A recent article in The Wall Street Journal perfectly summarized the dilemma faced by today’s investors.

Being a successful investor, the article explained, means “bigger gambles, lower returns.”

This reality can be credited to the world’s central bankers and their relentless efforts to stimulate economic growth through zero and negative interest rates.

The Good Old Days…

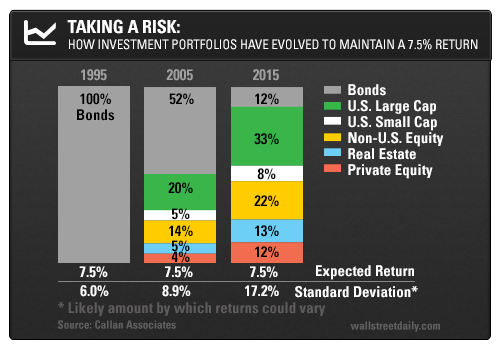

The WSJ pointed out that it used to be much easier to make an annual 7.5% on your money. That is, in fact, the rate many pension funds and similar entities have as a target.

Back in 1995, that target was met very easily, just by buying and holding investment-grade bonds.

I made this exact point in my recent article on investing for a child’s college fund. In the 90s I was a broker, and I recall that simply investing funds in U.S. Treasury zero coupon bonds was a perfect and conservative way to grow a college fund into a substantial and promising sum.

In 2002, high-quality corporate bonds, on average, returned 11%. That was a year where stocks tanked 22%.

And again, as shown by the Journal, even as recently as 2005, bonds could make up 52% of a portfolio targeted to make 7.5% a year.

…Have Faded Away

But those days are long gone.

The Fed and other big banks have turned us all on to hedge funds in order to get a decent return on our money.

Like the big institutional investors, it’s time that we pile on some risk in order to get back to that 7.5% return.

The chart below depicts the portfolio allocation needed by pension funds to earn the same return an ultra-safe U.S. Treasury security did two decades ago.

Of course, the allocation will be different for individual investors since we have minimal access to private equity funds.

It’s a good starting point, however, for a discussion on asset allocation in today’s environment.

Regardless, it’s crucial to keep in mind that every individual is unique, with different risk tolerance.

These suggestions must be adjusted to reflect an investor’s lifestyle, investment portfolios, and overall preferences.

Asset Allocation

The asset allocation that I recommend is vastly different than what robo-advisors are encouraging.

Their algorithms have been skewed by years of central banks’ liquidity pushing stocks higher. That era finally seems to be coming to an end, with U.S. stocks little changed since the end of 2014, and it’s imperative that investors be ready for a change in landscape.

A Bloomberg survey found that many portfolios at firms like Betterment and Wealthfront are 80% to 90% stock-based, which isn’t a good situation to be in if a bear market strikes.

Based on my decades of experience in the investment industry as well as my foresight into the future of the market, here’s a breakdown of my preferred asset allocation…

Bonds – 20%.

I firmly believe the “mad” central bankers will keep their crazy policies. From nothing, we now have $10 trillion worth of global sovereign debt with a negative yield!

As institutional investors chase safety, the remaining bonds with a positive yield – U.S. Treasuries, foreign bonds in places like Australia and emerging markets, and high-quality corporate bonds – will be drawn toward negative yields as if being sucked into a black hole. I would continue to avoid junk bonds.

Thus, bond prices will go up as yields drop, profiting the holders of such bonds.

Real Estate/REITs – 20%.

The same logic applies to REITs – in the search for yield, investors will bid up the prices on REITs. And there is, in fact, something tangible backing up the yield.

However, it’s important to be very picky. Buying a shopping center REIT, while retailers are falling victim to the success of Amazon (NASDAQ:AMZN) and the like, would not be wise.

Invest in REIT mainstays rather than risks.

Stocks – 50%.

This money in turn has to be broken down further.

I would put only half of the funds into U.S. stocks because of their current high valuations. The cyclically adjusted price-to-earnings ratio, known as the CAPE or Shiller P/E ratio, is at the 10th highest level ever.

Then I’d reserve 85% of this allotment of funds in large-cap stocks, with the remainder in small caps.

I’d lean towards funds that invest in sectors with safety and yield, like consumer staples.

The other half, I would spread around the world.

European as well as many other emerging markets are cheap. Some of them are cheaper than they’ve been in 10 or 20 years. I expect returns from these markets to outperform those of the U.S. market.

But not just any foreign market will do. Once again, it’s important to buy with precision in mind.

In Europe, for instance, banks must be avoided. Negative rates are killing them. That means sidestepping index funds. Vanguard FTSE Europe (NYSE:VGK), for example, has over 21% of its portfolio in financial stocks.

Don’t be afraid to invest a percent or two in frontier markets, either. They’re largely non-correlated with U.S. markets and have repeatedly outperformed their larger emerging market cousins in recent years.

Commodities – 10%.

So far in 2016, commodities have been the top-performing asset class, and warrant about a tenth of investment fund allocation.

The 11% gain on the Bloomberg Commodity Index outpaced both global bonds (6%) and global equities (2%).

At the moment though, I would put most of that percentage into precious metals with a bit invested in still-cheap agriculture-related commodities.

Following this allocation model generally, with the necessary tweaks to represent individual needs and interests, should bring investors to the “promised land” – that now-elusive target of a 7.5% annual return.