FORECASTSTOCKS:

The European debt contagion remains front and center. Spanish and Italian short-and-long term bond yields have moderated recently given the ECB looks to step in to buy’em. This shall support stocks in the short-term, but won’t solve the overriding debt and fiscal problems...kicking the can down the road so to speak. So enjoy it while it lasts; after the euphoria will come the days of reckoning. How long? Good question.

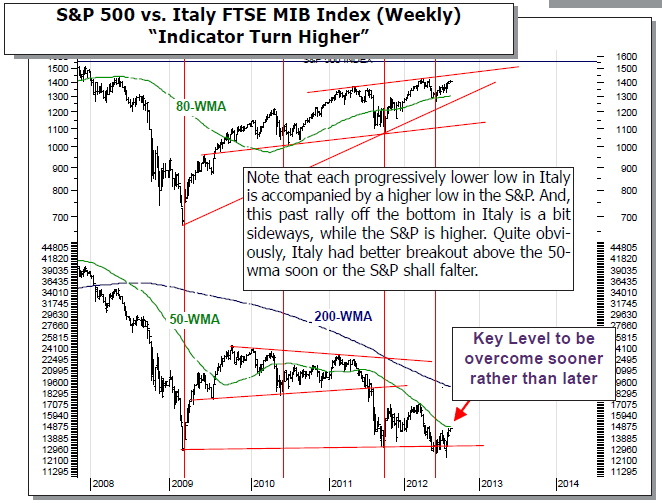

STRATEGY: The S&P 500 remains above long-term support at the 160- wma at 1215; which delineates bull/bear markets. However, the 200-dma support level at 1334 remains the bulls “Maginot Line,” while overhead resistance at 1340-to-1360 was extended above and now becomes support. This, coupled with the recent S&P 500 bullish weekly key reversal higher has suggested the 1450-to-1500 zone would be tested; but gosh darn it...this rally is one of the “weirdest” we’ve seen, and this obviously causes us some degree of trepidation. Melt-up or melt-down?

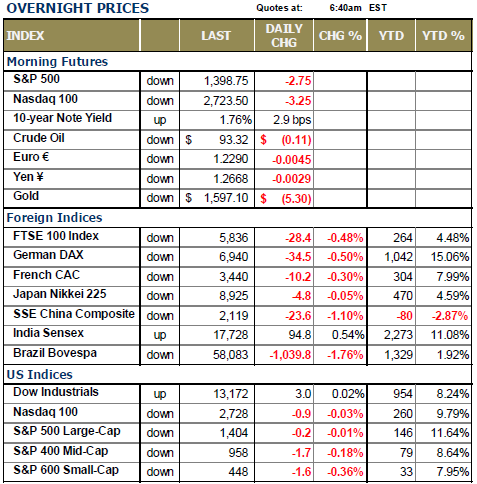

WORLD MARKETS ARE ALL LOWER THIS MORNING as the recent bout of strength predicated upon both Fed and ECB stimulus is starting to wane somewhat. Up until this point, the benefit of the doubt has rested with policy-makers to “do the right thing” by coming forth with a coordinated round of QE to support both the US and Europe. And lest us not forget China – where it is likely the reserve rate shall be cut sooner rather than later; and interest rates on deposits lower. In other words, risk is being taken out of the markets until they see the “whites of their eyes,” as this is about all that can be accomplished without the “real QE thing.”

This is clear in the manner the major market averages have traded – erratically lower and higher – with the end result being a stationary market. The past two trading sessions have shown very low volume figures, with the past 5-day S&P total gain of +4.6 points, with the past 4-closes within 1 point of each other. This is a “malaise” to be sure; and it is one that causes us some trepidation given our models have now progressed into overbought levels.

That said, we think it prudent to adjust the portfolio in light of the current situation from a management point-of-view. Hence, we’ll be exiting our Russell 2x Long (UWM) position on the opening this morning; and there could be others in the days ahead. Conversely, if we are wrong, then we’ll admit do and then re-enter the position – but from a higher confidence point-of-view than we currently hold.

To Read the Entire Report Please Click on the pdf File Below.