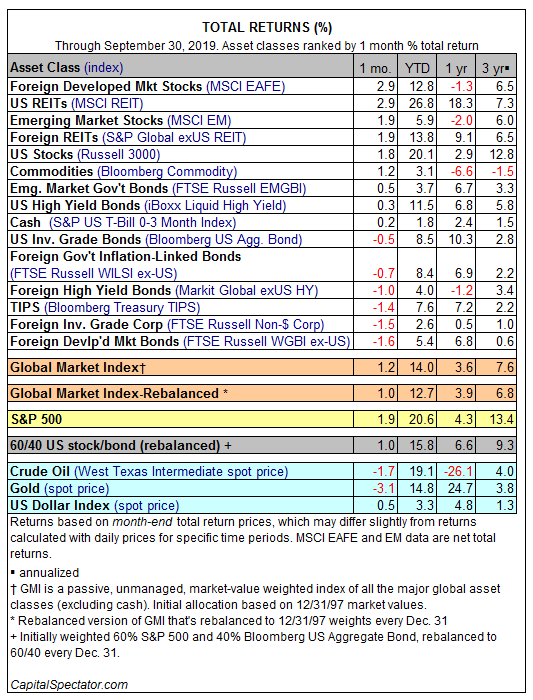

Foreign stocks in developed markets rebounded in September, posting the strongest performance for the major asset classes last month. The gain was coupled with a sharp loss for bonds in foreign developed markets—September’s deepest setback.

The iShares MSCI EAFE (NYSE:EFA) Index, a popular measure of equities in developed markets ex-U.S., jumped 2.9% last month. The increase marks the benchmark’s first monthly advance since June.

Although EAFE’s September rally is the leader, the return is effectively tied with U.S. real estate investment trusts (REITs), which lagged by the smallest of margins. The MSCI REIT Index rose 2.86% last month, fractionally behind EAFE’s 2.87% gain. (Note: EAFE performance reflects net returns in unhedged U.S. dollar terms.)

Last month’s biggest loser: fixed-income in foreign markets in developed economies. The FTSE Russell World Government Bond Index ex-U.S. slumped 1.6% in September (in unhedged U.S. dollar terms). The setback marks the deepest monthly loss for the index in more than a year.

Despite recent declines in some corners of the global markets, all the major asset classes continue to post gains so far in 2019 through the end of the third quarter. Leading the across-the-board wins: U.S.-listed securitized real estate shares. The MSCI REIT Index is up an impressive 26.8% this year on a total return basis. That’s well ahead of the second-best year-to-date performer: U.S. stocks (Russell 3000 Index), which is posted a 20.1% total return through September 30.

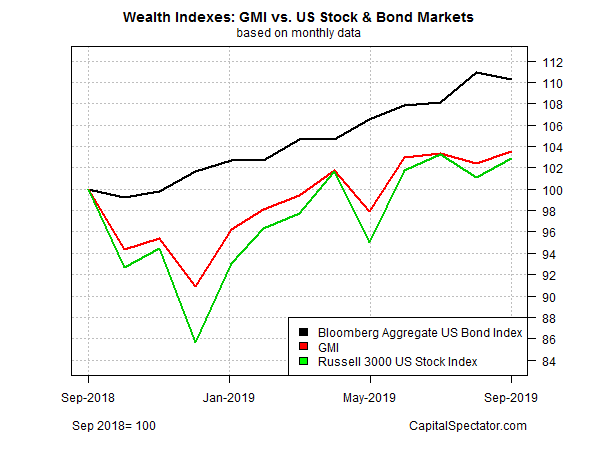

With rallies in all corners of global markets for 2019, it’s no surprise that the Global Market Index (GMI) closed last month with a strong year-to-date gain. This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights is up 14.0% in 2019 through the end of September.

Turning to trailing one-year results, GMI is ahead by a less impressive 3.6%, just ahead of the modest 2.9% increase for U.S. stocks (Russell 3000). By contrast, U.S. fixed income (Bloomberg Aggregate U.S. Bond Index) has generated a robust one-year performance, rising 10.3% on a total return basis through the end of September (black line in chart below).