Global markets are still in the grips of China fears, and it is uncertain whether the Chinese government can do enough to reassure global investors. The People’s Bank of China (PBoC) fixed the CNY largely unchanged from its position on Friday. But this halt in the weakening of the currency appears to have done very little to investors’ expectations that there will be further depreciation of the currency in the near future. And the concerns over China’s economic health were only added to today by the massive 13.4% spike in the HIBOR – the inter-bank lending rate for the CNH. As George Soros argues in “The Alchemy of Finance”, these sorts of out of control ‘investor perceptions’ have the power to impact fundamentals – ‘reflexivity’, as he terms it.

The strong NonFarm Payrolls data out of the US on Friday did little to calm investor concerns because it is backward looking, and the current fear in the markets is concerned with what will happen now and in the future. Currently, markets are beset by a self-perpetuating cycle of fear that has little concern for what the economic data is saying. Even though global growth does not seem to have been that bad in Q4 2015, the issue now is that this bout of fear could seriously impact real growth in Q1 2016.

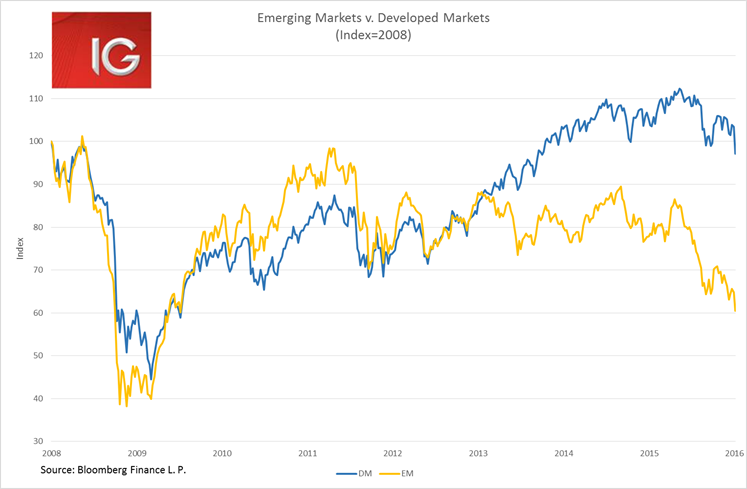

Investors have been shaken by the further devaluation of the CNY and the ineffectual management of the Chinese capital markets by the government regulators. The open of the Chinese cash market today has looked like a battle ground between state buying and investors still trying to get out, and has done little to ease the sense of fear seen in other Asian equity markets. A purported bounce in equities off the back of heavy Chinese intervention in the FX and equity markets is looking less likely. If this fails to materialise, markets do face a real risk of seeing the next leg lower from the August selloff coming in Q1 2016. And it is a risk that is most pressing for emerging markets. Now does not look like a good time to try and pick a bottom in emerging markets with the MSCI Emerging Markets index pushing to new lows not seen since 2009.

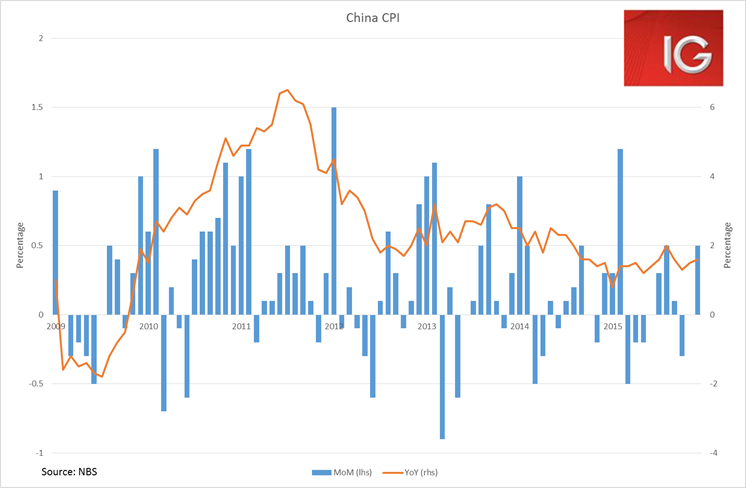

The Chinese inflation data out over the weekend provides some interesting insights on its future direction. Chinese December CPI saw its biggest month-on-month increase since August. This seems significant given that both August and December saw notable devaluations in the CNY. When one digs into the CPI components, it was food and consumer goods that saw most of the inflationary gain, which are also the components where growing inflationary pressures from a weaker currency are to be most keenly felt. Core CPI (excluding food and energy) has remained flat for the past two months in both year-on-year and month-on-month terms, which gives weight to the argument that tradables are increasingly driving the gains in inflation. Chinese PPI and CPI are likely to steadily increase throughout 2016 alongside a further devaluation of the currency. The concern is that this deflationary pressure is likely to be pushed onto global markets and could result in other competitive FX devaluations and easier monetary policy from central banks.

China concerns were writ-large on the ASX today, as we touched levels not seen since July 2013. 4910 has been a key level for the index, and when the index broke through that level to touch 4880 alarm bells were ringing. Although a little bit of buying came back into the market in the afternoon pushing it back up to close above 4910. Nonetheless, the ASX 200 has now lost 7% so far this year – its worst start to a year on record and there is little indication that the worst of the selling is behind us yet.

Global demand concerns have seen a terrible performance by materials and energy firms today. BHP Billiton Ltd (AX:BHP) and Fortescue Metals Group Ltd (AX:FMG) both lost roughly 5% or more today. There has been a bit of buying in the gold miners as investors try to hedge some of the market volatility by buying gold.

It was also a dismal performance by the banks as financials lost 1.4%. Macquarie Group Ltd (AX:MQG) saw the worst of the selling losing 3.5%.