Stocks that exhibit low volatility are prized as a risk factor that’s expected to beat the broad market over time, according to academic research and countless backtests. Real-world investment results, however, reflect mixed results in recent years, based on representative ETFs. Meanwhile, some analysts have been warning in recent months that low-vol stocks climbed too far too fast and are vulnerable to a correction. The warning carries more weight these days in the wake of low vol’s stumble relative to equities generally and other factor strategies.

Over the past three years, low-vol performance enjoys a modest edge compared to everyone’s favorite stock market index, the S&P 500. iShares Edge MSCI Minimum Volatility (NYSE:USMV) is ahead by 11.7% on an annualized total return basis – comfortably above the 9.7% increase for SPDR S&P 500 (NYSE:SPY), as of July 13, 2017. For trailing five-year results, however, SPY tops USMV: 14.8% vs. 13.2%, according to Morningstar.com.

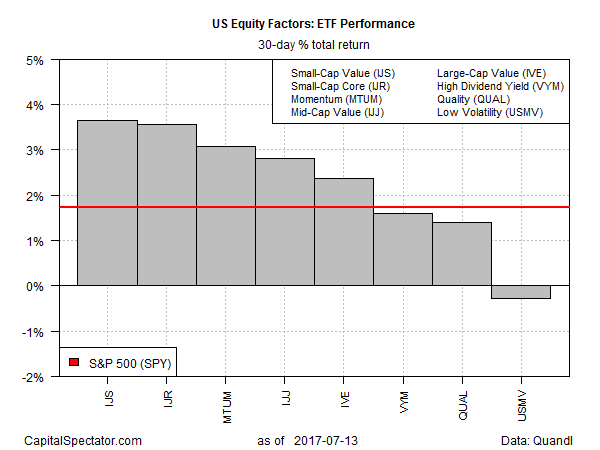

Whatever the future holds for the low-vol factor, as an investment strategy it’s become a popular destination – too popular, by some accounts, and now suffers from high valuations. Minds will differ on this point, but it’s interesting to note that low vol stocks have been stumbling lately – relative to the broad equity market and other factor strategies. Consider how iShares Edge MSCI Minimum Volatility USA (USMV) compares with seven other ETFs that represent the usual suspects in the US equity factor niche. For the trailing 30-day period through yesterday (July 13), USMV is the only fund with a loss.

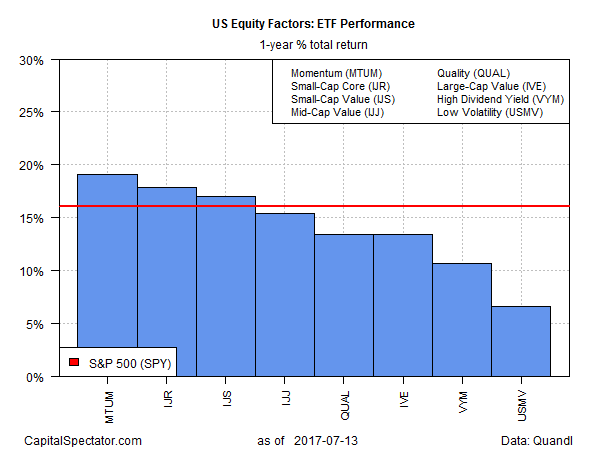

For the trailing one-year data, USMV is still in positive terrain, although the ETF’s 6.6% total return also looks weak by comparison with the rest of the smart-beta field and the equity market overall.

The recent stumble for low vol could be noise, of course. Yet there’s been talk recently that stocks that fit the bill in this corner have been suffering from high valuations. MarketWatch.com analyst Mark Hulbert in May asked: “Are low-volatility stocks in a bubble?”

Perhaps, but if they are, low-vol shares are a bit less bubbly at the moment. That doesn’t mean that these stocks can’t fall further. In any case, recent history reminds us that regardless of long-term expectations or academic credentials, factor strategies go through risk-on/risk-off cycles just like the rest of the equity market, although not necessarily in line with trends for other factors or the broad stock market.