low vol anomaly though this sounds more like micro inefficiency to me, as these guys are not just irrational, but bipolar. Meanwhile, as countries/industries aren't good to allocate between, one is stuck in these bad sectors and 1) receive no premium and 2) can't move because of conventions. Methinks they are gilding the product differentiation lily here.

They conclude, noting that one should use both industry/country risk and idiosyncratic beta risk to allocate capital, and I agree. I would state it simpler: rank everything by Total Volatility over the past 9 months using daily returns, and don't invest in anything in the top half. That would include country risk, industry risk, beta risk, and idiosyncratic volatility. If you are a Sharpe ratio maximizing investor, you would be better served simply minimizing the volatility subject to a long-only constraint, but if you are benchmarking, by eliminating the above-average volatility equities you have something with a more moderate beta but without the high-vol detritus that brings down returns and increases portfolio volatility.

While the basic low vol strategy is a commodity, one can easily add 200 basis points of value by relaxing the constraints of size/currency across the globe, but this only works because many investors are constrained in their size/currency equity allocations (eg, large-cap Europe, small cap UK), and this is easy techinically but difficult politically. One may also add 100 basis points of value via using the right 'risk' metric when choosing low vol, as it's really a 'low risk' story, though this is dangerous and investors should be wary because most people who try this unconsciously overfit the problem and make it worse.

I feel for these guys. On one hand, good approaches are simple. On the other, if you state it as such, it becomes a commodity that is soon sold at cost. The dominant solution is to portray a vague convoluted solution that is both deep and powerful.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

New Paper: The Essence Of The Low Risk Anomaly

Published 02/05/2013, 02:24 AM

Updated 07/09/2023, 06:31 AM

New Paper: The Essence Of The Low Risk Anomaly

Bradley, Wurgler, and Taliaferro (2013)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.