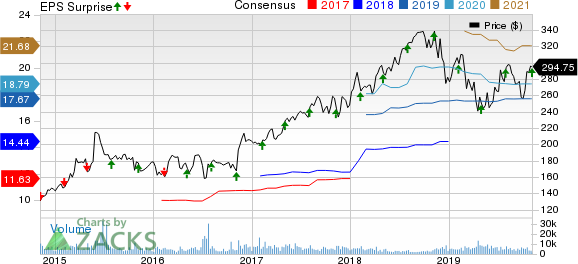

Humana Inc.’s (NYSE:HUM) third-quarter 2019 operating earnings per share of $5.03 beat both the Zacks Consensus Estimate and the year-over year figure by 9.8%. This upside can primarily be attributed to Medicare Advantage membership growth and higher revenues.

Operational Update

Revenues of $16.2 billion were up nearly 14.3% year over year. Moreover, the top line surpassed the Zacks Consensus Estimate by 0.5%.

Adjusted consolidated pre-tax income of $869 million decreased 5.7% year over year due to weekday seasonality.

Benefit ratio expanded 300 basis points (bps) to 85%.

Operating cost ratio contracted 210 bps to 11.4%.

Segmental Results

Retail

Revenues from the Retail segment were $14.09 billion, up 17% year over year. This can primarily be attributed to Medicare Advantage membership strength and higher per member premium along with improved state-based contracts membership.

Benefit ratio of 85.9% expanded 270 bps year over year due to 2019 HIF suspension, unfavorable impact from weekday seasonality, lower favorable prior-period development in the segment and the shift in Medicare membership mix.

The segment’s operating cost ratio of 9.3% contracted 190 bps year over year on the suspension of the health insurance industry fee (HIF) in 2019, better scale efficiencies related to its Medicare Advantage membership and operating cost efficiencies.

Group and Specialty

Revenues from the Group and Specialty segment were $1.89 billion, down 0.3% from the prior-year quarter due to a reduction in fully-insured group commercial and specialty membership, the impact of a few contractual incentives and also adjustments related to the TRICARE contract of 2018.

Benefit ratio expanded 560 bps year over year to 86.3%, due to the impact of weekday seasonality in the quarter under review, effect of HIF suspension in 2019, lower prior-period development, effect of the continued migration of fully-insured group members, and dental network contracted rates.

Operating cost ratio contracted 170 bps year over year to 21.9%.

Healthcare Services

Revenues of $6.6 billion increased 11% year over year, primarily owing to Medicare Advantage membership growth.

Operating cost ratio expanded 10 bps year over year to 96.2%.

Individual Commercial

Humana exited this business effective Jan 1, 2018.

Financial Update

As of Sep 30, 2019, the company had cash, cash equivalents and investment securities of $16.36 billion.

Debt-to-total capitalization ratio as of Sep 30, 2019 was 34.3%, contracting 310 bps from Dec 31, 2018.

Operating cash inflow totaled $2.4 billion at third-quarter end, up 8.3% year over year.

Capital Deployment

The company paid out cash dividends worth $74 million in the quarter under review. In October 2019, it declared a cash dividend of 55 cents per share, payable Jan 31, 2020 to its shareholders of record as of Dec 31, 2019.

In July 2019, its board of directors approved a share repurchase plan worth $3 billion, set to expire Jun 30, 2022. It also entered into an agreement in July this year with a third-party financial institution to implement a $1.00-billion ASR program under the authorization. In the quarter under review, the company repurchased around 2,695,900 shares under this plan.

As of Nov 5, 2019, it had remaining share repurchase authorization of $2 billion.

2019 Guidance

After third-quarter results, the company revised its 2019 guidance. Adjusted EPS is now expected to be approximately $17.75. The 2019 individual Medicare Advantage membership is anticipated to be around 530,000 members.

Zacks Rank

Humana carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Performance of Other Players

Among other players from the medical sector, having already reported third-quarter earnings, the bottom-line results of UnitedHealth Group Incorporated (NYSE:UNH) , Anthem Inc. (NYSE:ANTM) and Centene Corporation (NYSE:CNC) topped the respective Zacks Consensus Estimate.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Anthem, Inc. (ANTM): Free Stock Analysis Report

Humana Inc. (HUM): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Original post

Zacks Investment Research