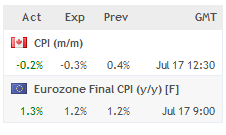

The US dollar rose Tuesday on the combination of stronger retail sales and Fed hints that cuts might not be so deep. The pound lagged and cable fell to the lowest since April 2017 on Brexit fears. CPIs for UK, Eurozone and Canada all came in within expectations, but GBP continues to focus on No-deal related remarks 6 days ahead of the revelation of the new PM. US building permits and housing starts fell by more than expected.

From the Fed

Former St. Louis Fed President Bill Poole once argued that markets focus too much on the upcoming Fed meeting and not enough on themes and policies that will persist. At this point, a July 31 cut is inevitable. Retail sales were strong with the control group up 0.7% compared to the +0.3% consensus but minutes after the release, Powell brushed it off. He called theconsumer and domestic economy solid but once again pointed to uncertainty on trade, business investment and inflation.

It's increasingly clear that the Fed thinks it has gone beyond neutral and needs to take back some rate cuts to boost inflation. Evans and Kaplan added more color Tuesday with Kaplan's comments giving a boost to the dollar by framing a cut as 'tactical' and not the start of a cycle. Evans continued to flirt with the idea of a 50 bps cut but was clear that he only sees 50 bps in total easing this year and whether it was all at once or in two parts was a matter of strategy.

Markets and the Fed are on the same page in terms of near term action but where the rhetoric and market pricing diverges is into 2020. There is a 45% chance of four or more cuts by this year priced into the Fed fund futures market. The implication is that there will be a deeper slowdown but the Fed and other central banks could engineer a soft landing.

Back to Politics

Of course, since it's 2019, it all comes back to politics. What markets are grappling with is Brexit and the US trade war. Johnson and Hunt both said they would need to tear up the Irish border backstop Tuesday and a leak suggestedJohnson was serious about keeping out MPs around the Oct 31 Brexit deadline. That helped to send cable down 110 pips. On the US side, Trump took a less optimistic tone on China and talked about tariffs. That hurt equities.

Inflation will be the theme in the day ahead as the pound searches for a spark of life in a market that's betting heavily against it, according to CFTC data. The consensus is for a flat monthly reading and 2.0% y/y rise.

Earlier today, Canada's June CPI held at 2.2% (median core y/y) with the figures among the few spots showing an acceleration in inflation (and an acceleration in activity). The Canadian dollar remains by far the strongest currency so far this year as it is over the last 6 months.