Tech giant Amazon (O:AMZN) reported a surprise profit in Q3 and the stock surged over 10%, as investors applauded the unexpected swing to profitability.

This surprise profit was led by Amazon’s cloud computing division – Amazon Web Services (AWS).

AWS accounted for only 8% of Amazon’s total revenue, but 52% of the operating profit.

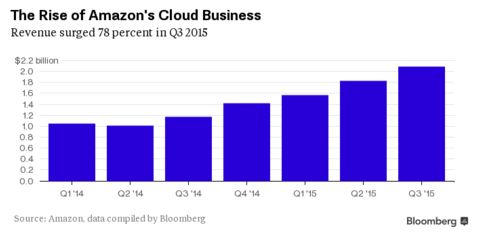

Although AWS has been a mainstay in the cloud computing sector for quite some time, it’s now beginning to eclipse even the most optimistic projections.

The massive cloud computing division within Amazon is delivering serious financial results for the tech giant.

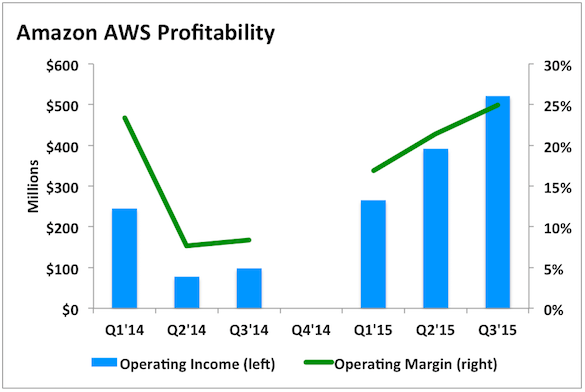

Unlike Amazon’s core E-Commerce business, which operates on razor thin margins (i.e. 1.6%), AWS is a high margin business.

Some analysts project that AWS margins are within the 25% range.

Historically, Amazon has operated at a loss, as their low margin E-Commerce business and costly Cap-Ex investments wiped out any chance of generating profit. The swing to profitability led by AWS is beginning to change that narrative rather quickly.

It begs the question – what is the value of AWS – and is the market undervaluing the earnings power of this business?

i.e. if Amazon were to spin off AWS (similar to E-Bay (O:EBAY) / PayPal (O:PYPL)) – what valuation would it command?

So back to my question about valuation – what value should be assigned to AWS?

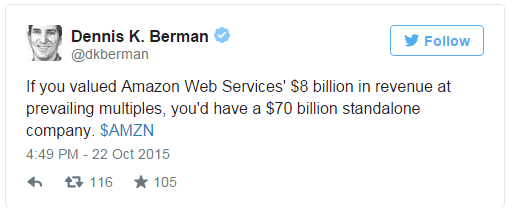

WSJ Financial Editor Dennis Berman recently weighed in on this topic:

As his tweet suggests, AWS’s $8B (run rate) in revenue results in a $70B valuation.

However, I think Amazon is a much different animal than your typical SaaS/Cloud company, so I feel that a 13X revenue multiple is more appropriate.

Here are a few interesting stats to that lead me to that conclusion:

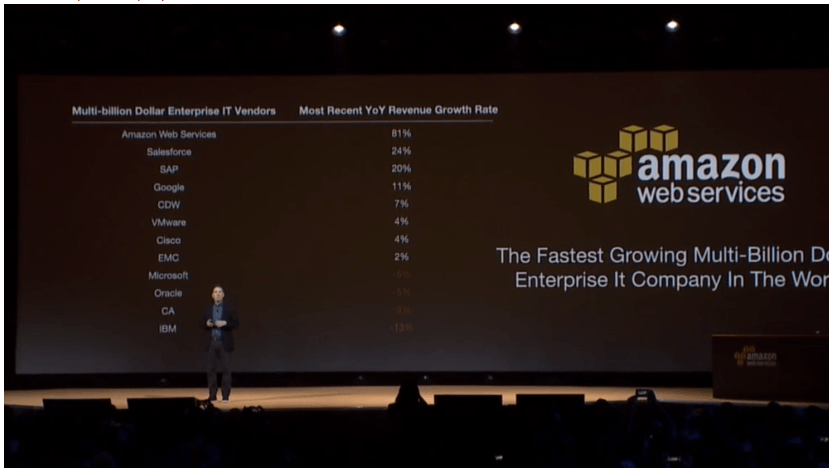

- Explosive Revenue Growth – AWS has generated over $7B in sales over the past 4 quarters. It is by far the fastest growing multi-billion dollar enterprise company in the world.

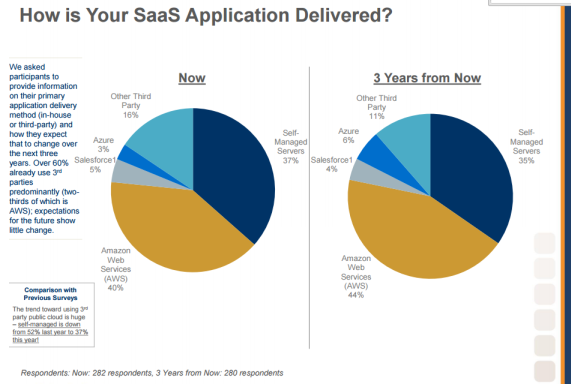

- Dominant Market Position – In a recent SaaS survey by Pacific Crest, Amazon is the most popular SaaS application delivery platform with 40% market share.. and 3 years from now that is expected to grow to 44%. SaaS is a disruptive sector that continues to grow at an impressive clip and AWS is very well positioned to benefit from this trend.

- Increasing Margins – Operating margins are rise – AWS operating margins were ~25% in the recent quarter compared to ~20% over the past 4 quarters. Not only is this business profitable, but the trend below shows that margins are gradually increasing each quarter.

4.Given these unique characteristics, I feel that a 13X revenue multiple is more appropriate for valuation purposes. AWS’s revenue growth and profitability is off the charts and they occupy a dominant competitive position in the SaaS application delivery space.

Using a 13X revenue multiple, it results in a standalone valuation of $104B.

Amazon’s cloud business is just getting started and has the potential to be a true powerhouse in the tech world.

I think the market may be even underestimating just how powerful and ubiquitous this platform could become.

With Amazon’s market cap approaching the $300B level, they are solidifying their position as a tech powerhouse. The only 3 tech companies with a higher market cap are Apple (O:AAPL), Google (O:GOOGL), and Microsoft (O:MSFT).

If AWS continues on their current trajectory, it’s possible that folks will begin to think of Amazon as a cloud computing company that sells books, instead of the other way around.