Several Fed officials are scheduled to speak over the next week, but we're keen to hear what James Bullard will have to say. Expect more Brexit-deal chatter, though we think it is unlikely the PM will get a revised deal with the EU this week. In our opinion, a deal hinges more heavily on UK parliamentary arithmetic

U.S.: A little more colour on the Fed's decision

The latest Federal Reserve interest rate cut failed to generate much excitement in markets, but Fed Chair Jerome Powell did at least stress the central bank’s commitment to preserving the U.S. expansion. We continue to think the Fed will cut interest rates further despite their latest forecast snapshot suggesting there is a limited appetite amongst officials to do so right now. There are seven different Fed officials scheduled to speak over the next week so we will get a little more colour on their individual thinking. Most interest will likely be on James Bullard who was the lone voter favouring an immediate 50bp rate cut.

In terms of data, the final reading of 2Q GDP is set to be confirmed at 2% growth, but we will be focusing on the durable goods orders numbers for August and some of the inflation numbers. The Federal Reserve is very nervous about the outlook for investment with the durable goods orders report currently indicating a probable contraction in 4Q19/1Q20. Further weakness here this week would be a cause for concern. At the same time there is evidence of a pick-up in some inflation pressures after core CPI and average earnings accelerated sharply. If we get a sharp rise in the Fed’s favoured measure of inflation, the core PCE deflator, this could cast some doubt in the market’s mind that we will get the full 75bp of cuts they are currently priced for. We continue to look for a December rate cut and a 1Q20 rate cut.

Brexit deal chatter to dominate UK newsflow next week

There are two things to watch in the UK next week.

The first is the Supreme Court ruling early in the week, where judges will rule on whether PM Johnson’s suspension of parliament was unlawful. While legal experts are divided on what the outcome may be, it’s not certain this will make a massive difference to Brexit, at least in the near-term. Remember one of the consequences of the original suspension was that it would become harder to legislate against an October ‘no-deal’ exit. However, MPs succeeded in approving a law designed to force the prime minister to ask for a further Article 50 extension, just in case they are unable to get a new deal through parliament.

With that in mind, the bigger focus for markets will be on whether the PM can agree a revised deal with the EU. Despite positive comments from European Commission President Juncker, this still seems unlikely.

The British PM will reportedly meet key European leaders at the UN next week. But so far, UK proposals for a revised Irish backstop – the mechanism to avoid a hard border on the island of Ireland – have reportedly been met with scepticism by EU officials. In reality, the chances of a deal hinge more heavily on the UK parliamentary arithmetic, but despite some more positive signals from some Labour MPs over recent weeks, the PM still faces an uphill battle to get a deal approved by lawmakers.

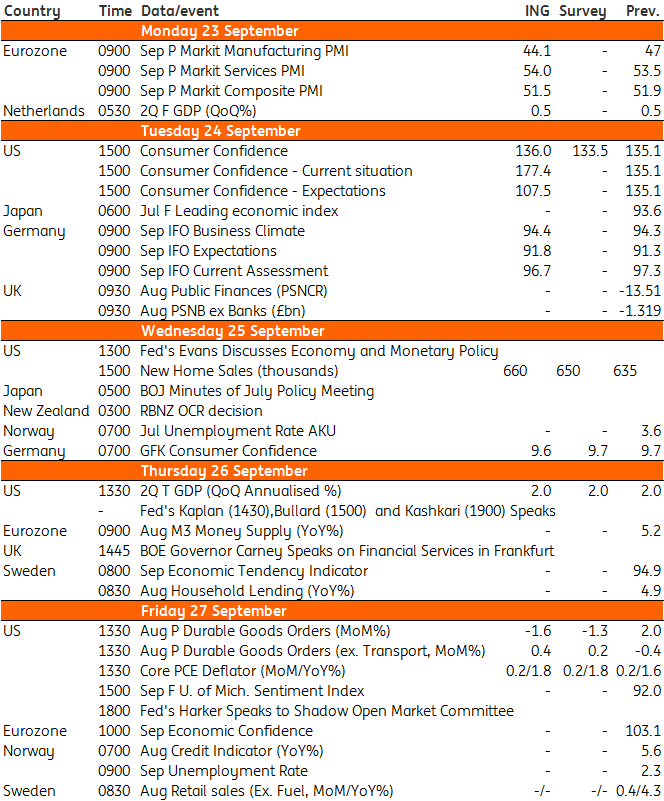

Developed Markets Economic Calendar

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more